The post Bitcoin Price at Risk? Mt. Gox Shifts Billions in BTC appeared first on Coinpedia Fintech News

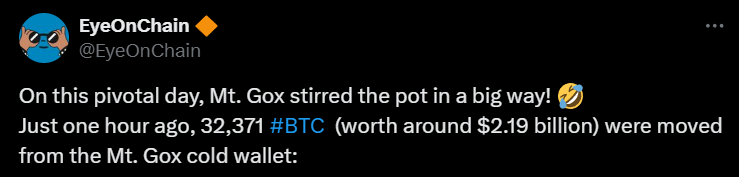

Bitcoin (BTC), the world’s largest cryptocurrency by market cap, has fallen below the $68,000 level as defunct Mt. Gox moves billions worth of BTC. On November 5, 2024, the Whales transaction tracker made a post on X (Previously Twitter) that Mt. Gox had moved a substantial 32,371 BTC worth $2.19 billion, from its cold wallet.

Mt. Gox’s Billion-Dollar BTC Transactions

This significant BTC transfer took place on a crucial U.S. presidential election day.

According to the data shared by Whale Tracker, 30,371 BTC was transferred to the wallet address “1FG2Cv.” However, no further movement or transfer has been witnessed from this address yet.

Additionally, 2,000 BTC has been moved to the cold wallet “1jbezD,” and another 2,000 BTC was transferred from Mt. Gox to the wallet address “15gNRV.”

Despite these substantial Bitcoin transfers, the asset price appears more resilient after falling below the $68,000 level. Following the decline, BTC has found support at the 200 Exponential Moving Average (EMA) in the four-hour time frame and is now moving upward.

Bitcoin Price Analysis

At press time, BTC is trading near $68,150 and has experienced a price decline of 1.35% in the past 24 hours. During the same period, its trading volume jumped by 26%, indicating increased participation from traders and investors ahead of the U.S. election.

Bitcoin Technical Analysis and Upcoming Level

According to expert technical analysis, Bitcoin appears neutral as it currently sits at a crucial support level within the breakout zone and has also found support at the 200 EMA. However, the purpose of Mt. Gox’s substantial BTC transaction remains unknown, so there is a strong possibility that this has not impacted the price.

Based on recent price action, if BTC closes a four-hour candle above the $69,000 level, there is a strong possibility it could rise significantly in the coming days.

In the struggling cryptocurrency industry, whales and investors are actively participating as BTC’s large transactions have skyrocketed by 90% in the past 24 hours. These notable large transactions highlight significant participation amid the price decline ahead of the election, which is a bullish sign.