The post 1.38 Billion XRP Tokens Move From Exchange, Election Fever or What? appeared first on Coinpedia Fintech News

The current market sentiment across the cryptocurrency landscape appears bullish as pro-crypto presidential candidate Donald Trump leads in U.S. election polls.

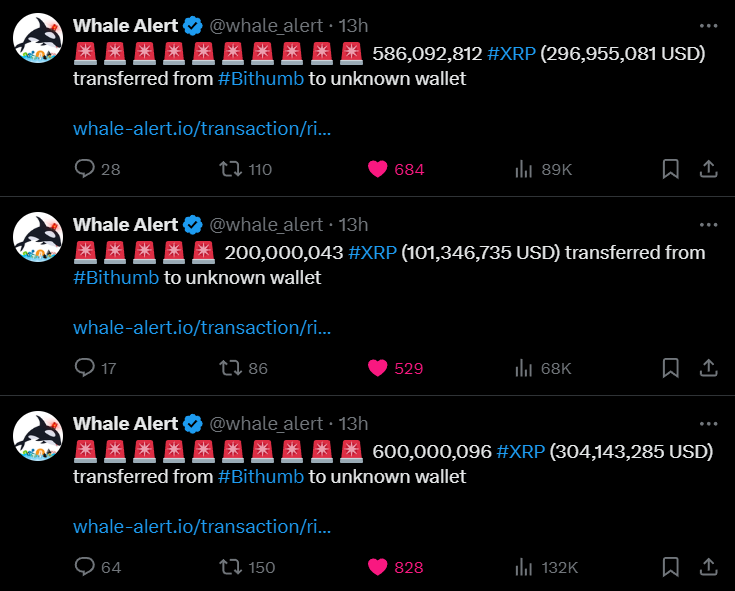

1.38 Billion XRP Transfer

Amid this bullish sentiment, whales and investors have transferred a significant 1.38 billion XRP tokens worth $702.38 million from Bithumb to an unknown wallet. This notable XRP transfer has raised concerns among investors and traders about whether it was a purchase or something else.

Following this significant token transfer, XRP’s price surged by 5.5% in the past 24 hours and is currently trading near $0.532. During the same period, its trading volume bounced by 27.5%, indicating growing participation from traders and investors amid the election excitement.

XRP Technical Analysis and Upcoming Levels

According to expert technical analysis, XRP currently appears neutral, with no clear signs of an upside rally. This speculation may arise from the current price momentum, where tokens are showing an upside with strong bullish action.

However, XRP seems to be struggling to maintain momentum. Traders and investors may see an upside rally if it closes a daily candle above the $0.55 level. If this occurs, there is a strong possibility that XRP could soar by 15% to reach the $0.65 level, its usual target within the ongoing channel pattern.

Bullish On-Chain Metrics

XRP’s on-chain metrics suggest that bulls are currently favoring long positions. According to the on-chain analytics firm Coinglass, XRP’s long/short ratio is currently at 1.03, indicating strong bullish sentiment among traders. Additionally, its open interest has jumped by 9.5% over the past 24 hours, indicating the growing interest of traders resulting formation of new positions.

The combination of rising open interest and a long/short ratio above 1 indicates that bulls are currently dominating the asset, which could be a sign of a buying opportunity.