On-chain data shows the 7-day average Bitcoin mining hashrate has just witnessed a fresh surge to set a new all-time high (ATH).

Bitcoin Mining Hashrate Has Observed A Sharp Rise Recently

According to data from Blockchain.com, the 7-day average of the BTC mining hashrate has observed growth recently. The “mining hashrate” here refers to a metric that keeps track of the total amount of computing power that the Bitcoin miners have connected to the blockchain.

The BTC network runs on a consensus system based on proof-of-work (PoW), in which the miners make use of this computing power to solve mathematical problems.

This entire power pool doesn’t work in tandem, however; miners use their individual mining farms to compete against each other to be the first to add the next block to the chain, rather than collectively working towards the same goal.

This is by design, since if power was centralized on a group of entities, Bitcoin wouldn’t be able to claim itself as a “decentralized” network. But if there is no collective BTC power, then what’s the significance of the total hashrate? The answer is simple: it’s a reflection of the sentiment among the miners as a whole.

When the value of this metric goes up, it means the miners are finding the BTC blockchain to be an attractive venture. On the other hand, it registering a decline suggests some of these chain validators are no longer finding the network profitable, which is why they have decided to disconnect their machines.

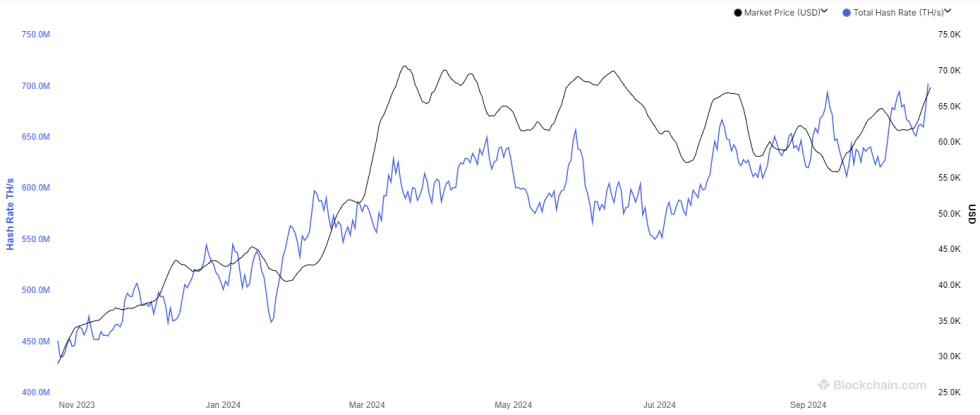

Now, here is a chart that shows the trend in the 7-day average Bitcoin mining hashrate over the past year:

As displayed in the above graph, the 7-day average Bitcoin mining hashrate has seen some rapid growth over the last few days and has surpassed the ATH set earlier in the month. The reason behind this latest spike in the metric could lie in the bullish price action that the cryptocurrency has enjoyed recently.

Miners make the primary part of their income through the block subsidy, a fixed BTC reward that they receive as compensation for adding blocks to the network. The block subsidy is given out at a more or less constant rate of time, so the only real variable related to miner revenue is the USD value of BTC.

The growth in the mining hashrate earlier in the month had come right after a rally in the price. The miners had been expecting the run to continue, but once it had become clear that wasn’t happening, they had pulled back on their upgrades.

A similar pattern had also been witnessed last month. It now remains to be seen if the latest increase in the Bitcoin mining hashrate would have the same fate, or if this price rally is one that would make expansion worth it for the miners.

BTC Price

The Bitcoin price rally has seen a setback during the last couple of days as the asset has retraced to the $67,100 mark.