Memecoins are crucial to the blockchain and the cryptocurrency community, and Binance Research highlights their unique value proposition.

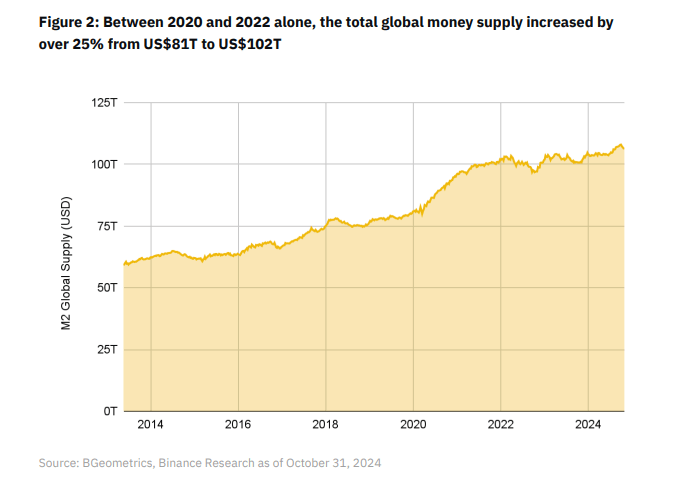

According to Binance rerport, the rise of memecoins coincides with the expansion of the world’s money supply. As money and capital become readily accessible, risk-on investments like Bitcoin, altcoins, and memecoins become attractive options.

Although memecoins promise a strong upside, they are also a high-risk investment since they’re highly speculative and have few use cases. However, their recent performance seems to defy the odds—their market cap was up by 22% immediately after the US election.

Doge and PEPE coins are two of the top gainers among coins this Wednesday, adding 15% and 11% to their values, respectively.

Binance Research: 75% Of All Memecoins Were Launched Last Year

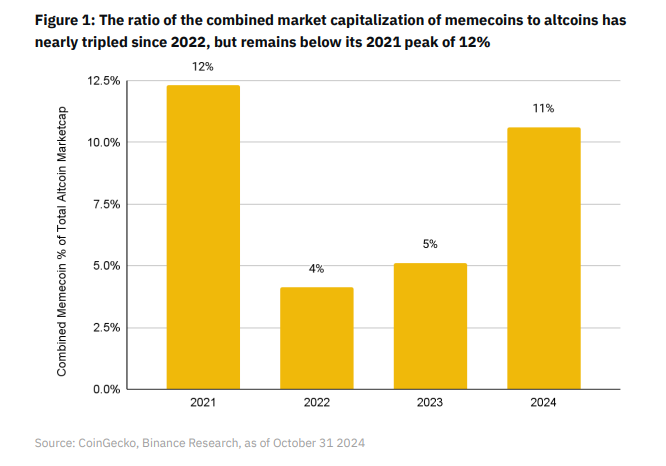

According to a November 2024 Binance research, meme currencies are growing in popularity because people are now looking at risk-on investments. The report adds that the global money supply is expanding, and many retail investors are looking at alternative ways to generate wealth. This niche’s market value has tripled since 2022, thanks to these coins’ popularity.

Binance’s report also mentioned the regulator’s distrust of Initial Coin Offerings (ICOs). With this order, developers will now consider private venture capital funding (VCs) to promote their projects. Experts call this the “Low Float and High FDV” approach, meaning only a few tokens are available for trading but boast a higher valuation.

Memecoins Remain An Accessible Investment Option

While the approach benefits developers and early adopters, it may put regular investors at risk. As such, many retail investors look for memes as alternative investment options. These are the primary reasons why meme tokens are popular and highly accessible to all.

Binance adds that roughly 75% of all meme currencies were launched last year. The Binance team acknowledged that many found launching these projects easy, but sustaining their operations is challenging. According to the same report, around 97% of all memecoins have died, and the rest struggle but managed to ride on the election hype this year.

Memecoins Jump by 22% In A Day, Thanks To Election Hype

While these coins are considered community-driven and accessible investments, they’re also highly speculative. Many in the community have placed their bet on a “meme coin supercycle” to coincide with Bitcoin’s run. The bet paid off, and the memecoins’ market cap is now above $73 billion, reflecting a 22% increase.

Featured image from xtsupport.zendesk.com, chart from TradingView