The post Breaking: Tapioca DAO Drops 93% After Major Crypto Exploit appeared first on Coinpedia Fintech News

Another hack has shaken the crypto industry. This time, Tapioca DAO has fallen victim to a massive security breach. An attacker compromised the deployer address resulting in theft of $1.6 million of $TAP tokens. The exploit caused the token price to plummet by 93%. Let’s dig into what really happened and what’s at stake here.

A Shocking Takeover

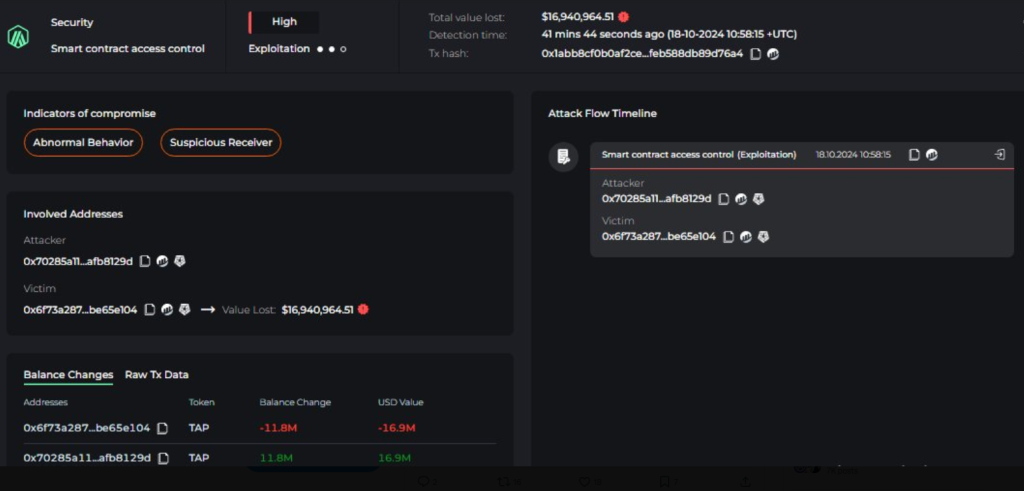

Cyvers Alert flagged unusual transactions from Tapioca DAO, signaling that something was wrong. The deployer address was compromised, allowing the attacker to take control of the vesting contract.

The exploiter transferred 21 million $TAP token worth $1.6 million by activating the emergency rescue of protocol. The feature that was built for such a situation became the weapon of the thief. After transferring the funds to a new address, they were swapped for 591 ETH. This drain in liquidity caused the price of $TAP token to take a sharp nosedive. From around $1.30, the token fell to $0.098—a massive 93% value lost.

The mastermind behind this hack is still unknown. Also there has been no official announcement from Tapioca DAO at the time of writing.

Where Did the Money Go?

Once ETH was received, the exploiter bridged the funds to the BNB chain using Stargate Finance. More interestingly, the wallet of the attacker has approximately $4.7 million in stablecoin like BSC-USD and USDC. This suggests that this was not the first exploit by the attacker.

What to Expect

This exploit adds fuel to the existing question about the security of DeFi protocols. And not just protocols but overall every crypto project. The crypto community has suffered with exploits and hack in the past 4 months. One of the biggest hacks involves Indian crypto exchange Wazirx where the community lost around $230 million. This raises concerns about how secure crypto people’s funds are. Let’s wait and watch to see what comes out of this case. Does it end in a real hack or a warning by some brown or white hat hacker. Whatever happens, it is clear that the protocol makers need to really focus on the security of their products.

ALERT

ALERT