Bitcoin (BTC) corporate adoption continues to gain momentum as video-sharing and cloud services platform Rumble recently unveiled a BTC treasury strategy. This move aligns with a growing trend of corporations worldwide embracing Bitcoin as a strategic asset.

Rumble Announces Bitcoin Treasury Strategy, Stock Rises

The YouTube competitor is the latest company to join the Bitcoin bandwagon, as its Board of Directors approved a corporate treasury diversification strategy that allocates a portion of its excess cash reserves to BTC.

As part of this strategy, Rumble plans to purchase up to $20 million worth of BTC. The company described Bitcoin as a “valuable tool for strategic planning.” Rumble CEO and Chairman Chris Pavlovski explained:

We believe that the world is still in the early stages of the adoption of Bitcoin, which has recently accelerated with the election of a crypto-friendly US presidential administration and increased institutional adoption. Unlike any government-issued currency, Bitcoin is not subject to dilution through endless money-printing, enabling it to be a valuable inflation hedge and an excellent addition to our treasury.

The company stated that its management would evaluate factors such as market conditions, Bitcoin’s trading price, and Rumble’s cash flow needs to determine the timing and amount of BTC purchases. However, it emphasized that the strategy could be modified, paused, or discontinued.

Interestingly, the announcement followed a poll conducted by Pavlovski on X, where he asked users whether Rumble should add Bitcoin to its balance sheet. Over 93% of the 43,790 respondents voted in favor of the proposal.

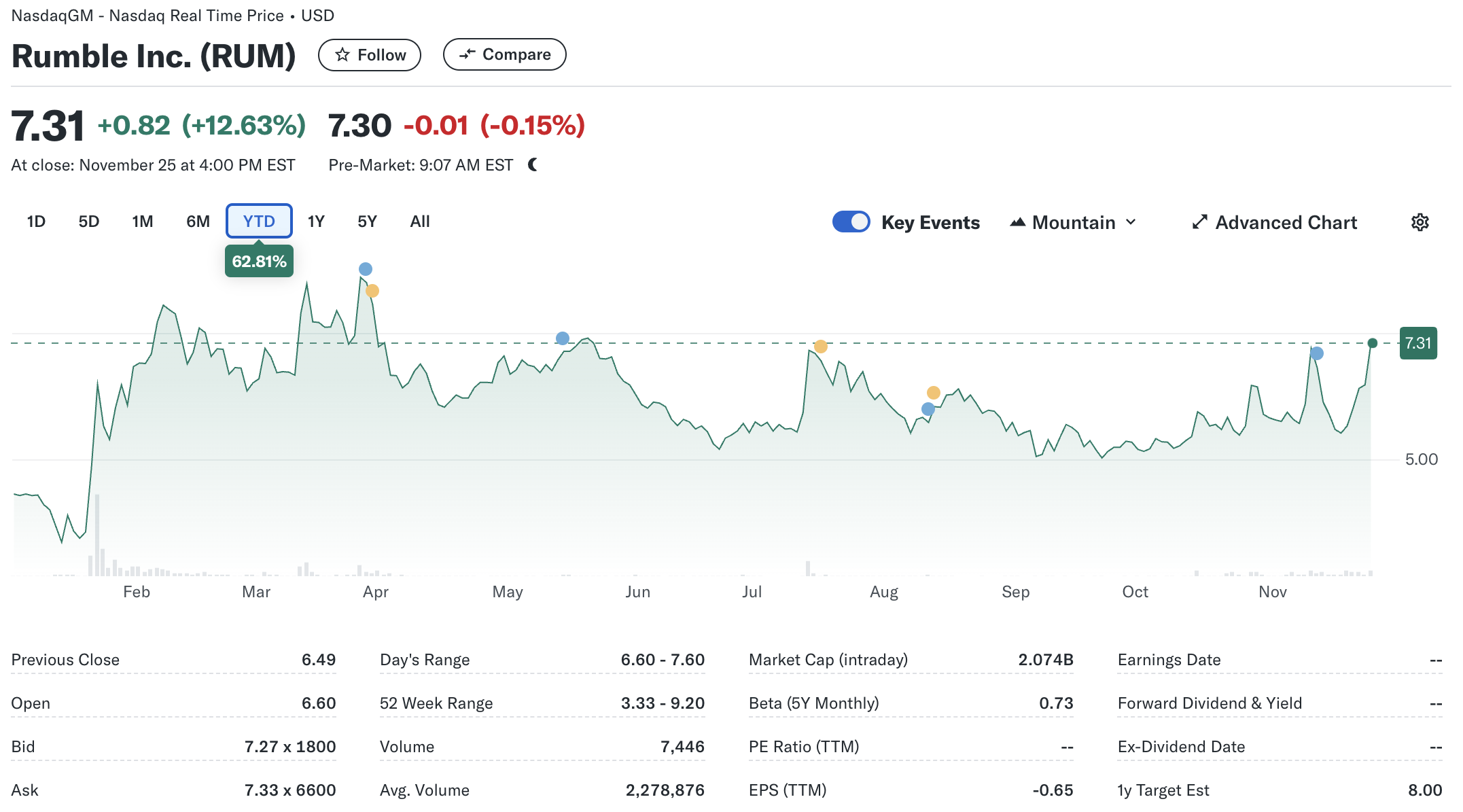

Rumble’s stock price surged after the announcement, reflecting investor confidence. The tech company’s shares closed at $7.31, marking a 12.63% increase in a single day.

BTC as a Corporate Asset: A Winning Strategy?

Rumble’s decision to add BTC to its balance sheet mirrors the approach of MicroStrategy (MSTR), a pioneer in Bitcoin treasury management. Yesterday, the Michael Saylor-led firm revealed that it had acquired an additional 55,000 BTC, bringing its holdings to $5.4 billion.

MicroStrategy’s Bitcoin play has worked tremendously for the company’s stock performance. In the past year alone, MSTR price has increased by more than 670%, outperforming both BTC and the S&P 500 regarding returns on investment.

Meanwhile, Japanese firm Metaplanet recently crossed the 1,000 BTC milestone as it continues to bolster its Bitcoin holdings with frequent purchases. Additionally, speculation about major tech giants like Dell and Microsoft entering the Bitcoin market could fuel demand and drive the asset’s price to new highs.

A recent analysis by crypto experts shows that BTC may hit the highly-anticipated six-figure price target early next year. BTC trades at $92,071 at press time, down 5.5% in the past 24 hours.