Bitcoin spent the weekend trading within a relatively narrow range of $91,700 to $88,700, demonstrating robust price action. Despite the lack of significant price movement, the consistent ability to hold within this range underscores Bitcoin’s current strength and growing market confidence.

Key data from CryptoQuant adds further optimism, revealing a notable reduction in selling pressure. The data indicates fewer sellers in the market, aligning with the broader bullish sentiment that has fueled Bitcoin’s recent momentum. With the supply side constrained, demand could propel BTC higher, reinforcing the strong price action seen over the weekend.

This optimistic backdrop has sparked predictions of aggressive surges in the coming months as Bitcoin remains well-positioned to capitalize on favorable market dynamics. Analysts suggest that with selling pressure limited and demand continuing to grow, Bitcoin could be gearing up for its next significant breakout.

Investors are watching closely to see if this strength will lead to a new phase of upward momentum, potentially pushing BTC into uncharted territory as the market anticipates the next major move in this bullish cycle.

Bitcoin Flow To Exchanges Supports Bulls

Bitcoin has had an exhilarating few weeks, surging 39% in just nine days and marking one of its most aggressive upward moves this cycle. The recent rally has left analysts and investors both excited and cautious as Bitcoin continues to show resilience above key levels. While many expect BTC to maintain its bullish trajectory, opportunities to buy at lower prices are becoming increasingly scarce.

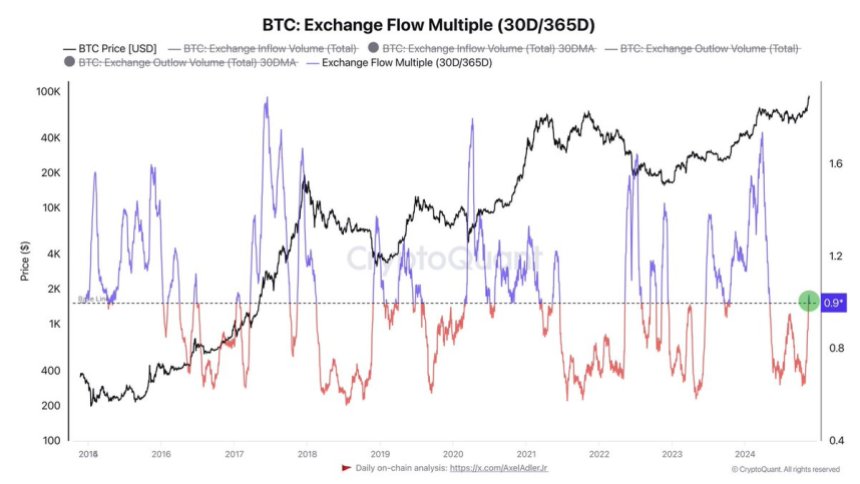

Data from CryptoQuant analyst Axel Adler adds valuable insight into the current market dynamics. Adler notes that the average flow of Bitcoin to exchanges over the past 30 days has not surpassed the average volume over the last 365 days.

This indicates a lack of significant selling pressure, suggesting that current holders are more inclined to retain their Bitcoin than sell into the rally. With fewer sellers in the market, Bitcoin’s price has the potential to climb further as demand increases.

However, analysts agree that consolidation around the current price range would be a healthy step before the next leg up. Consolidation could allow the market to stabilize, attract fresh demand, and establish stronger support levels for the next growth phase.

BTC Less Than 2% Away From ATH

Bitcoin is trading at $91,700, just under 2% away from its all-time high (ATH) of $93,483. This proximity to record-breaking levels has fueled optimism among investors, with the price appearing poised to push above the ATH again this week. Bitcoin’s price action remains robust, supported by increasing demand and bullish sentiment in the market.

The sustained strength of BTC’s price has been attributed to its ability to maintain key levels during periods of consolidation. This resilience indicates buyers continue to dominate, reinforcing the possibility of another breakout above the $93,483 mark. Analysts expect breaching this level would likely spark another wave of aggressive buying, potentially driving Bitcoin further into uncharted territory.

However, caution remains warranted. A breakdown below $87,000 would signal a retrace for Bitcoin, potentially initiating a short-term correction in the coming days. Such a move could provide a healthier foundation for the next growth phase, allowing BTC to consolidate and attract fresh demand.

Featured image from Dall-E, chart from TradingView