The post Crypto Market Watch: What to Expect from US Economic Indicators This Week appeared first on Coinpedia Fintech News

This week is going to be one of the most eventful weeks in the US economic landscape. From housing starts to consumer sentiment, several important indices are expected to be released within the next few days. The crypto community is closely watching each and every development in the traditional economy. Let’s understand in what way the said indices may influence the cryptocurrency market. Here is everything you should know!

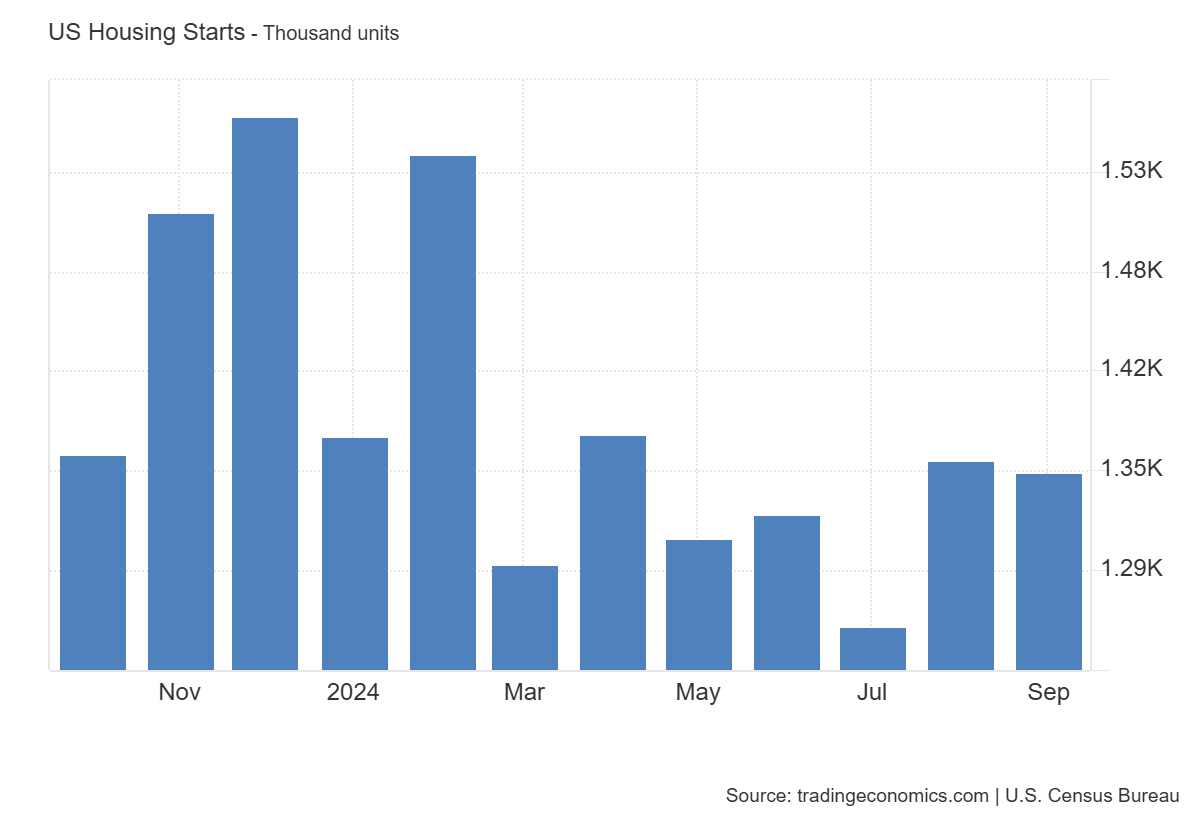

How Housing Starts Could Influence Crypto

The US Housing Starts index, which shows the number of new residential construction projects that have begun during any particular month, is scheduled to be released tomorrow. In September, it was 1.354M units – lower than the TEForecast of 1.38M units. Additionally, it failed to outperform August’s 1.361M units. This time, the consensus is that the index will decline slightly to 1.34M.

The index exceeding the consensus would signal economic resilience, which could make cryptos less appealing.

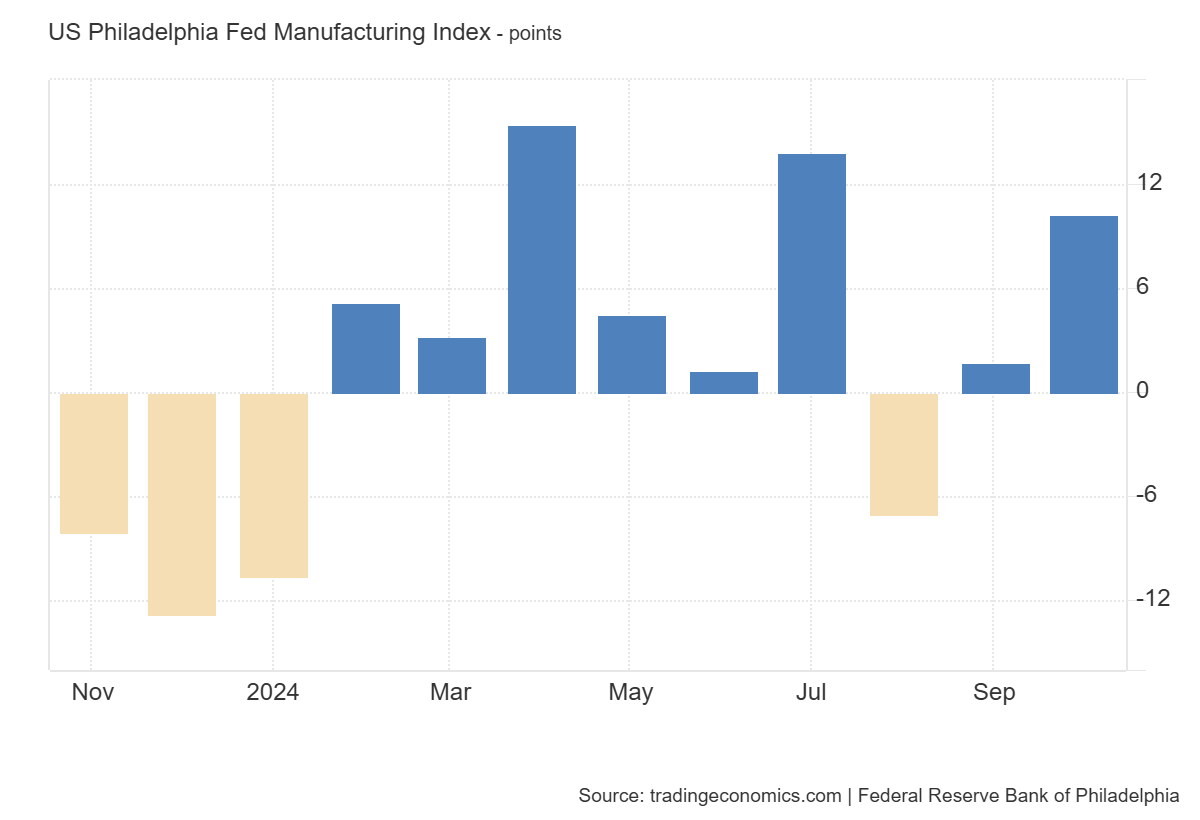

Philadelphia Fed Manufacturing Index and Crypto

The Philadelphia Fed Manufacturing Index, which is based on the Business Outlook Survey of manufactures in Philadelphia, is expected to be released on November 21, Thursday. In October, it was 10.3 points – far higher than the consensus of 3 points. Notably, in September, the index was just 1.7 points. This time, the consensus is that the index will cool down to 7 points. Meanwhile, TEForecast projects a jump to 11 points.

If the index increases as predicted by TEForecast, it would reinforce the growing strength of the traditional market, posing challenges for the crypto sector.

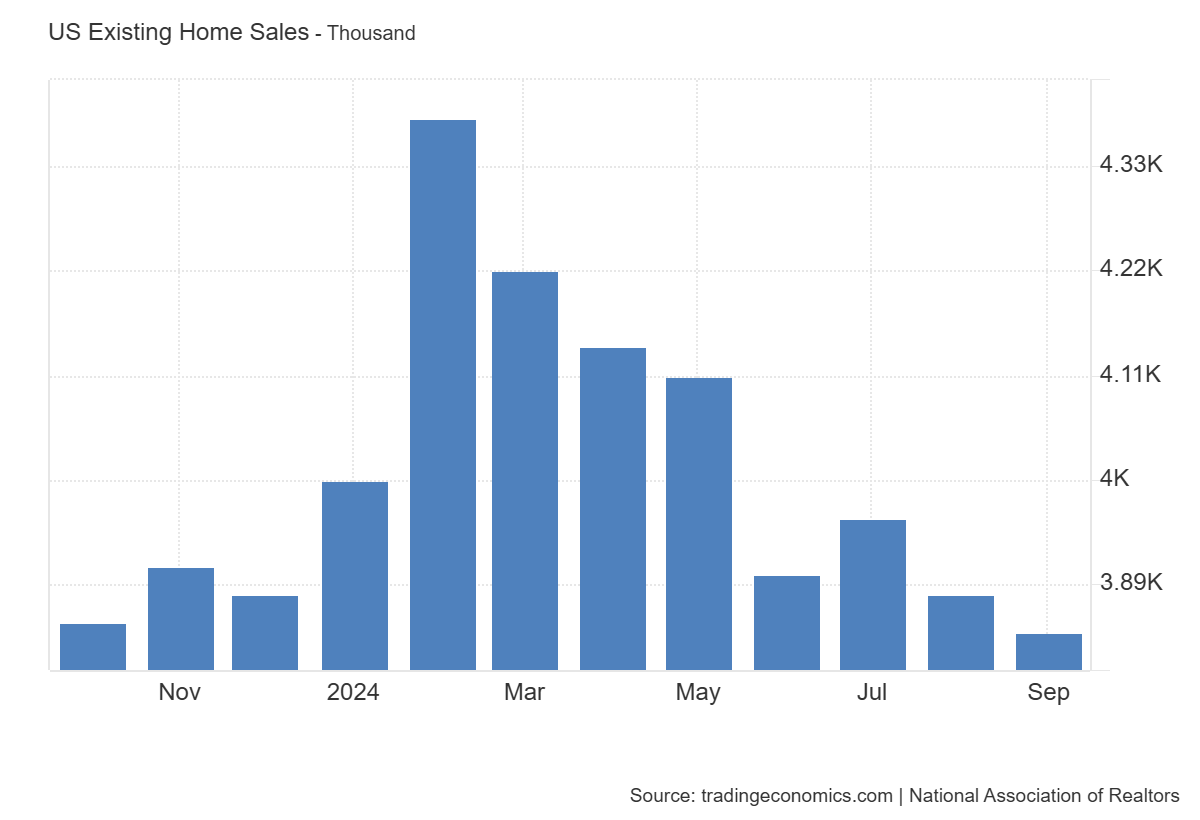

Existing Home Sales and Crypto Sentiment

The United States Existing Home Sales Index, which gives hints about people’s confidence in the US economy, is going to be released on November 21, Thursday. In September, it stood at 3.84M – far lower than August’s 3.88M. Last month, the consensus actually hinted at a better performance, this time too, the consensus suggests an improvement. TEForecast predict that the index will be 3.87M.

If the index exceeds the consensus, it could negatively affect the crypto market, as stronger home sales reflect rising economic confidence.

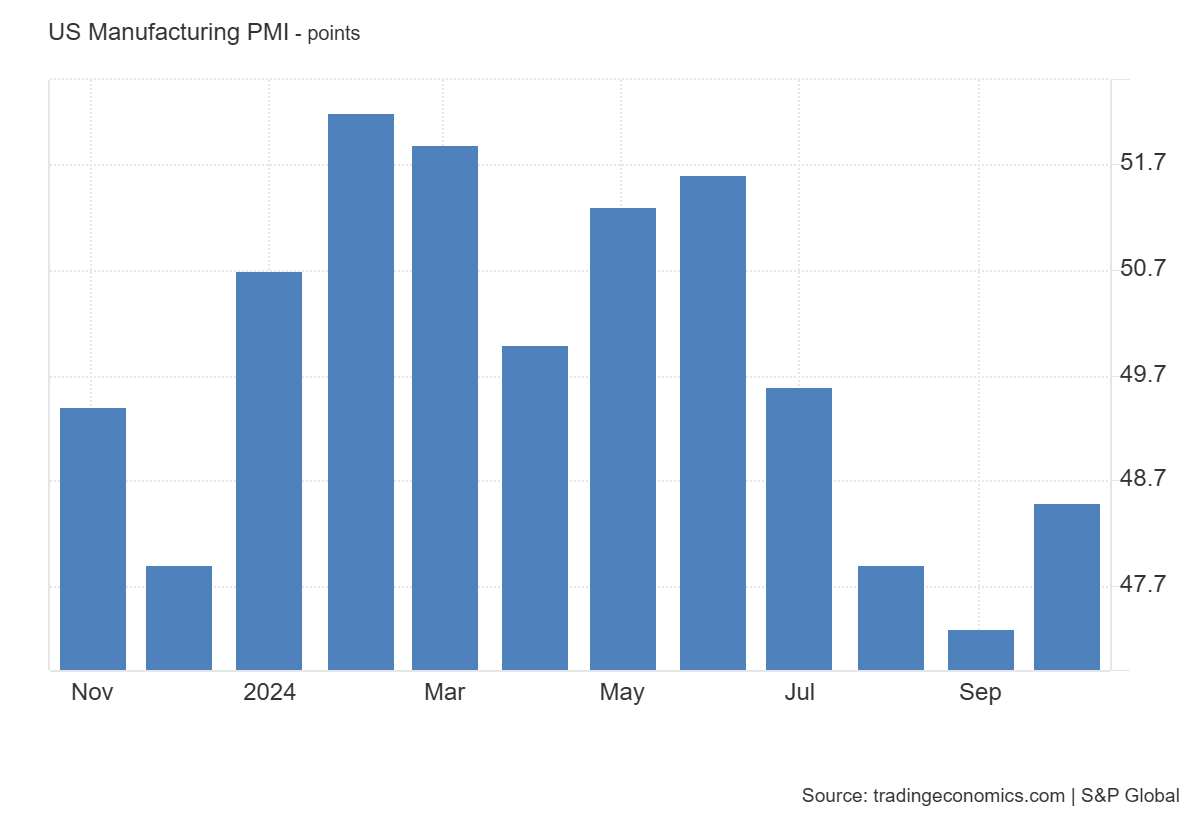

What Manufacturing PMI Tells About Crypto’s Future

The S&P Global Flash US Manufacturing PMI Index, compiled from questionnaires sent to purchasing managers, is scheduled to be released on November 22, Friday. In September, it slipped to a 15-month low of 47.3. However, in October, it rebounded slightly, rising from 47.8 to 48.5.

A decline in PMI could drive investors toward crypto, as a falling PMI heightens fears of an economic slowdown.

Michigan Consumer Sentiment: Crypto’s Opportunity or Risk?

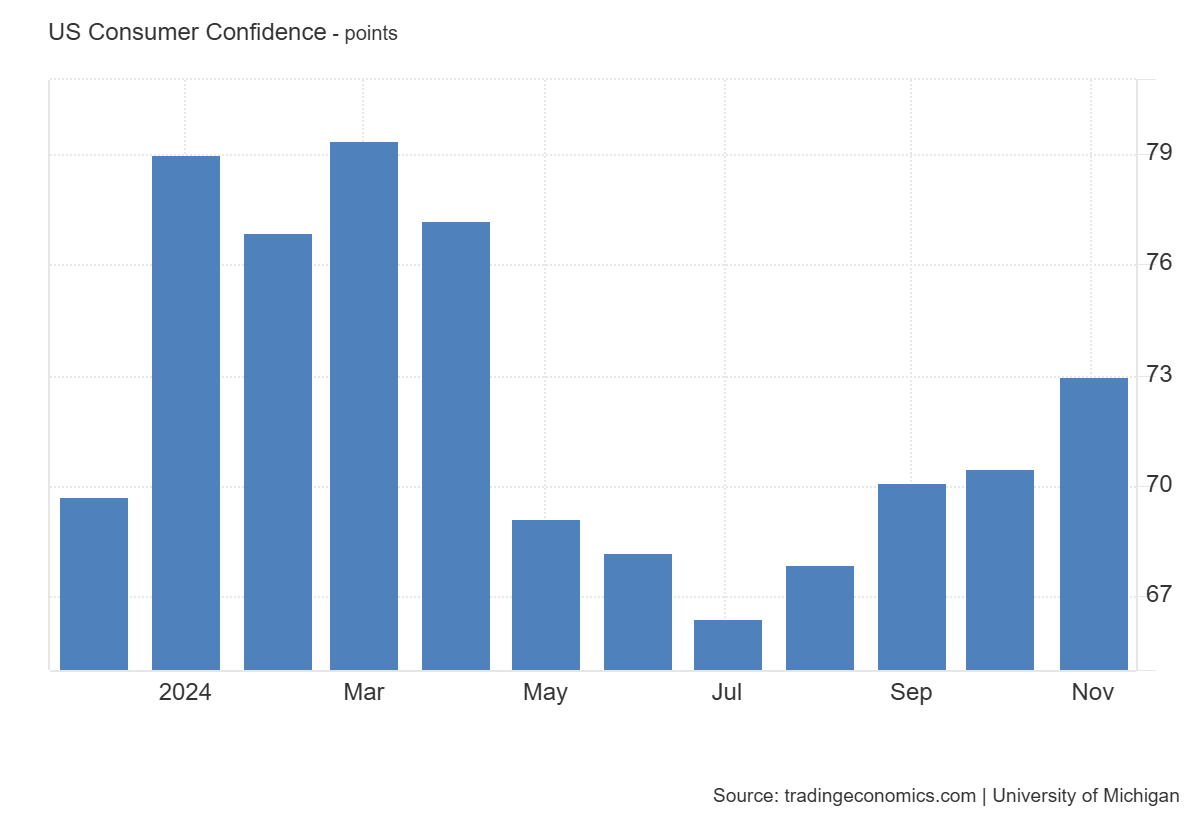

The United States Michigan Consumer Sentiment, which offers a glimpse into consumer expectations, is set to be released on November 22, Friday. Last time, it surged from 70.5 to 73 points – significantly better than the consensus of 71. This time, the consensus expect no change.

A rise in sentiment strengthens confidence in traditional investments, which might reduce crypto’s appeal in the short term.

The crypto market is sensitive to macroeconomic indicators. Strong data may lead to bearish trends, while weak data could boost crypto as a hedge.