The post POPCAT Could Hit $1.7 as On-Chain Data Signals Strength appeared first on Coinpedia Fintech News

The overall cryptocurrency market sentiment is quite unpredictable due to the ongoing volatility ahead of the presidential election. Amid this, Popcat (POPCAT), a popular meme coin is poised for a notable upside rally. This bullish speculation for the meme coin is based on the asset’s bullish price action.

POPCAT Technical Analysis and Upcoming Levels

According to the expert technical analysis, POPCAT has been trading within a bullish channel pattern in the four-hour time frame. Following a recent price decline, the meme coin has reached the lower boundary of the channel and has begun moving toward the upper level.

Apart from this, POPCAT’s four-hour chart shows that the asset has been forming an upper-high and upper-low pattern since the beginning of October 2024, and it is now heading toward forming a higher high.

Based on the price action and historical momentum, there is a strong possibility that it could soar by 17% to reach the $1.7 level in the coming days.

Additionally, POPCAT’s Relative Strength Index (RSI) suggests a potential upside rally as it is in an oversold area. Meanwhile, its 200-day Exponential Moving Average (EMA) indicates an uptrend, as the meme coin’s price is trading above the 200 EMA.

Bullish On-Chain Metrics

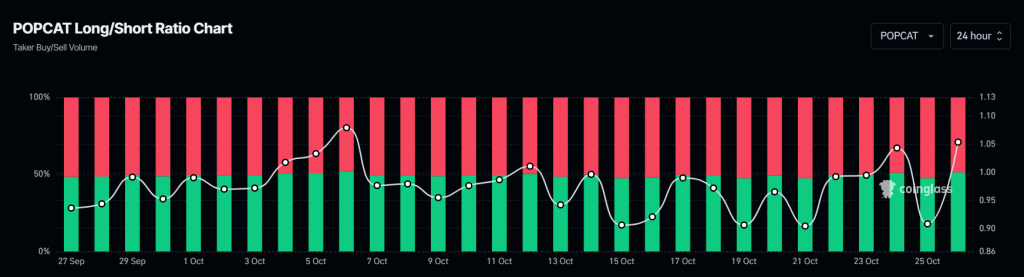

POPCAT’s bullish outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, POPCAT’s Long/Short ratio currently stands at 1.056, indicating a strong bullish sentiment among traders. Meanwhile, the ratio for the past four hours is at 1.15, suggesting that bulls have been strongly dominating during this period.

On the other hand, POPCAT’s open interest has dropped by 2%, indicating a liquidation of traders’ positions, likely due to the significant volatility in the past 24 hours.

Combining these on-chain metrics with the technical analysis, it appears that bulls are currently dominating the asset and may help it reach the speculated targets in the coming days.

Current Price Momentum

At press time, POPCAT is trading near $1.45 and has experienced a price decline of over 3.2% in the past 24 hours. During the same period, its trading volume jumped by 19%, indicating heightened participation from traders and investors compared to previous days.