Bitcoin has faced a turbulent week, with price swings ranging from a local high of $69,500 to a low of $65,000, cooling off after weeks of bullish excitement. Now, BTC is consolidating just below the crucial $70,000 level, a price point seen as a key threshold for the next major move.

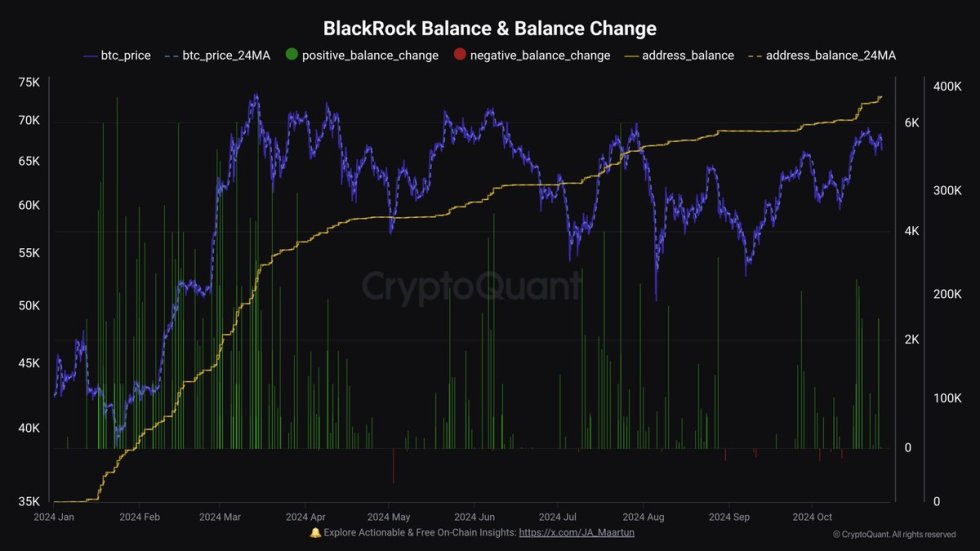

Despite the price cooling, top investors and analysts are keeping a close watch on market dynamics. CryptoQuant analyst and prominent investor Maartunn recently shared a chart highlighting a significant increase in BlackRock’s balance and balance changes in BTC, suggesting that the financial giant may be strategically propping up the market.

This insight into BlackRock’s growing involvement has sparked new optimism among investors, who view institutional support as a powerful foundation for Bitcoin’s potential rally. The company’s increased presence in the BTC market, as shown by Maartunn’s analysis, implies a deepening commitment that could bring greater stability and strength to BTC prices in the coming weeks.

As Bitcoin stabilizes below $70,000, these signals from large players like BlackRock add an extra layer of anticipation to the market, with analysts speculating that their influence could propel BTC through critical resistance levels.

Bitcoin Growth Sustained By Institutions

Bitcoin is approaching a pivotal moment, with market sentiment strongly favoring a push to new all-time highs in the near future. Analysts and investors are growing increasingly optimistic as ETF flows have shown consistent positivity over the past few weeks, bolstering expectations for BTC’s upward trajectory. Price action, too, has been resilient, consolidating near critical resistance levels and signaling underlying strength in the market.

A recent analysis by top analyst Maartunn sheds light on an intriguing dynamic involving BlackRock’s BTC holdings. Maartunn shared a chart revealing BlackRock’s Bitcoin balance and its net balance changes, indicating that the financial giant may be subtly propping up the market.

The chart highlights a notable trend: positive balance changes at BlackRock have overwhelmingly outweighed negative ones, suggesting a sustained accumulation phase. This pattern implies that BlackRock may be positioning itself as a key BTC market maker, possibly providing liquidity and contributing to price stability in a highly volatile market.

Such actions by BlackRock could prove to be a major catalyst for Bitcoin’s price, as institutional involvement historically encourages investor confidence and mitigates market downturns. With positive ETF flows and strategic accumulation from major players like BlackRock, the current setup points toward an environment primed for bullish movement. If BTC continues to hold these levels and institutional backing remains strong, the stage could be set for a rally that takes BTC to uncharted territory.

Bitcoin Testing Crucial Liquidity

Bitcoin is currently trading at $67,000 and appears to be forming a bullish flag pattern, which could potentially propel the price higher in the near term. The price has successfully held above the critical $65,000 level, providing a solid foundation for a bullish outlook as it indicates strong buyer interest. This key threshold has acted as support, preventing further declines and reinforcing the optimism among traders.

However, the next week will be crucial for Bitcoin. If the price fails to break above the $70,000 mark, a retracement to lower demand levels is likely. Such a move could test the 200-day moving average, currently situated at $63,275. Should BTC drop below the $65,000 mark, this area would become a focal point for traders seeking strong demand, as it has historically served as a significant support level.

Maintaining the bullish flag pattern and overcoming resistance at $70,000 will be vital for sustaining upward momentum. Traders will closely monitor price action to determine whether BTC can continue its ascent or if a pullback to lower levels is on the horizon. The coming days will reveal whether bullish sentiment can push BTC to new heights.

Featured image from Dall-E, chart from TradingView