The post Fed Rate Cut and Record Inflows into BTC and ETH ETFs, Top 3 RWAs Set to Rally appeared first on Coinpedia Fintech News

Trump has secured US Presidency over Harris, bringing into power a pro-crypto government in the financial heart of the world. The crypto community expects great things; for instance, the Bitcoin Act is expected to be passed. Trump’s win is also serving as a catalyst for the next bull run, as evidenced by Bitcoin’s new ATH over $75k, Fed rate cuts in line with analyst expectations, and now record inflows into BTC and ETH ETFs in the US.

Bitcoin ETFs saw a record $1.38 billion inflows after Trump’s victory, out of which BlackRock’s IBIT alone accounted for $1.1 billion. None of the ETFs showed any outflows. Ethereum ETFs didn’t fall behind either, logging $78 million in inflows. On November 8, BTC trades at $75.9k, while Ethereum witnessed a 4% rise in the past 24 hours.

Meanwhile, as many had predicted, the Federal Reserve has cut rates by 25 basis points, increasing liquidity for risk assets like Bitcoin and weakening the dollar in comparison. Experts predict a bull run to commence soon, pushing Bitcoin to $100k before 2024 wraps, and pulling ETH to $3,200 levels.

In a pro-crypto environment under Trump’s rule, Bitcoin will definitely flourish, being an asset already accepted widely as a store of value. However, we may be about to witness the age of altcoins now, fueled by positive regulations. DeFi had a big role in the bull run of 2021, and this time around, sectors like RWA, AI, and more stand out as top players.

In this post, we tell you about top RWA tokens all set to pump as we approach the next crypto bull run!

Top RWA tokens you can start HODLing before the next bull run

RWA or real-world asset tokenization is one of the most prominent crypto sectors at the moment, adding a factor of tangibility to crypto. With RWA tokenization, you can essentially turn ownership over any real-world asset (music, video, images, manuscripts, artwork, real estate, and more) into blockchain-based tokens. One asset can even be divided into multiple tokens, so several investors can have a stake in an asset. This way, previously illiquid and inaccessible markets are opened to investors from all kinds of economical backgrounds.

While many refrained from crypto due to the fact that the value of these tokens depend on supply and demand and therefore rely on speculation, RWA erases that worry and brings real-world value to crypto.

- Landshare ($LAND)

Landshare is a recently launched RWA project that helps property owners in the US put their real estate properties on the blockchain as crypto tokens, to make them more convenient to trade.

A little background: Landshare is the very first tokenized real estate platform on the Binance Smart Chain, and it has already sold four tokenized properties. Further, $LAND already has four CEX listings under its belt! In the last twelve months, $LAND has experienced a 155% growth. You can buy $LAND on MEXC, Gate.io, BitMart, BingX, and PancakeSwap. What’s more, according to the next listing rules of Binance, $LAND is soon to be listed on the biggest crypto exchange of all!

Landshare allows you to have fractional ownership of properties, with a very low threshold at just $50. Its multiple big listings ensure $LAND as a reliable investment with remarkable growth potential. The risk and volatility free crypto presents good diversification and passive income opportunities with yield farming and more. With a market cap around $5.35 million, $LAND is undervalued still, especially compared to contemporaries with empty promises, that have yet to sell any properties. Now is a good time to grab yourself some $LAND as we race towards the next crypto bull run!

- Ondo Finance ($ONDO)

Ondo Finance is another of the top RWA projects at the moment. It bridges TradFi and crypto by tokenizing traditional investment products, and opens them up to all kinds of investors instead of HNIs or big institutions, increasing accessibility.

Like Landshare, $ONDO offers mortgage-backed securities too. In the coming bull run, $ONDO is expected to bring sustainable gains. Notably, Ondo has a market cap of a little over $1 billion.

- Centrifuge ($CFG)

Centrifuge allows businesses to turn their RWA into tokens and then use them as collateral to borrow through Tinlake, a DeFi lending protocol. Small and medium enterprises can now access capital with ease, instead of going through a painstaking process full of paperwork.

Though at a market cap of $174 million, $CFG has seen a low of -19.5% in the last twelve months. The project is expected to gain as the bull run approaches.

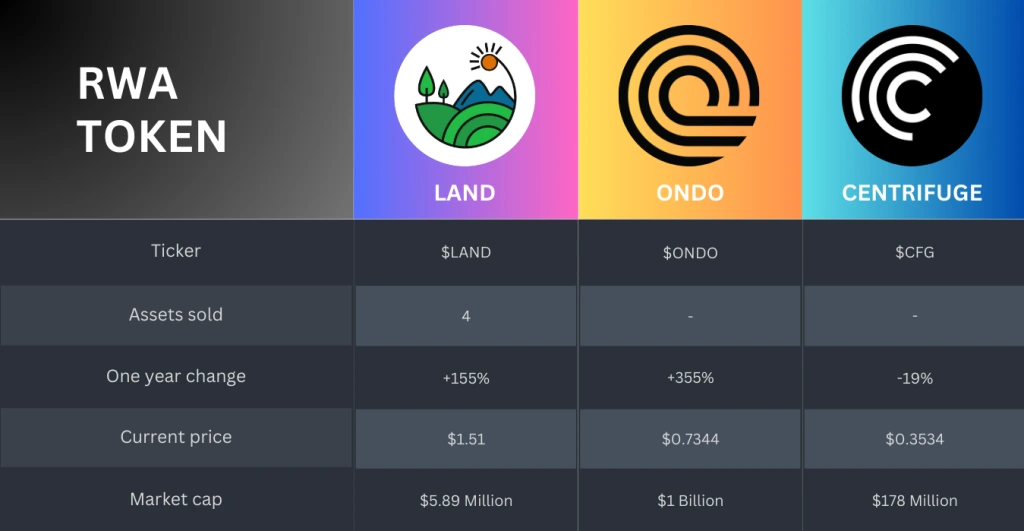

Compared to $ONDO and $CFG, $LAND is pretty new. Here’s a comparison of all three, for you to understand them better at a glance:

As you can see, Landshare already has notable achievements, and it happens to be undervalued still. Hodlers are expected to earn big in the next rally.

That being said, DYOR always!