Polymarket, the leading platform for prediction markets, exhibited groundbreaking activity across its markets over recent months. With the US presidential election, major sporting events, and significant crypto milestones as central topics, the data illustrates significant user drop-off after the election. However, volume and activity mostly remain in an upward trend even without the landmark market.

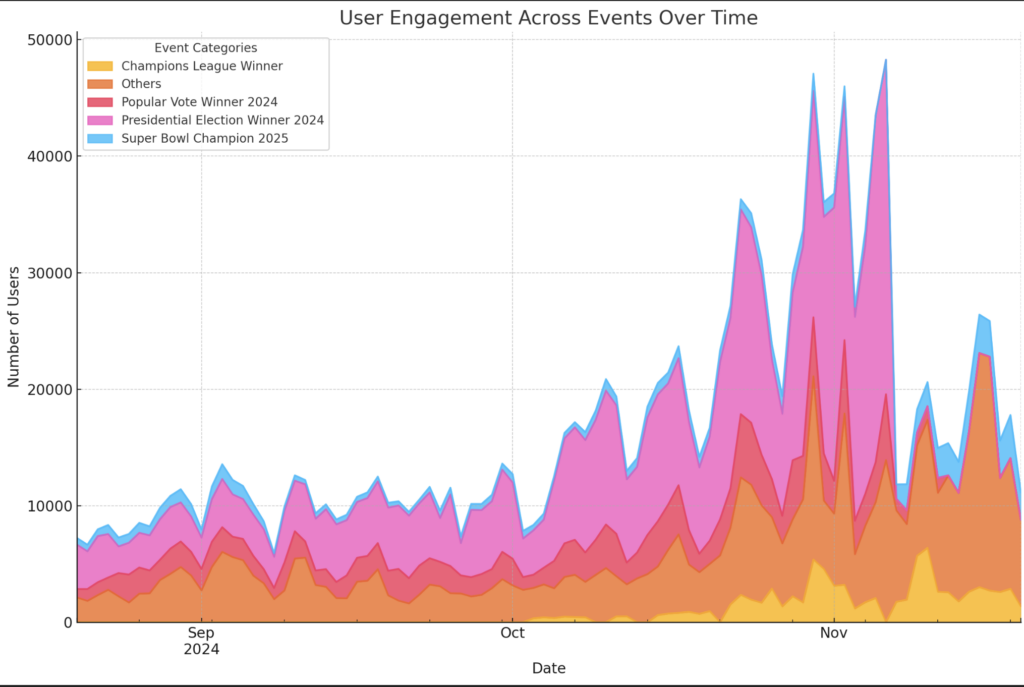

Per Dune Analytics data, Polymarket recorded peak engagement for the “Presidential Election Winner 2024” market, with daily user participation exceeding 49,000 in the days surrounding the election. Sporting events like the Champions League and the Super Bowl have also seen strong interest.

Specifically, the “Super Bowl Champion 2025 market” maintained steady user participation and daily figures consistently reaching the thousands. This reinforces the platform’s post-election ability to attract a broad audience base beyond financial and political predictions, tapping into mainstream entertainment and sports.

Other markets, which primarily relate to potential crypto price movements, also garnered consistent traction, reflecting the platform’s appeal among participants seeking market-aligned insights.

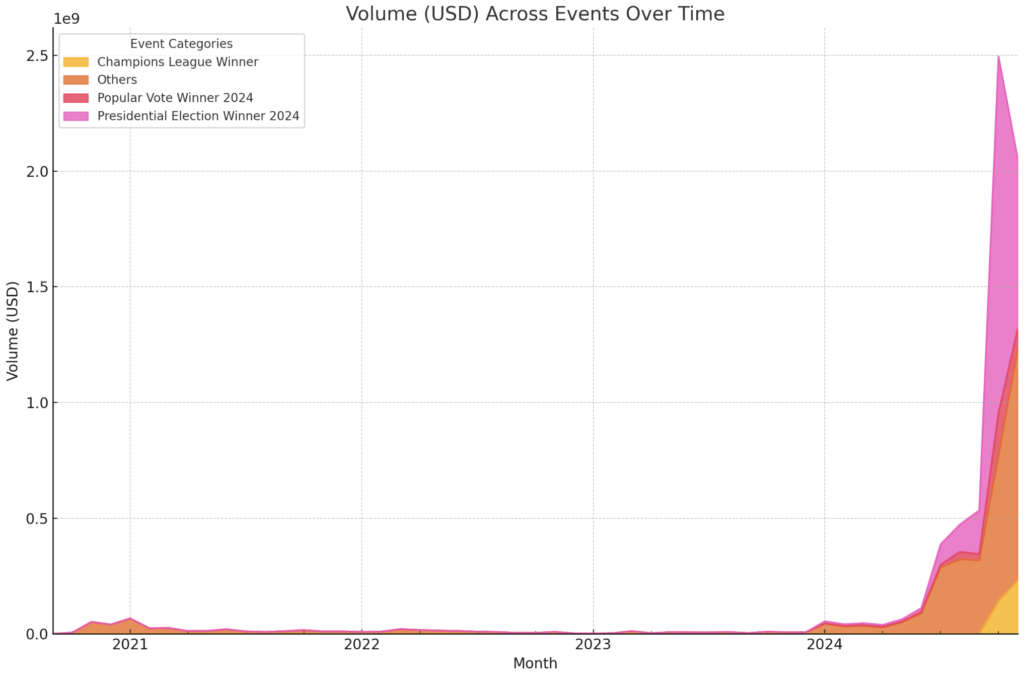

Trading volumes tell a parallel story, with the US Election generating disproportionate interest. As detailed in the data, the cumulative trading volume surpassed $2.4 billion monthly, signaling a robust intersection of finance, speculation, and socio-political developments.

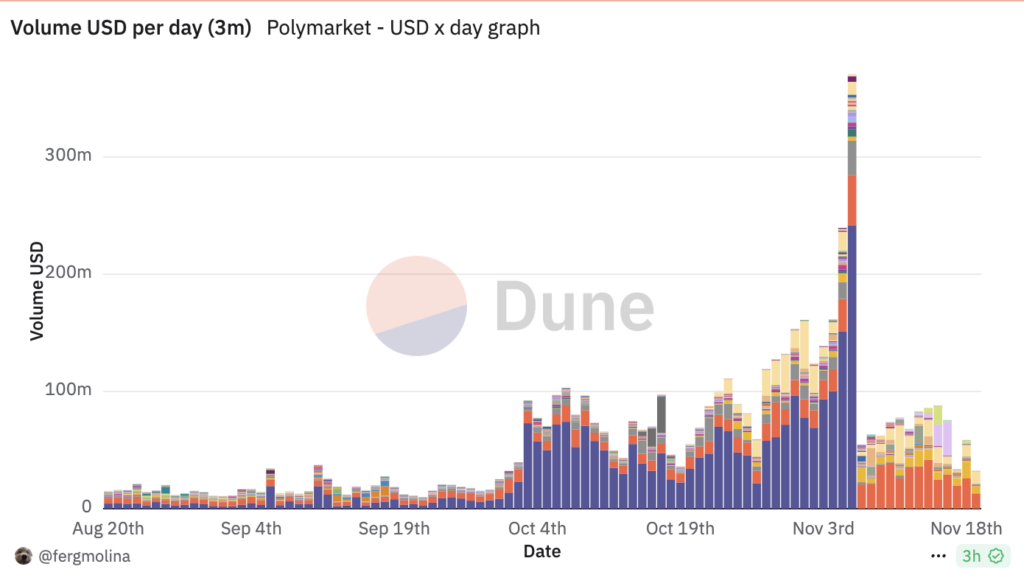

However, month-to-date November data suggests a fall to around $80 million per day, down from the $300 million average during the lead-up to the election. Still, if the US election markets are removed from the analysis, there is still a continued daily increase in user activity.

Polymarket’s performance during these months and continued interest in markets outside US politics highlights its persistence in the prediction market space and data indicating strong user engagement and significant trading volumes.

Current trends, therefore, suggest the crypto prediction market bubble has not popped since the end of the US election. While user interaction has fallen substantially, the data is certainly encouraging.

The post Polymarket survives post-election drop-off though volume falls 60% appeared first on CryptoSlate.