Aave, the decentralized lending platform, is among the largest DeFi protocols by total value locked (TVL). Over the years, despite the crypto price boom and bust cycle, the platform has operated flawlessly without any technical hitches.

Aave User Address Grew By 675% In One Week

Since the beginning of the year, Aave has dominated headlines, mostly around its price performance and rising TVL. However, looking at other metrics, the lending platform is performing solidly.

According to Santiment, Aave on Optimism is the fastest-growing protocol on their watch among platforms, commanding at least $500 million in TVL. The number of Aave addresses on Optimism grew by 675%, roughly twice that of KuCoin tokens (KCS).

At this pace, Aave outperformed Maker–another lending and borrowing protocol on Ethereum, Chainlink on Optimism, and Raydium–a top decentralized exchange (DEX) on Solana. Of note, Chainlink on Optimism and Raydium grew over the last week by 100%.

The fact that Aave on Optimism grew faster than Raydium, the top DEX on Solana, is a milestone. By default, any meme coin launching on Pumpfun that achieves at least 69 SOL automatically lists on Raydium.

Although only a small percentage graduate and are listed on Raydium, tens of thousands of meme coins launch on the meme coin launchpad on Solana.

Santiment now thinks AAVE prices may likely benefit from this growth. Pointing to historical performance, the sentiment analytics platform said there is usually a strong correlation between rising utility and consistent growth with long-term gains.

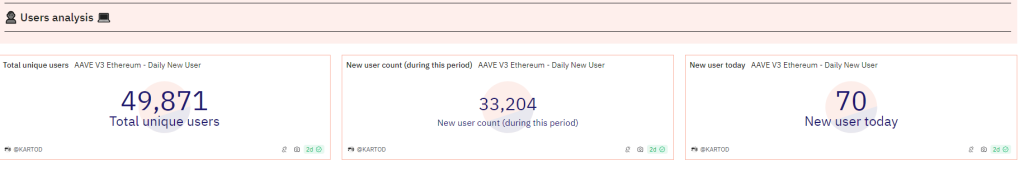

According to Dune, there are over 49,800 unique daily users of Aave v3 on Ethereum. Over the last two days, there were 70 new users. While there is growth in the number of cumulative users, as expected, the number of new users remains steady.

Will Prices Rise To Fresh 2024 Highs?

AAVE is trading above $150, trending at around 2024 highs. Although the token is in an uptrend, prices have moved sideways over the past four weeks. Technically, a close above $180 could drive demand, lifting prices to new 2024 highs in the coming days.

Possible drivers include the recovery of DeFi and other project-related factors. As of October 17, 56% of all cbBTC–the Bitcoin stablecoin by Coinbase–was locked in Aave.

The protocol also plans to launch a new Merit Program for cbBTC. Those who borrow USDC by issuing cbBTC as collateral will receive more rewards if they move their debt from USDT to USDC. Moreover, those who switch from wBTC to cbBTC collateral will receive additional collateral.