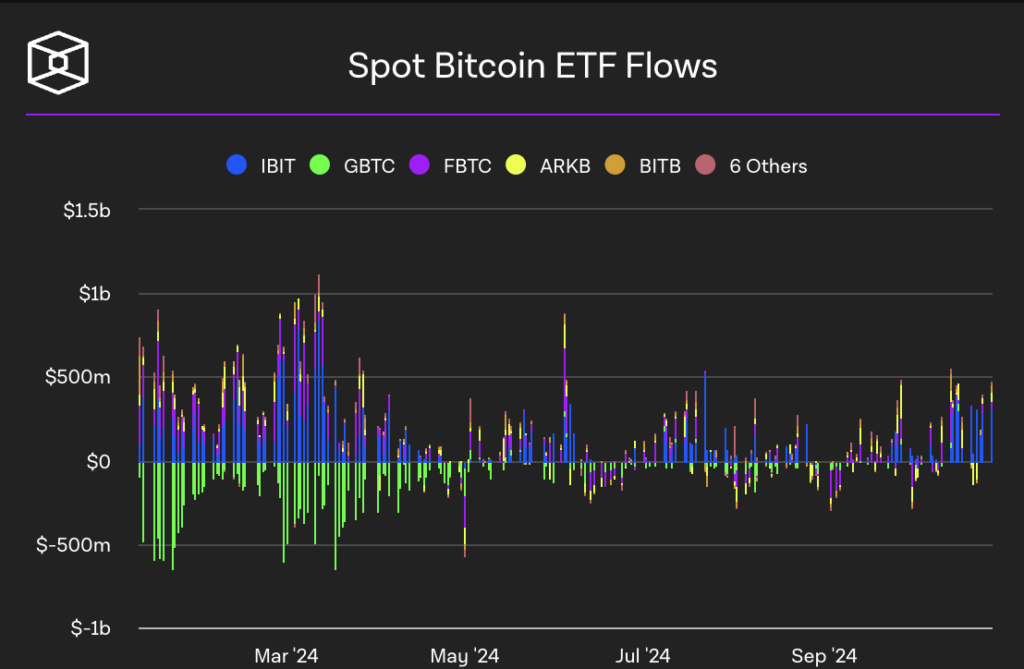

Bitcoin reached $73,500 on Oct. 29, coming within $200 of its all-time high of $73,700. On the same day, Bitcoin exchange-traded funds (ETFs) recorded total inflows of $870.1 million, indicating a significant increase in investment activity.

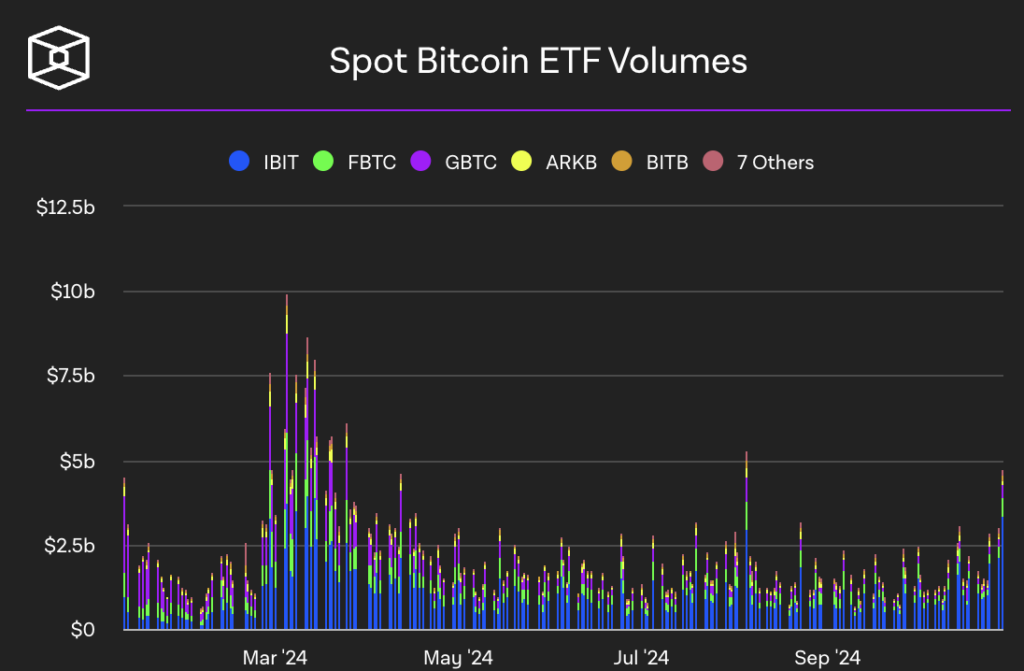

The Block historical data shows that with almost $5 billion in volume, yesterday was also within the top 10 days since the spot ETFs launched in January and the highest since August.

The iShares Bitcoin Trust (IBIT) led the inflows with $642.9 million, reinforcing its position in the market. Fidelity’s FBTC followed with $133.9 million, while Bitwise’s BITB attracted $52.5 million. ARK’s Bitcoin ETF (ARKB) saw inflows of $12.4 million, and Grayscale’s BTC fund added $29.2 million despite previous outflows.

As of press time, the Block data has not been updated to include Oct. 29. However, the visualization below illustrates that the $870 million inflow was only surpassed on eight other days since launch.

These substantial inflows align with Bitcoin’s price surge, suggesting increased investor confidence. The proximity to its all-time high may have spurred additional interest, especially with the US election just days away.

Market analysts are watching to see if this momentum will push Bitcoin past its previous peak. The significant capital flowing into ETFs like IBIT and FBTC indicates a strong appetite for Bitcoin exposure through traditional investment vehicles.

The post Bitcoin ETFs has Top 10 inflow day with $870 million acquired as Bitcoin closes in on all-time high appeared first on CryptoSlate.