The post Could a Bitcoin Reserve Change America’s Economic Future? appeared first on Coinpedia Fintech News

U.S. Senator Cynthia Lummis, famously called the “Crypto Queen,” has a big plan in mind: she wants the U.S. to build a Bitcoin reserve. Lummis believes this bold move could boost America’s economy by treating Bitcoin as a new kind of financial asset. But is Bitcoin really stable enough for that? Let’s dig into her proposal and see what challenges it might face.

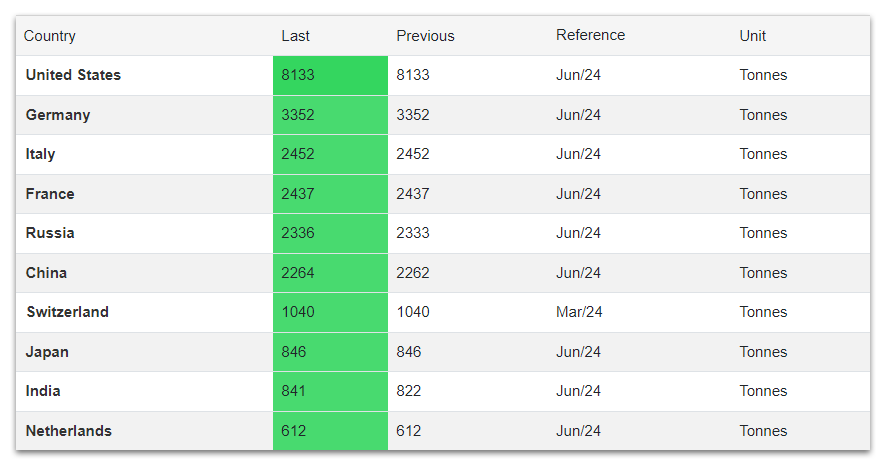

Bitcoin vs. Gold: Can Bitcoin Be as Reliable?

For years, the U.S. has relied on its massive gold reserves to keep the dollar stable. With over 8,000 tons, the U.S. holds more gold than most other countries. Gold’s steady value and easy tradability make it a strong support for the dollar. But Bitcoin is a whole different story. Its price can soar or plummet in a single day, making it far more unpredictable. With a proposed $200 billion Bitcoin reserve, we’re talking about a small fraction of the gold reserve’s value. The big question is: can Bitcoin ever match gold’s reliability?

How Would the U.S. Start Buying Bitcoin?

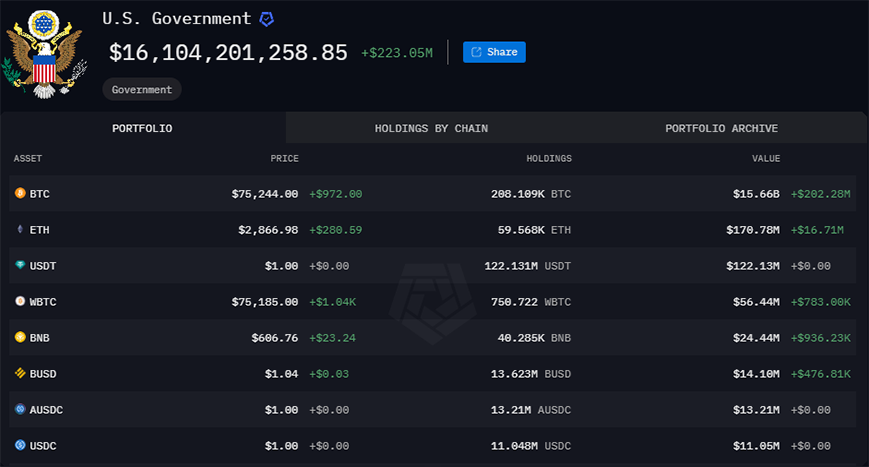

To kick things off, the new administration, under Trump and Vance, could use an executive order. This order would allow some Bitcoin purchases without the lengthy approval process needed for regular currency. Think of it like the government’s emergency oil reserve, which it tapped into in 2022 to ease gas prices. This approach would sidestep some hurdles and treat Bitcoin as a “strategic asset.” But for a lasting Bitcoin reserve plan, Congress would likely need to give the green light and secure multi-year funding. And convincing lawmakers, especially the crypto-cautious ones, could be a tough sell. Also, it is worthy to remember that the U.S. government already holds 208,109 BTC with a worth of $15.66 billion as of the time of writing. Along with this, they also have other major cryptos in their custody seized from various cases.

What to Expect Next?

Senator Lummis’s idea is ambitious, but getting it approved won’t be easy. Bitcoin still has a reputation for being risky, and many in Congress might see it as too unpredictable for a national reserve. With inflation still being a big concern, the government might hesitate to add Bitcoin to its reserves. Right now, the idea of a national Bitcoin reserve could lead to some interesting debates, but we probably won’t see big changes just yet. Still, it’s something to keep an eye on—who knows what role Bitcoin might play in America’s future?