The post Render Token Breakout: Is a New ATH on the Way? appeared first on Coinpedia Fintech News

Render Token (RNDR) is on the move again, climbing 8.64% in just 24 hours to hit $7.65. After months of struggling with resistance, this breakout has sparked fresh optimism. But with big hurdles still ahead, will RNDR keep climbing, or is this just a short-lived rally?

Finally Breaking Free

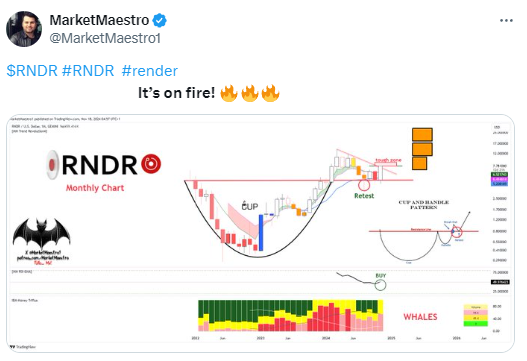

It’s been a tough few months for RNDR. The token was stuck in a descending channel, unable to make real progress. But this week, it broke through a key resistance at $6.67. That level had held it back for a while, so moving past it was a big win for buyers. An X user with the history of sharing insightful charts shared his finding of Cup and Handle formation in the token chart.

This rally didn’t come out of nowhere, though. The $4.00 support proved to be a solid base, giving buyers the confidence to step in. Now, RNDR has its sights on $12.05, a level where sellers have taken control in the past. It’s not going to be easy, but the momentum looks strong—for now.

Why the Buzz Around RNDR?

There’s been a lot of action in the market. Trading volumes spiked as RNDR made its move, showing that interest is high. On the technical side, things are looking solid too. The 20-day moving average has already crossed over the 50 and 100 MA and is now moving to cross the 200 MA soon. This shows the rising momentum in Render.

The RSI is at 64.18. That’s still in the bullish zone, but it’s getting close to overbought territory. The Chaikin Money Flow (CMF) sits at 0.28, meaning capital is flowing into the token. These signals suggest the rally has some legs, though nothing is guaranteed.

There’s one concern, though. Daily active addresses dropped sharply, from 703 to just 209. Fewer users engaging with the network could mean the rally might slow down or even pause. It’s something worth keeping an eye on.

What’s Next?

RNDR is heading toward some tough resistance levels. The next stops are $9.47 and $11.22 before the big challenge at $12.05. If it can push through, the all-time high zone of $13.29 might even come into play.

But nothing is certain in crypto. For this rally to keep going, buyers need to stay active. If demand weakens, RNDR could get stuck below $12.05. For now, though, the breakout has sparked hope—and traders are watching closely.