The latest weekly digital asset fund flow report from CoinShares has revealed that last week, crypto asset investment products saw roughly $2.2 billion in net inflows globally, marking the largest inflow since July.

This rise in inflows comes amid the gradual recovery of top crypto assets last week, with the majority now reclaiming major highs and registering nearly double-digit gains over the past 7 days.

Who Led the Charge?

Bitcoin-based products were the standout beneficiaries of last week’s inflows. US spot Bitcoin exchange-traded funds (ETFs) added $2.1 billion, with BlackRock’s IBIT ETF alone generating over $1.1 billion.

The cumulative inflows for these Bitcoin ETFs, which began trading in January, now stand at $21 billion. These funds have grown to manage a record $66 billion in assets under management, highlighting their significant role in the market.

Notably, the renewed confidence in Bitcoin products mirrors earlier this year’s positive sentiment. Last week’s inflows were the largest since March, when US spot Bitcoin ETFs saw $2.6 billion as Bitcoin reached its all-time high above the $73,000 price mark.

This strong demand suggests that investors remain bullish on Bitcoin’s long-term prospects, despite recent market fluctuations. While Bitcoin stole the spotlight, other cryptocurrencies also experienced inflows last week although way lesser than that of BTC.

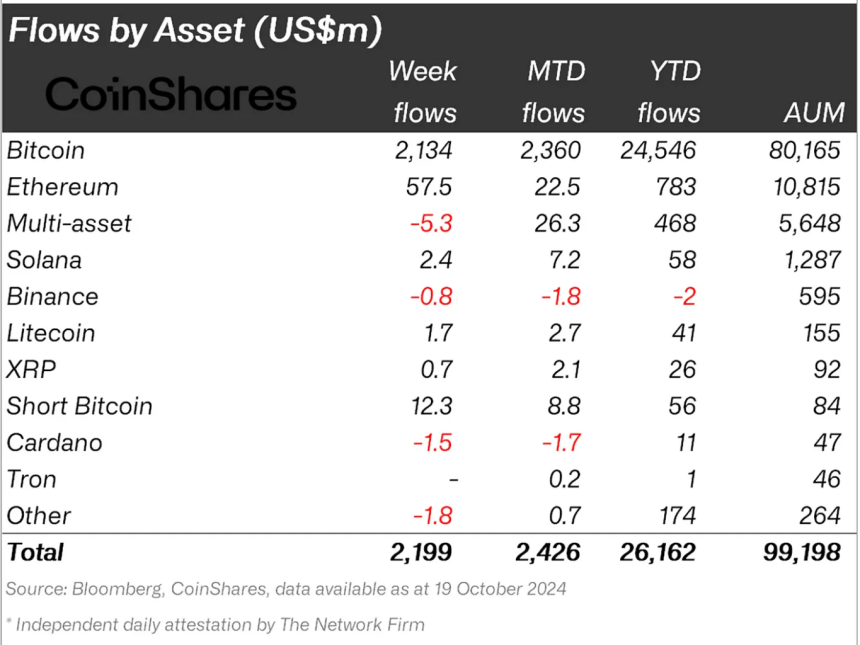

Ethereum-based products attracted $58 million in net inflows, while Solana, Litecoin, and XRP-based funds saw smaller inflows of $2.4 million, $1.7 million, and $700,000, respectively.

However, multi-asset investment products did not fare well, experiencing net outflows of $5.3 million, ending a 17-week streak of consecutive inflows.

What Prompted The Surge In Crypto Inflow?

According to CoinShares, this surge in inflows is tied to growing optimism about the upcoming US elections, with a potential Republican victory driving investor sentiment.

Many believe that a Republican administration would favor the digital asset market more favorably, leading to an increase in investor confidence and positive price momentum. James Butterfill, Head of Research at CoinShares, particularly noted:

We believe this renewed optimism stems from growing expectations of a Republican victory in the upcoming US elections, as they are generally viewed as more supportive of digital assets.

Notably, Butterfill, reiterated these views, adding that trading volume for these investment products surged by 30% last week. Total assets under management (AUM) for crypto funds are now nearing the $100 billion mark on a global scale, highlighting the substantial interest in digital assets.

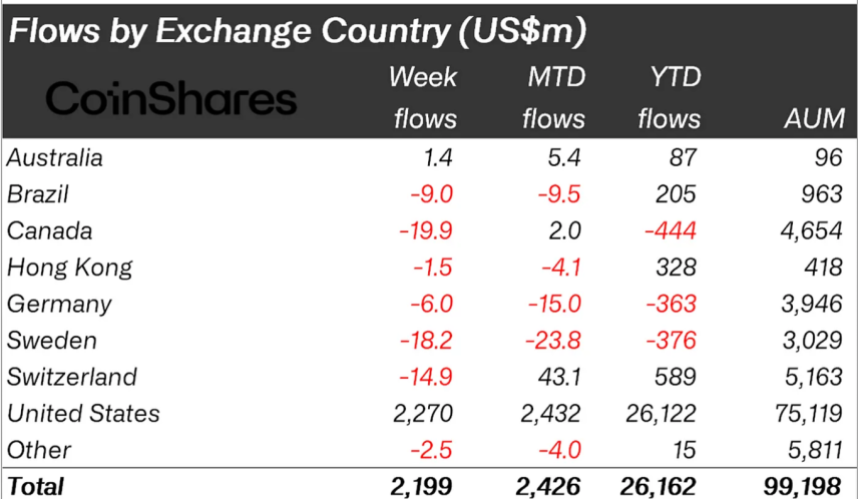

However, while US-based funds thrived, investment products in other countries such as Canada, Sweden, and Switzerland experienced net outflows, indicating a more polarized global market.

Featured image created with DALL-E, Chart from TradingView