The post Ripple Donates Another $25M To Fairshake Super PAC: A Pro-Crypto Initiative appeared first on Coinpedia Fintech News

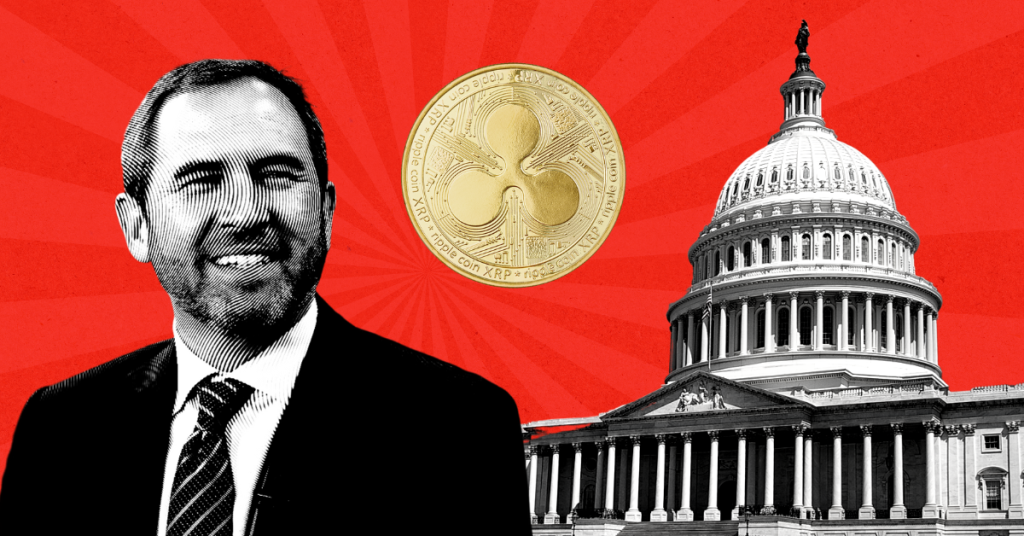

In a recent X post, Ripple CEO Brad Garlinghouse has revealed that Ripple is contributing another $25 million to Fairshake, noting that Fairshake is the most successful multi-candidate, bipartisan Super PAC in American history.

“Electing pro-crypto, pro-growth, and pro-innovation candidates is a no-brainer, and to continue that momentum, Ripple is contributing another $25 million to Fairshake. Onwards!” he shared.

Ripple CLO Reacts

Ripple CLO Stuart Alderoty also responded to Brad’s post. He underscored that Ripple committed to being a top-tier supporter for Fairshake since it first started and before anyone knew what impact it might have. He revealed that this is their third contribution in as many years to the most successful PAC in US history. “Innovation is here to stay and we will remain a strong force in DC for years to come,” he noted.

Notably, Ripple has donated $45 million to the PAC before the 2024 elections, making it one of Fairshake’s biggest contributors alongside Coinbase, Jump Crypto, and Andreessen Horowitz.

Super PAC’s Massive Momentum

The bipartisan Super PAC has become a powerhouse in U.S. politics. The pro-crypto PAC has gained massive momentum following the recently concluded US elections. Fairshake spent over $130 million on more than 50 congressional races, which paid off as the US is all set to have its most pro-crypto Congress ever.

The Ohio senatorial race between pro-crypto Bernie Moreno and anti-crypto Sherrod Brown, where the former emerged victorious, was the most notable of these congressional races in which Fairshake was involved.

White House’s First Crypto Specific Role

Under the Trump administration, the Crypto Czar position will be the first crypto-specific role in the White House. Key figures like Coinbase CEO Brian Armstrong and former Coinbase executive Brian Brooks have reportedly met with Trump to discuss crypto policy. Cardano Founder Charles Hoskinson has advocated for Coinbase CEO Brian Armstrong for this role. Brad Garlinghouse has also come forward as a potential candidate for the crypto Czar role.

The introduction of this position, aimed at centralizing crypto policy, has left investors speculating about the possible massive price movements in the crypto market.