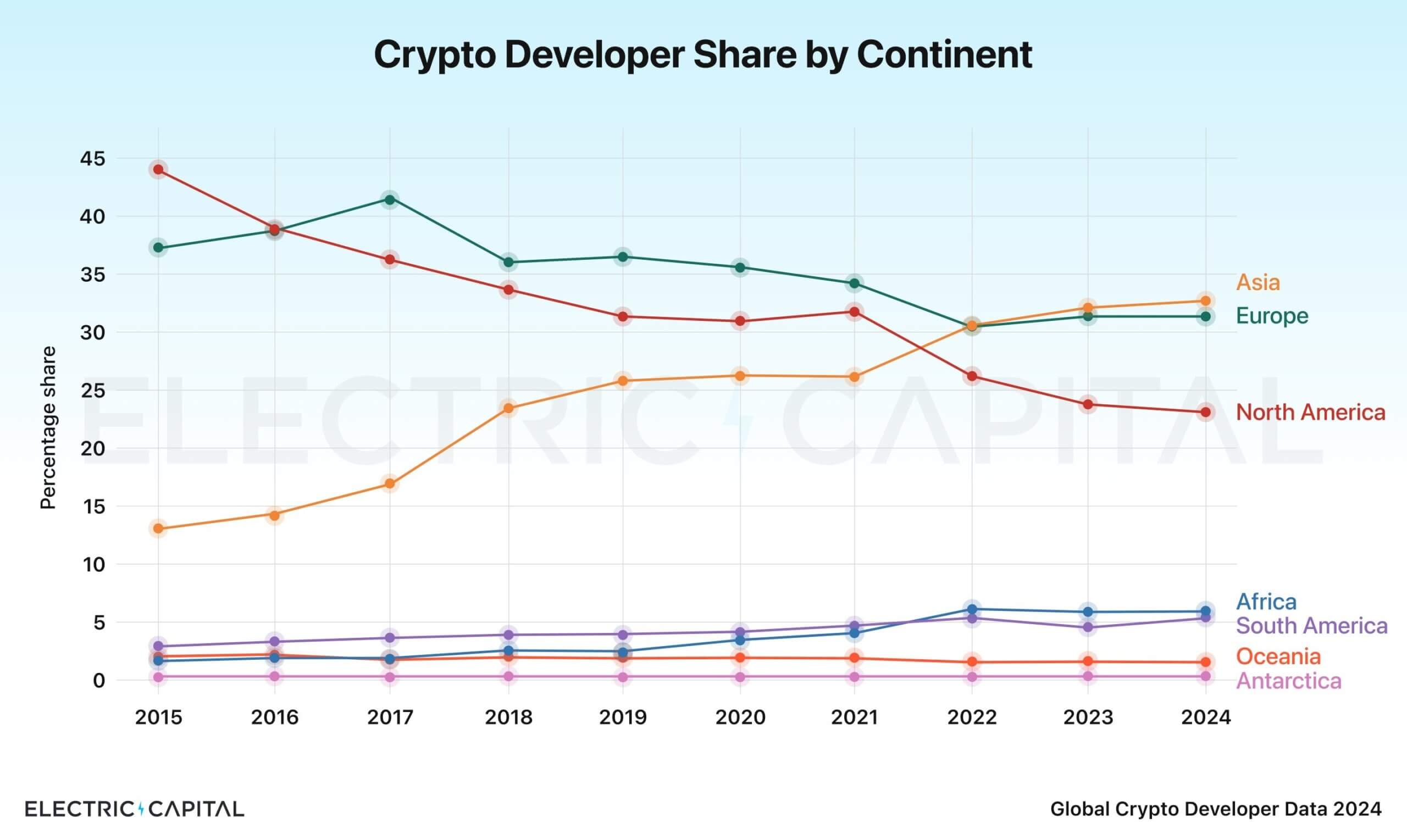

Asia has surpassed North America as the leading hub for crypto developers, according to a report from Electric Capital.

Maria Shen, partner at Electric Capital, pointed out that Asia has steadily increased its share of global crypto developers, climbing from 13% to 32% since 2015. In contrast, North America’s share dropped from 44% to 25% over the same period.

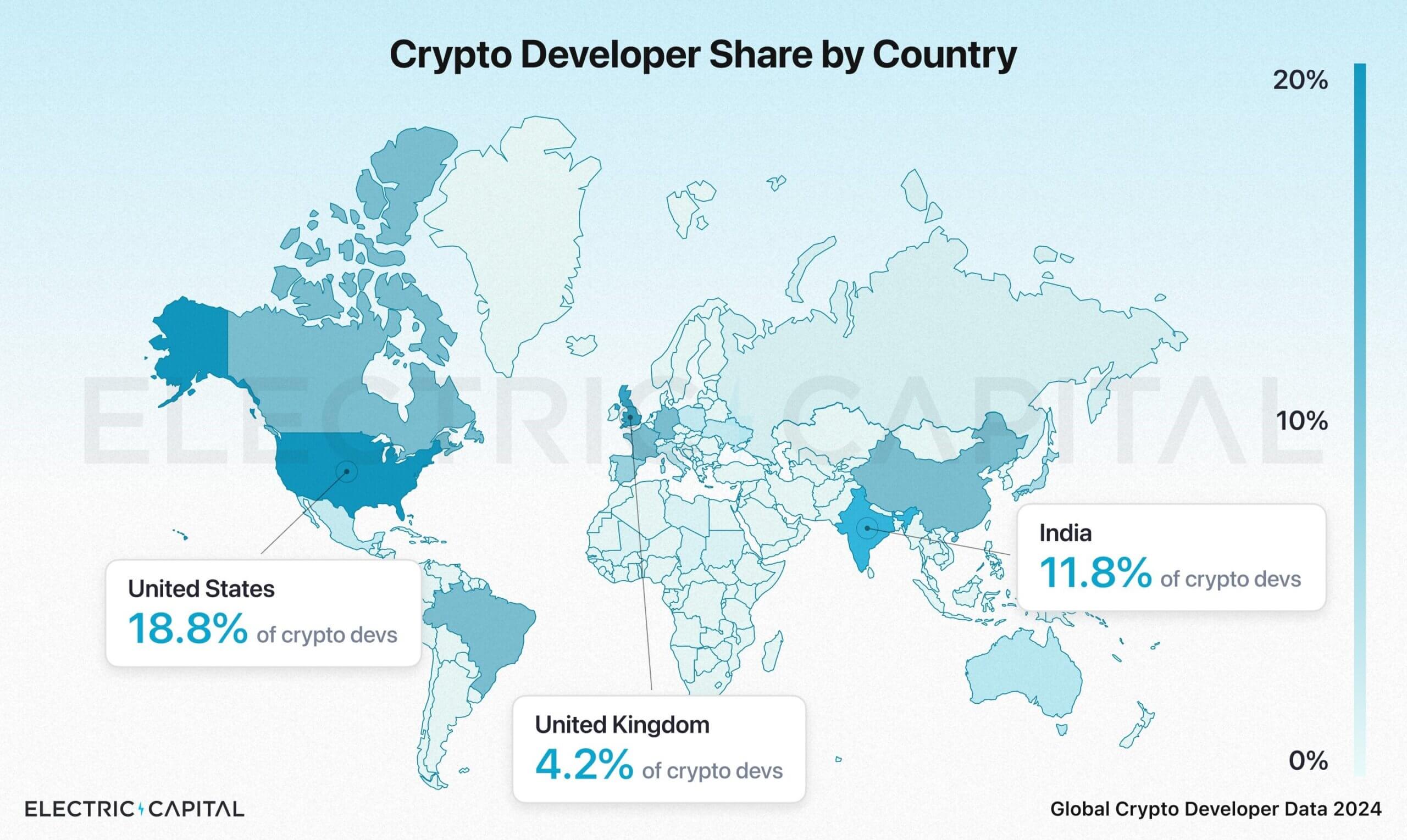

However, Shen noted that while North America’s influence on the global stage has lessened, the United States still leads among individual countries regarding crypto developer presence.

US crypto talents

The Electric Capital’s report highlighted that the United States accounts for 18.8% of crypto developers globally. India and the United Kingdom follow closely, with 11.8% and 4.2% market shares, respectively.

However, the report also challenges the perception that US crypto developers are concentrated only in California and New York.

While 22.3% of crypto developers live in California and 13.7% in New York, 64% work outside these states. This dispersion presents an opportunity for job and wealth creation nationwide, benefiting other communities and political backgrounds.

Talent drain

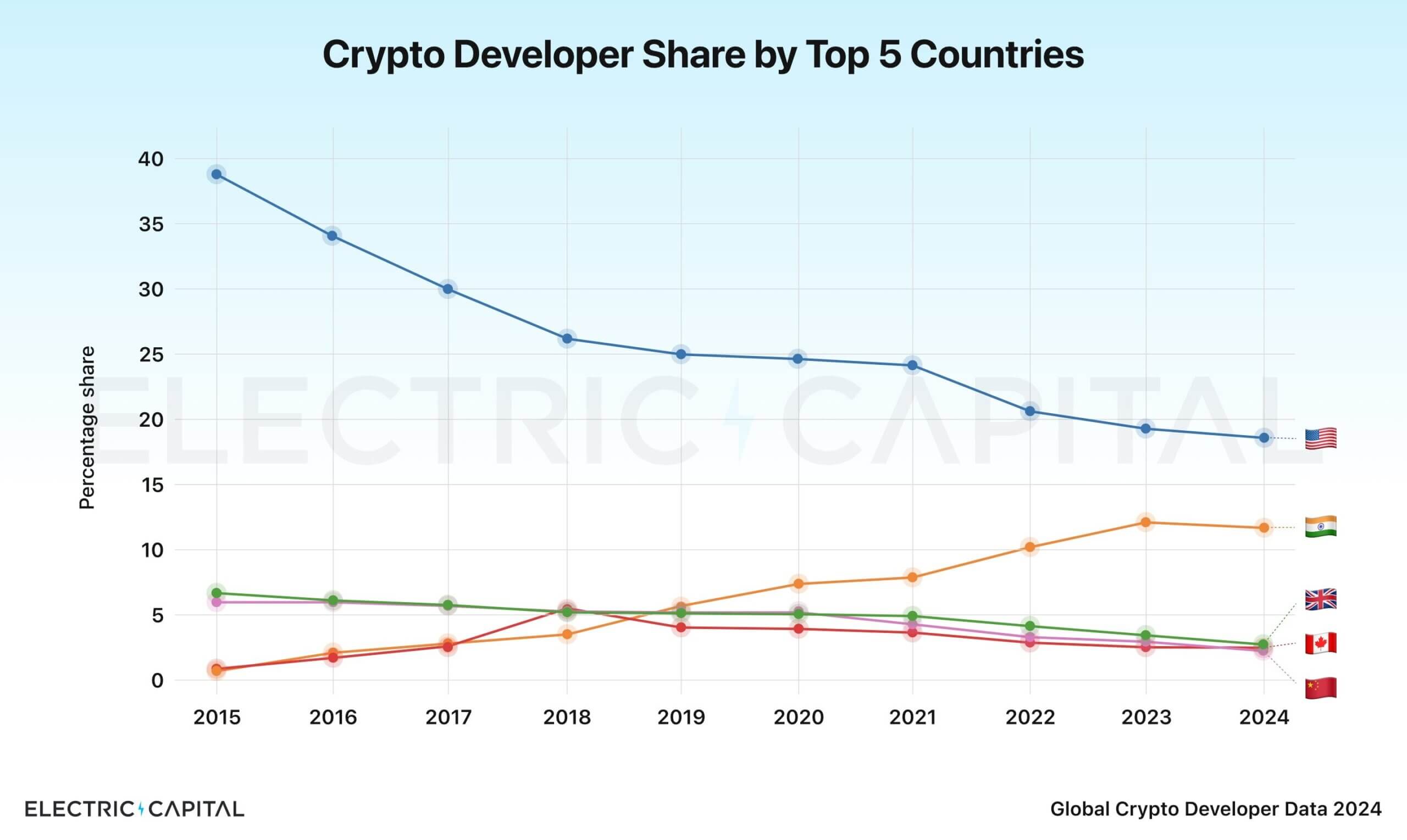

However, a broader look at the sector shows that the US is experiencing a talent drain as most blockchain developers, around 81%, are based outside the country.

Notably, the US has experienced a 51% decrease in its share of crypto developers since 2015—a period that saw the global crypto market grow from around $5 billion to a staggering $2.4 trillion.

Experts believe this decline may reflect regulatory uncertainty and the country’s lack of clear crypto policies. Over the past years, US authorities have adopted a regulation-by-enforcement approach that has led to hostile actions against industry players.

This has resulted in the departure of several crypto firms outside the US into more friendly crypto hubs in Hong Kong, Singapore, and other jurisdictions.

Meanwhile, Shen noted that the US’s declining market share could result in potential challenges for the country in staying competitive in digital currency innovation. She further suggested that this trend may signal a risk to national security and a possible innovation gap.

The post Asia emerges as new crypto developer powerhouse, leaving US behind appeared first on CryptoSlate.