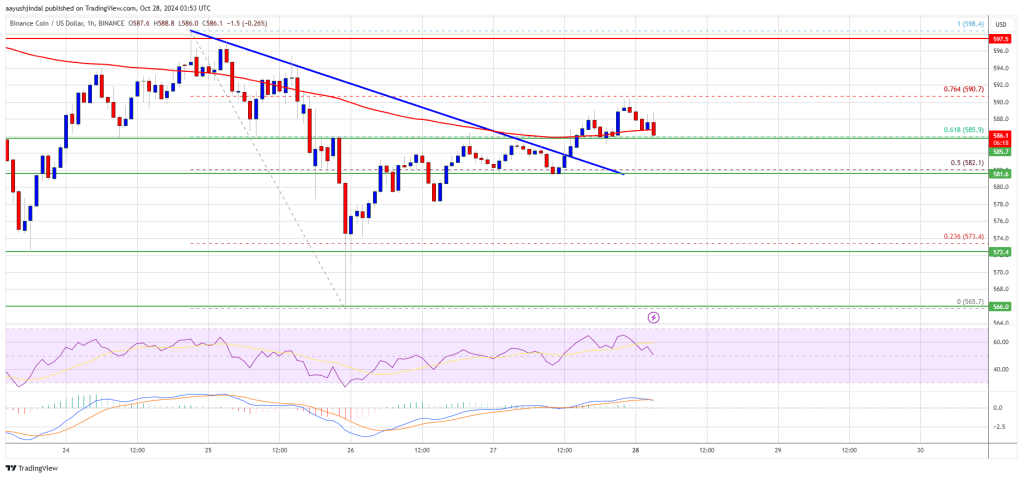

BNB price corrected gains below the $580 level. The price is now recovering higher and facing hurdles near the $590 resistance zone.

- BNB price started a downside correction from the $600 resistance zone.

- The price is now trading below $590 and the 100-hourly simple moving average.

- There was a break above a connecting bearish trend line with resistance at $585 on the hourly chart of the BNB/USD pair (data source from Binance).

- The pair must stay above the $590 level to start another increase in the near term.

BNB Price Aims Fresh Increase

After struggling above $605, BNB price saw a downside correction. The price dipped below the $590 and $585 support levels like Ethereum and Bitcoin.

There was a move below the $580 and $575 levels. The price even dipped below $572 before the bulls appeared near $590. A low was formed at $565 and the price is now correcting losses. It climbed above the $575 level and the 50% Fib retracement level of the downward move from the $598 swing high to the $565 low.

There was a break above a connecting bearish trend line with resistance at $585 on the hourly chart of the BNB/USD pair. The price is now trading below $590 and the 100-hourly simple moving average.

If there is a fresh increase, the price could face resistance near the $590 level or the 76.4% Fib retracement level of the downward move from the $598 swing high to the $565 low.

The next resistance sits near the $598 level. A clear move above the $598 zone could send the price higher. In the stated case, BNB price could test $605. A close above the $605 resistance might set the pace for a larger move toward the $620 resistance. Any more gains might call for a test of the $632 level in the near term.

Another Decline?

If BNB fails to clear the $590 resistance, it could start another decline. Initial support on the downside is near the $585 level. The next major support is near the $582 level.

The main support sits at $572. If there is a downside break below the $572 support, the price could drop toward the $565 support. Any more losses could initiate a larger decline toward the $550 level.

Technical Indicators

Hourly MACD – The MACD for BNB/USD is losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BNB/USD is currently near the 50 level.

Major Support Levels – $585 and $582.

Major Resistance Levels – $590 and $598.