Dogecoin has seen a jump of over 12% during the past day, but this trend brewing in an on-chain indicator could spell a bearish end to the run.

Dogecoin Investors Have Been Showing Signs Of FOMO Recently

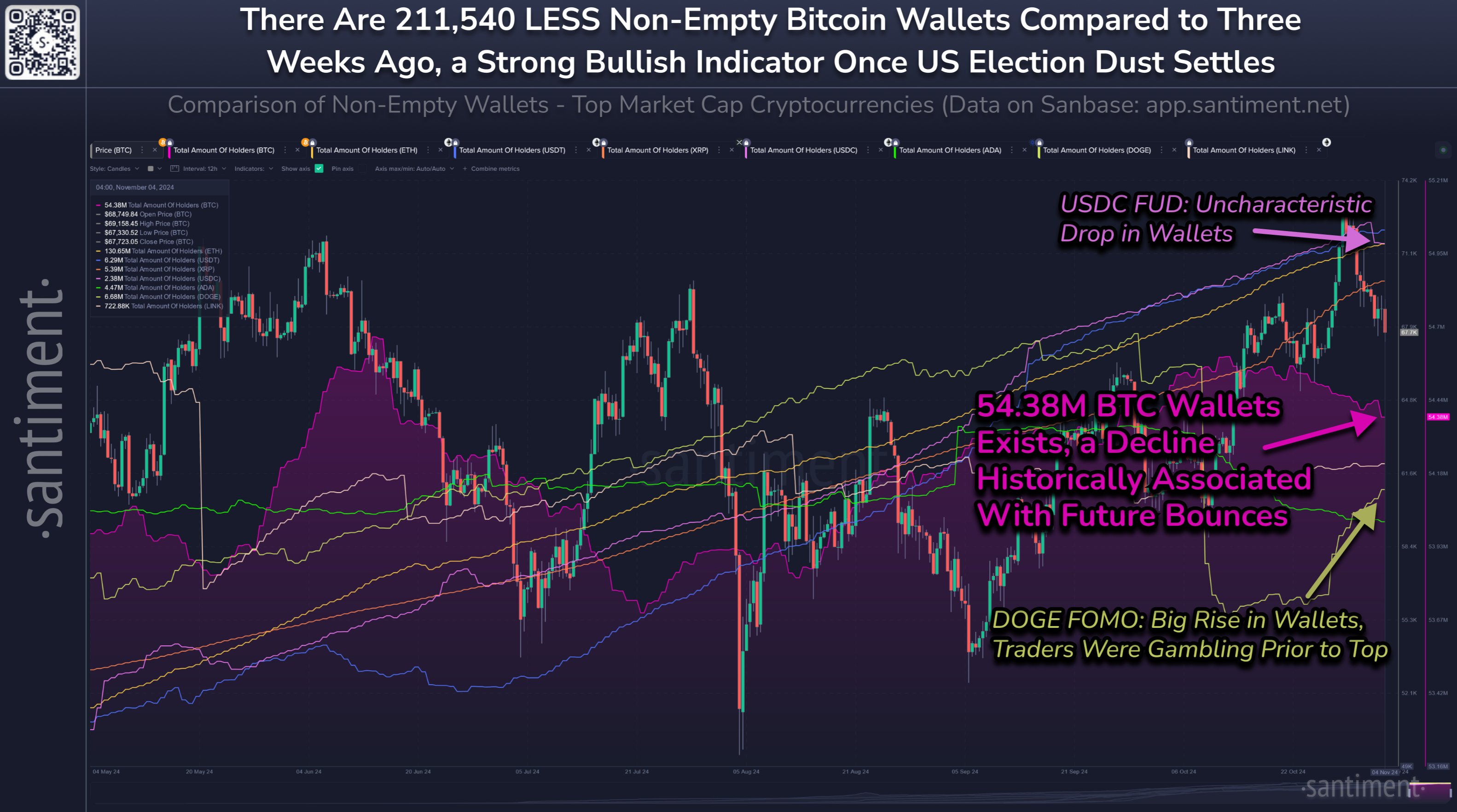

In a new post on X, the on-chain analytics firm Santiment has discussed about how the trend in the Total Amount of Holders has been like for the various top coins in the cryptocurrency sector.

The “Total Amount of Holders” here refers to an indicator that, as its name suggests, keeps track of the total number of addresses on a given network that are carrying a non-zero balance.

When the value of this metric rises, it means new investors are joining the blockchain or old ones who had sold earlier are buying back into the coin. The indicator also registers an increase whenever existing users divide their holdings into multiple wallets for purposes like privacy.

In general, all three of these factors are simultaneously at play whenever this trend develops, so some net adoption of the asset could be assumed to be taking place.

On the other hand, the indicator going down suggests some of the holders have decided to clear out their wallets, potentially because they want to get away from the cryptocurrency.

Now, here is a chart that shows the trend in the Total Amount of Holders for Bitcoin, Dogecoin, and other top assets:

As displayed in the above graph, most of the assets have registered an increase in Total Amount of Holders recently, but Bitcoin has gone against the grain as its non-zero wallets have declined instead.

More particularly, the number one cryptocurrency today hosts 211,500 less addresses compared to three weeks ago, which has brought the metric’s value to 54.38 million.

This means that some investors of the asset don’t believe the current rally would continue further, as they have decided to liquidate their holdings at the recent prices.

Historically, assets in the sector have tended to be sensitive to investor sentiment, but the relationship has been an inverse one: prices tend to go up when investors are showing FUD, while they go down in times of FOMO.

Thus, the recent drop in the Total Amount of Holders may actually prove to be a bullish sign for Bitcoin. From the chart, it’s visible that the metric has shown the opposite trajectory for Dogecoin, as 46,400 addresses with a balance have showed up on the network in the past week alone.

“This is a sign of traders speculating and gambling on meme coins, even after last week’s local top,” notes the analytics firm. Going by what history tells us, this FOMO may not be the best sign for Dogecoin.

DOGE Price

Dogecoin has continued its latest bullish push during the last 24 hours as its price has broken beyond the $0.168 mark. Given the FOMO that has been developing, however, this run may not be sustainable.