The post Bitcoin Ready for Pump? On-Chain Insights Amid U.S. Election Polls appeared first on Coinpedia Fintech News

The cryptocurrency market appears to be recovering as former U.S. President Donald Trump leads the presidential election polls. Amid the ongoing election, with Trump as a potential winner, Bitcoin (BTC), the world’s largest cryptocurrency by market cap, has reached $70,000 while breaching the crucial resistance level.

Given the notable upside rally, it appears that if Trump continues to lead in the election polls there is a high possibility that BTC will experience a significant rise.

Bitcoin’s Bullish On-Chain Metrics

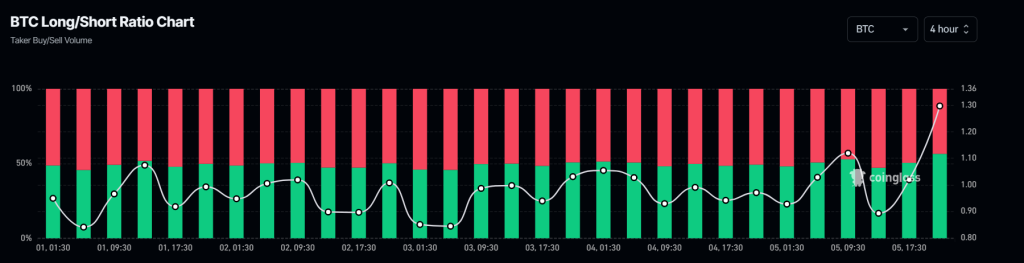

However, on-chain metrics suggest a strong bullish sentiment for Bitcoin. According to the on-chain analytics firm Coinglass, BTC’s Long/Short ratio currently stands at 1.30, the highest since the beginning of November 2024. This notable increase indicates that bulls are currently dominating the asset.

Additionally, BTC open interest has soared by 2.95% in the past 24 hours and has been steadily rising. This increase in open interest suggests that traders are forming new positions in anticipation of the election results.

Whale and Investor Activity

Besides this, it appears that whales and investors are preparing for the election results, as their significant transactions have surged notably. According to the on-chain analytics firm IntoTheBlock, the volume of large transactions by whales has increased by 89.11% over the last 24 hours, indicating a bullish outlook for BTC.

Current Price Momentum

As of now, BTC is trading near $69,855 and has experienced a price surge of over 1.95% in the past 24 hours. During the same period, its trading volume jumped 27%, indicating heightened participation from traders and investors amid election polling.

Price Prediction Commentary

Recently, analysts at the private wealth management firm Bernstein shared a report stating that if Trump wins the election, Bitcoin could reach $80,000 to $90,000. Conversely, they noted that if Kamala Harris wins, BTC could drop to around $50,000.

However, given the current sentiment and election polling, it appears that Trump is likely to win, and we may soon witness BTC reaching a new all-time high along with other cryptocurrencies.