The post Crypto Market Crash: Bitcoin Drops to $69K, Will BTC Reverse to $73.8K or $65.4K? appeared first on Coinpedia Fintech News

With a massive correction in Bitcoin on Thursday, the crypto total market cap dropped by 3.10%. The slip-down continues with an intraday drop of 0.80%, accounting for a wipeout of nearly $100M in the entire crypto market.

With the sudden surge in bearish momentum, the derivatives market witnessed a quick fall, with the 24-hour Bitcoin long-to-short ratio dropping to 0.92%. Further, the liquidations have reached $276.86 million, with the long liquidations accounting for $246.38 million.

In a bearish resurgence, the Bitcoin open interest has declined by 5.36%, reaching $41.24 billion. Will this correction result in an extended crash this week? This Coinpedia article focuses on Bitcoin price action to determine the next possible move. So, read until the end and subscribe for the latest analysis and updates.

BTC Price Analysis

As the Crypto Bullish Rally cools down, Bitcoin registers its third negative day, creating a triple black growth pattern. Yesterday, the bearish reversal started with a 0.55% drop on Wednesday, leading to a 2.90% drop last night.

This completes the evening star pattern in the daily chart, as it faced opposition from the near all-time high levels. Currently, the BTC price is trading at $69,556, with an intraday pullback of 0.97%.

With a minor lower price rejection, the largest cryptocurrency is taking support from its 78.60% Fibonacci level at $68,943. As the bearish pullback intensifies, BTC’s week-to-date gains are now limited to 2.39%, compared to 8.34% at its peak on Tuesday.

Despite the sudden surge in selling pressure, the simple moving averages maintain a bullish signal. The 50-day and 200-day SMA has given a golden crossover. Meanwhile, the 100-day SMA maintains a positive trend in attempts to cross above the 200-day EMI.

However, the momentum indicator shows MACD and signal lines struggling to sustain a positive alignment and warns of a bearish crossover.

With the general market anticipating a post-retest reversal in Bitcoin, the crossroads at the $69k barrier remains crucial. A quick V-shaped recovery will increase the chances of surpassing $73,800 and creating a new all-time high.

Conversely, a drop below the 78.60% Fibonacci level could prove fatal for the current market sentiments. With the US presidential elections over the horizon, increased institutional support through ETFs, and the recent rate cuts, the general mass expects a new ATH. Closing below the $68,943 level will increase the chances of a slip to $65,439.

Bitcoin On-chain Reveals Room for Growth

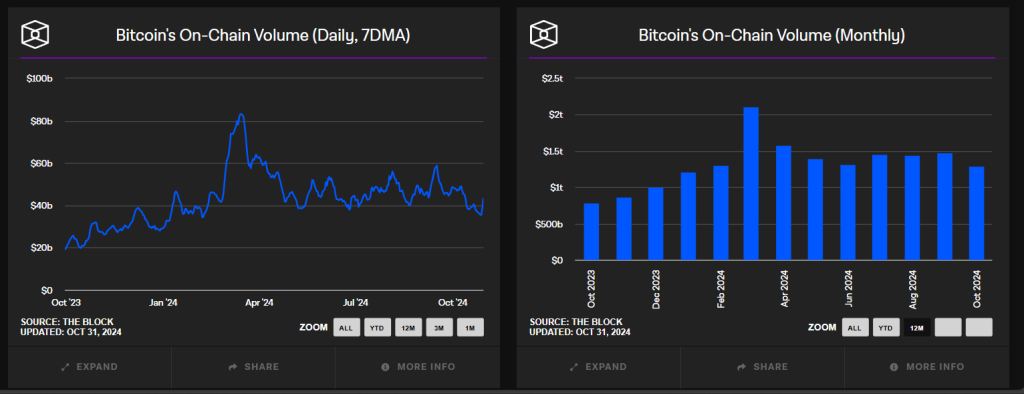

With the price action analysis suggesting a quick reversal necessary for a sustained uptrend in Bitcoin, the on-chain analysis reveals massive room on the upside. The Bitcoin on-chain volume is currently standing at $43.25 billion, slightly more than half of the 52-week high of $83.14 billion.

Meanwhile, the monthly volume peaked at $2.11 trillion in March 2024 and is currently standing at $1.29 trillion. Hence, compared to the peak of the 2024 rally, the on-chain value of Bitcoin has the potential to surge higher.

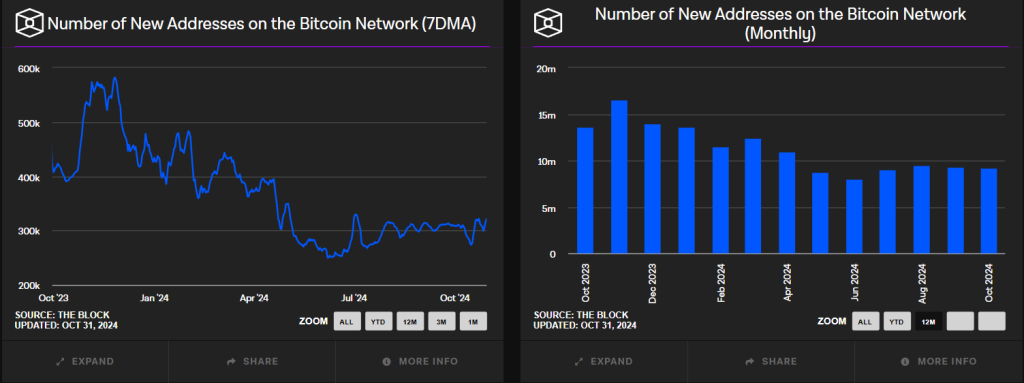

Furthermore, the number of new addresses over the Bitcoin network has been on a declining trend. The daily new addresses stand at 321.57k. This is slightly more than half of the 52-week high of 578.17k registered in last year’s November. It has nearly halved in the past 12 months but shows a promising recovery compared to the massive drop in June.

Hence, the possibility of an on-chain volume and the number of new addresses over the Bitcoin network will likely surge higher in the refreshed crypto rally. In short, it increases the chances of Bitcoin reaching the $90,000 mark by the end of the year if the bullish rally sustains.

Curious to know if Bitcoin will hit $100,000 in 2024? Find a technically and logically driven answer in Coinpedia’s BTC price prediction, and subscribe to us for the latest crypto updates!