The post Bitcoin ETF Inflows Surge: BlackRock’s Massive $1.1B Mark appeared first on Coinpedia Fintech News

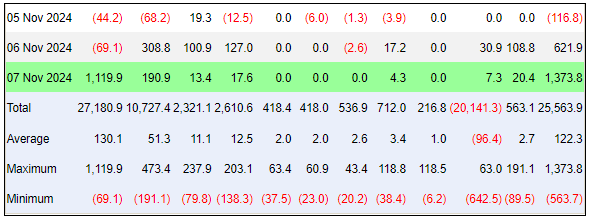

BlackRock’s spot Bitcoin ETF has pulled off something huge. On November 7, this fund saw a mind-blowing $1.119 billion in inflows—an impressive recovery after losing $113 million just two days before. To put it into perspective, BlackRock’s fund made up a massive 82% of all spot Bitcoin ETF inflows that day. With Bitcoin hitting record prices, it seems investors can’t get enough of it. So, what’s driving this wave of excitement?

Bitcoin Hits Record High, Fueling More Interest

Bitcoin’s price recently hit an all-time high of $76,943, just a day after reaching $76,500. And this rally didn’t happen in a bubble; it came right after Donald Trump’s recent political win, which many see as a plus for crypto. Some market analysts think his pro-crypto stance could push Bitcoin even higher, with a few boldly predicting it might reach $100,000 before long. Investors are sensing an opportunity here, which could explain the big inflows into Bitcoin ETFs. If prices keep climbing, these funds might just keep raking it in.

Other Bitcoin ETFs Join the Action

While BlackRock is clearly leading the charge, other Bitcoin ETFs are also riding the wave. Fidelity’s Wise Origin Bitcoin Fund saw inflows of $190.9 million, while ARK’s 21Shares Bitcoin ETF added $17.6 million. Although these numbers aren’t as huge as BlackRock’s, they still show strong demand from investors wanting to get in on Bitcoin. In a market once led by direct Bitcoin trading, ETFs are now becoming a serious way for people to invest in crypto.

What’s Next?

Bitcoin’s price is hovering around $75,950, still up nearly 2% over the last day. With Trump’s potential influence on the crypto scene, optimism is high, and more big moves could be on the horizon. As long as this bullish trend continues, it looks like Bitcoin ETFs, led by BlackRock, will stay in the spotlight. And who knows? We might just see more records break soon.