In a story within the decentralized prediction market sphere, a researcher has accused a crypto bettor, operating under the pseudonym ‘Fredi9999’ or simply ‘Fredi,’ of significantly manipulating the odds for former President Donald Trump on the crypto platform Polymarket. Over the past fortnight, Trump’s probability of winning has surged from near parity with Vice President Kamala Harris to a substantial 60.7%, while Harris’s odds have dwindled to 39.3%.

The allegations were brought to light by Domer (@Domahhhh), a pseudonymous political crypto bettor, who detailed his findings in an extensive thread on X. Domer stated: “A long-winded and winding update on Fredi9999 — the person or entity — who is singlehandedly rocketing up the price of Trump on prediction markets around the world. Spoiler alert: I managed to make contact with him, I think, and he blocked me after a few minutes. Sensitive guy! We’ll get back to that.”

Is Crypto Plattform Polymarket Manipulated?

Domer elaborated on the mechanics of the alleged manipulation, highlighting that Fredi has been placing substantial bets exclusively on Trump, reportedly exceeding $25 million. This influx of capital has introduced a premium of approximately 5% to 8% on Trump’s odds, making bets on Trump more expensive while simultaneously reducing the cost of betting on Harris by a similar margin. According to Domer, this strategy disrupts the supply and demand equilibrium on Polymarket, leading to skewed pricing that does not accurately reflect the broader market sentiment.

Further analysis by Domer revealed that Fredi9999 is not confined to a single account. Instead, multiple accounts—PrincessCaro, Michie, and Theo—are believed to be controlled by the same entity, collectively holding positions worth around $28 million. The synchronization of large deposits from crypto exchange Kraken, typically in increments of $500,000 or $1 million, into these accounts before deploying funds solely on Trump-related markets suggests a coordinated effort to influence market outcomes.

Supporting this claim, @fozzydiablo, another researcher, identified patterns across the four accounts that imply a single user’s control. Domer referenced @fozzydiablo’s findings, linking to a detailed analysis.

Data suggests a single entity has been purchasing all Trump related bets on @Polymarket totaling $26 million.

– Fredi9999

– PrincessCaro

– Michie

– Theo4Taking a look at their betting activity we can analyze when the accounts are placing bets.

What’s most interesting is when… pic.twitter.com/2eSv2AKRhW— Fozzy (@fozzydiablo) October 16, 2024

Domer also speculated on the possible identity and motivations behind Fredi’s actions. Observations regarding the linguistic patterns in comments made by Fredi and associated accounts—such as the use of both British and American English spellings and peculiar spacing around punctuation—hint at a potential French origin. Domer posited: “AI thinks the writing/spelling/weird misspellings points to a Frenchman who has learned British English and spent time in America.”

However, Domer acknowledged the possibility of ulterior motives, including the scenario where Fredi might be part of a larger scheme or even an elaborate role-playing act designed to obscure true intentions. The researcher emphasized the unprecedented nature of a $25 million all-in bet on a single candidate, highlighting the necessity for further investigation to uncover underlying motives.

Domer wrote: “Maybe it’s all a LARP and somebody is just having fun pretending with all of this, trying to seem unsophisticated on purpose. Maybe it’s connected to Elon [Musk] or some other huge GOP megadonor. I have no idea, and it’s a bit of a game to figure out what is going on here. Maybe it’s actually [famous crypto trader] GCR despite GCR saying it’s not him. GCR’s guess is it is someone trying to send Bitcoin skyrocketing, which is a good explanation.”

This revelation comes amid criticism from Hasu, a strategic advisor to crypto project Lido Finance and strategy lead at Flashbots. He remarked via X: “Polymarket is good, yes, but I feel like it’s time to call them out on their bullshit of putting ‘volume’ front and center, while aggressively hiding open interest everywhere on their website. […] This market is not deep on traditional scale yet, especially given the magnitude of the event. Its misleading reporting and giant shadow thrown by the media just makes it seem that way. And this is assuming there is 0 fake volume on Polymarket.”

Historically, significant individual bets have occasionally influenced prediction markets. Domer referenced past instances from the 2008 and 2012 US presidential elections, where single large bettors attempted to sway market odds for John McCain and Mitt Romney, respectively. Both instances ultimately did not alter the election outcomes, leading to skepticism about the efficacy and impact of such large-scale bets.

Domer concluded his analysis by questioning the broader implications of Fredi’s actions: “Why do I care about this? Good question! It’s important to know who you’re betting against. Is this a super smart trading firm and I should be scared? Is this an idiot betting on what he wants to happen and I should be happy? Is this just a lame attempt to give the impression that Trump is winning by a lot with 0 other motives? It’s hard to figure out what is going on here.”

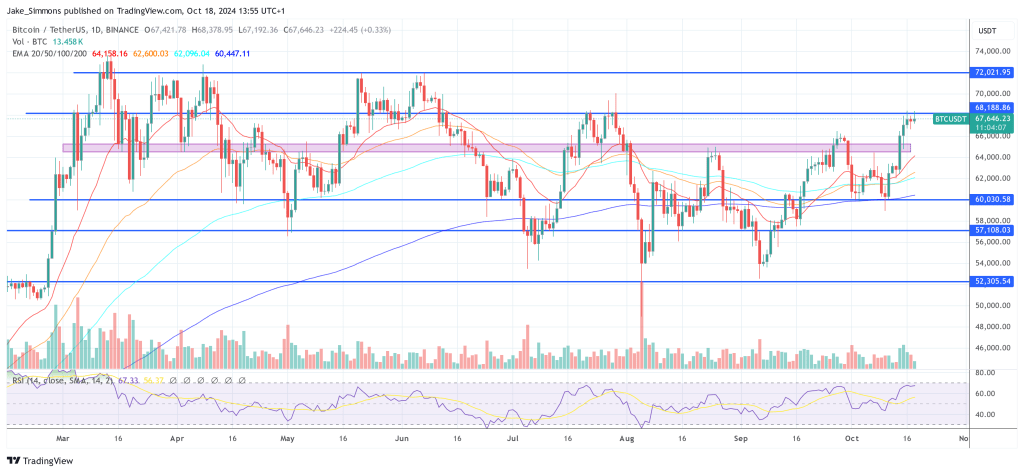

At press time, BTC traded at $67,646.