The post Bitcoin Profit Journey :From Massive Gains to Steady Growth appeared first on Coinpedia Fintech News

Bitcoin is no stranger to impressive gains, but the latest rally—reaching up to $90,000 this November—has people talking. Many are asking: does this spike hold a candle to the explosive returns BTC has given in the past, or are we just getting started? With high hopes for even bigger returns, let’s look at Bitcoin’s journey and what might be coming.

An Impressive Rally, But History Has Seen Bigger

Sure, this November has been big—Bitcoin surged by about 40% since mid-October, climbing from $66,800 to $90,200. The gains alone are enough to keep any investor glued to the screen. But interestingly, Bitcoin’s profit-taking levels this time are only about half of what they were at past all-time highs, showing that traders are holding on, maybe anticipating even bigger moves. According to Glassnode, “realized profit volumes” have averaged around $1.56 billion daily since the first crypto topped its previous peak. That’s about half of what we saw in earlier rallies, which hints that maybe this rally is just warming up.

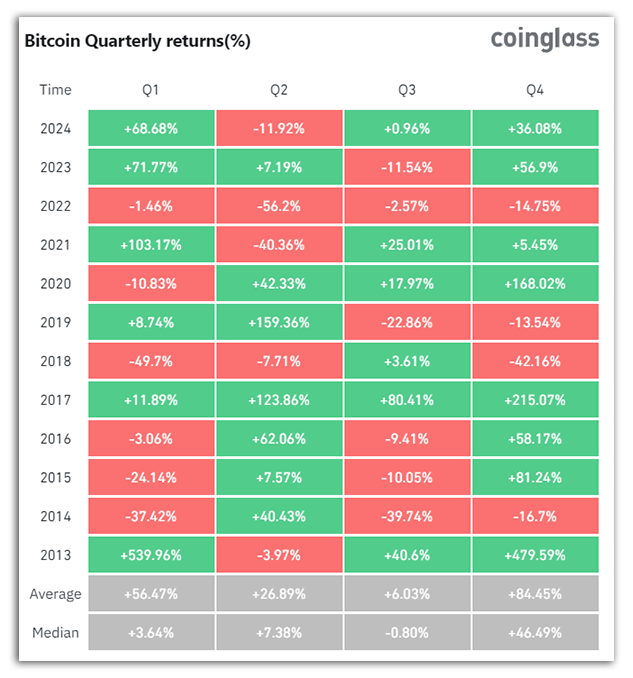

Back in early 2013, BTC delivered quarterly returns of over 539%—a pace we haven’t seen lately. While today’s 36% quarterly gains in Q4 of 2024 are noteworthy, they pale compared to the earlier days. Interestingly, Bitcoin’s profit-taking levels this time are only about half of what they were at past all-time highs. This shows that traders are holding on, possibly anticipating even bigger moves.

Bitcoin Makes a New Record

On November 11, BTC set a new single-day gain, shooting up by $8,400. Renewed interest following the latest U.S. presidential election partly fueled this surge.

The excitement feels much like it did during Bitcoin’s 2017 rise, leaving traders wondering how high it could go. However, unlike the earlier days, institutions, governments, and seasoned investors now fill today’s market, making the crypto less wild than before. In the past, Bitcoin’s peaks were often fast and dramatic, with realized profits hitting $3 billion per day in those major bull runs—twice the amount we’re seeing now.

Author of the famous book “Rich Dad Poor Dad”, Robert Kiyosaky in his X post shared his plan to continue buying BTC till it reaches $100k.

What to Expect

Will Bitcoin break its previous records and deliver another triple-digit return? While predicting is tricky, it’s clear Bitcoin is no longer the underdog. Talk of a U.S. Bitcoin reserve and more institutional backing means Bitcoin is growing out of its “volatile asset” phase into a more respected role in finance. Still, with Bitcoin, surprises are always around the corner.

For those watching closely, Bitcoin’s evolution from a speculative bet to a legitimate financial instrument feels more real than ever. Whether it continues to climb or pulls back, Bitcoin’s potential is one to keep an eye on.