The post US Election 2024: Who will Win and How Crypto Market will React to it? appeared first on Coinpedia Fintech News

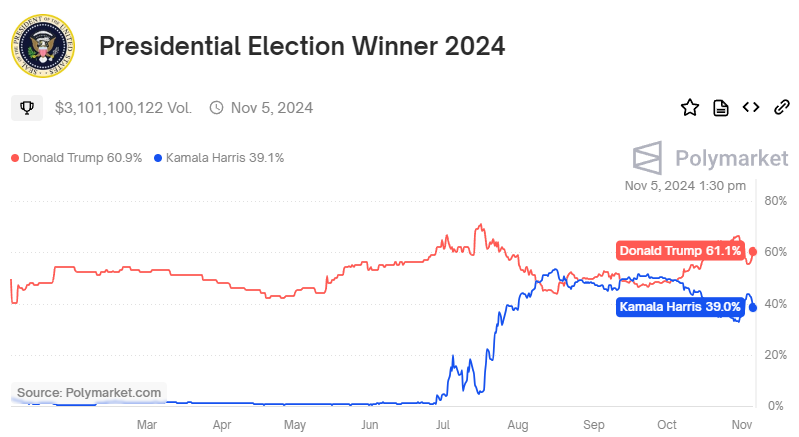

As the 2024 US presidential election comes down to the wire, the stakes couldn’t be higher for the crypto market. Just a few hours are left before the polling starts. This is a peak moment not just for U.S. politics but for the crypto industry as well. People are watching everything related to this election very closely. Data from Polymarket shows that Trump holds a 61% chance of winning however Harris has only 39%. Let’s dig into how the crypto market might react to either outcome.

Trump’s Potential Win: A Bitcoin Rally?

If Trump wins, Bitcoin fans might be in for some exciting times. Some experts at Bernstein think Bitcoin’s price could jump pretty fast—maybe hitting between $80,000 and $90,000 within just two months. That’s higher than its previous peak of about $73,800. Why do crypto people have so much optimism towards this? Well, Trump has shown a very crypto friendly attitude. Even his running mate JD Vance is also a great supporter of Bitcoin and crypto. This adds more weight to Trump’s crypto pro stance. We have witnessed the bitcoin price moving according to the rise and drop in odds of Trump victory. Crypto space believes his winning can bring crypto-friendly regulations. He has shared his plan to fire the SEC chair Gary for his anti crypto behavior. This excites the crypto industry more and they believe he can bring a nourishing environment for the digital space.

What If Harris Wins? A Slower Road for Crypto

If Kamala Harris manages to pull ahead, the story changes quite a bit. Analysts expect Bitcoin could feel some pressure and might dip down to around $50,000, which would be a pretty steep drop of over 25%. The industry believes the administration will bring more strictness for the crypto space under Kamala’s command. Investors are definitely feeling nervous about that. Bitcoin believes are still optimistic pointing towards the long term growth of crypto. This view is driven by the growing adoption of Bitcoin ETFs and increasing interest from institutions and retail investors.

What to Expect After the Election

Looking ahead, the election’s outcome is bound to stir the crypto market, regardless of who wins. Standard Chartered analyst Geoff Kendrick notes that if Harris takes the prize, Bitcoin might stabilize around $75,000 by the end of 2024. But if Trump wins, we could see Bitcoin soar to as much as $125,000. It’s a tense time for both crypto and stock markets, with everyone holding their breath. Whether you’re a seasoned investor or just curious about the future of Bitcoin, the next few hours and days will surely be interesting.