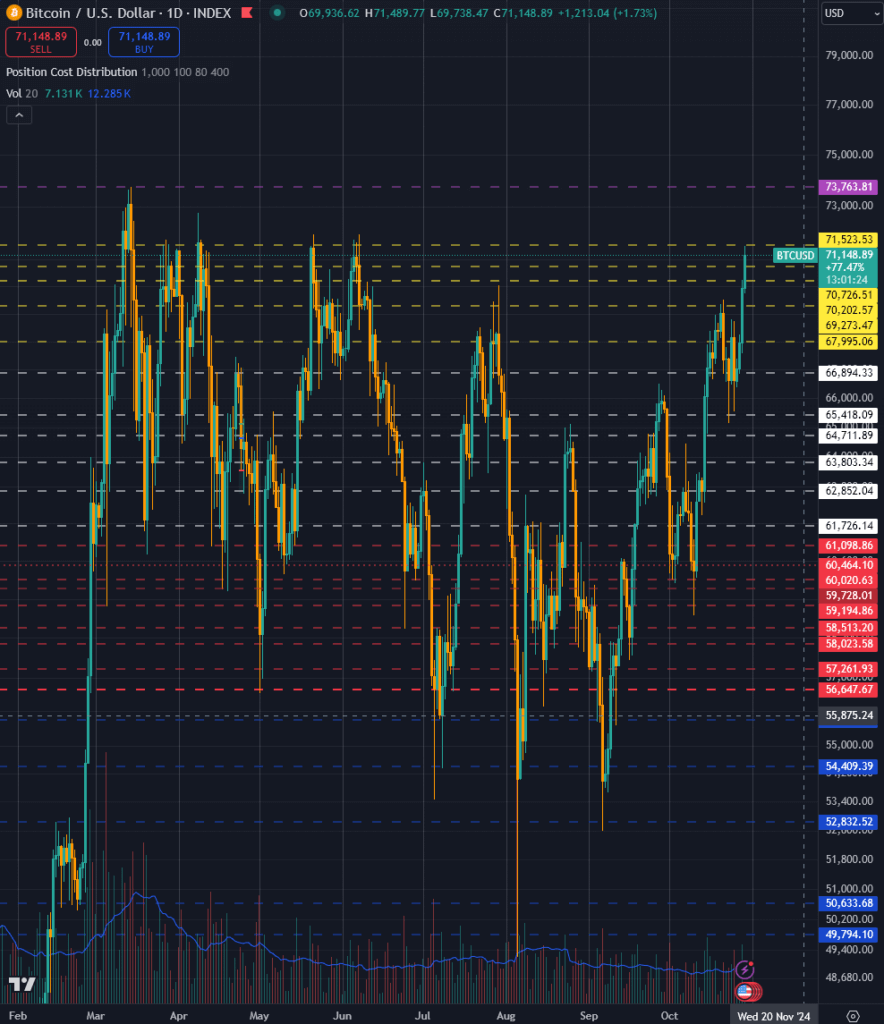

After nine months of trading within consistent price channels, Bitcoin is threatening to break out above a new all-time high and enter true price discovery. My price channels have been noted for their correlation with key Bitcoin movements through 2024.

However, we’ve now hit the top of my channels for only the sixth time this year. All but once, Bitcoin retraced from the current price, and that was when we hit a new all-time high, indicating we’re either at a local top or a new era of price discovery is before us.

Currently traded at the top of a core price channel between $67.9k and $71.5k, Bitcoin will be around a price point it has only spent several days in throughout its history if it surpasses this key resistance. Between $71.5k and $73.7k, there is little price action to allow analysts to ascertain reasonable support or resistance.

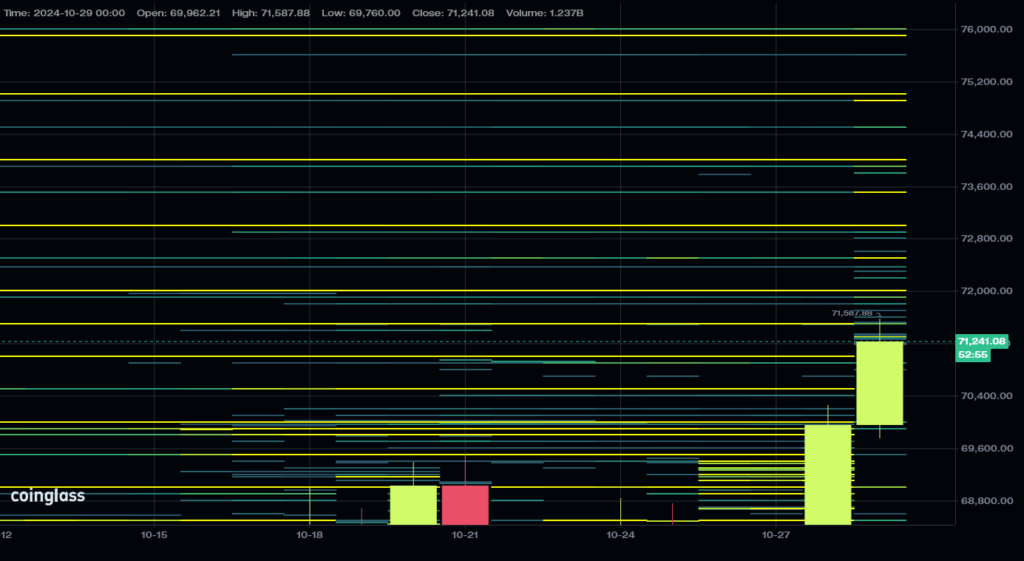

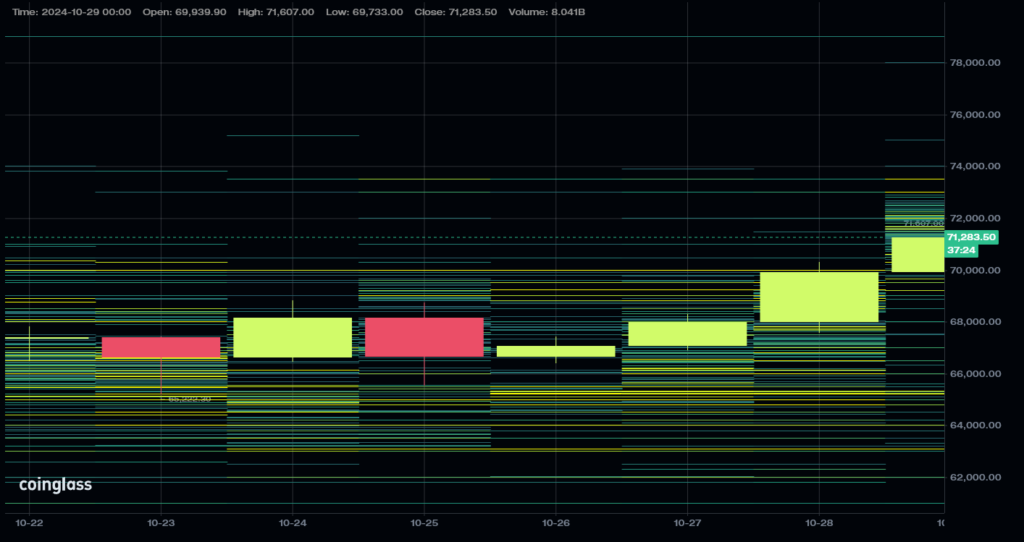

However, reviewing the spot order books and derivative positions does offer some basic insights. Coinglass data reveals several notable sell order blocks within the order book across major exchanges above the all-time high of around $76k. Yellow bars denote cumulative orders on Binance over 200 BTC. These areas could provide resistance should Bitcoin approach these prices.

Interestingly, there is a severe lack of liquidity for sell orders on perpetual futures markets on Binance above the all-time high. This could reduce resistance in futures markets if profit-taking does not immediately occur should Bitcoin enter price discovery. Again, yellow denotes order values above 200 BTC, with none above $73.7k

Based on current market liquidity and the limited price action above the current price. The below levels may be worth considering for potential support and resistance areas should Bitcoin continue its bullish journey.

Note: Historical activity is not necessarily representative of future market activity, and market liquidity changes from moment to moment. The price channels presented in this insight are for educational and informational purposes only. They do not predict future prices but simply indicate areas where market liquidity could potentially impact the velocity of Bitcoin’s price.

The post Above the all-time high of $73.7k these could be the new resistance levels to watch appeared first on CryptoSlate.