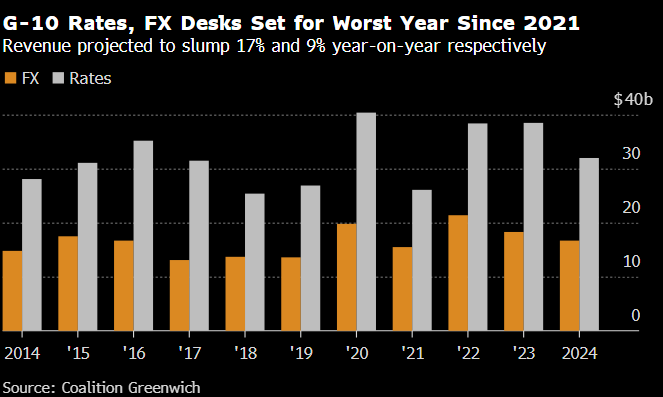

Banks are experiencing a significant decline in foreign exchange and rates trading revenue, while stablecoins are gaining traction as an alternative for cross-border transactions. Global banks are on track to report the lowest FX and rate trading revenue since before the pandemic, with projections showing a 17% year-on-year slump and a 98% decline, specifically in FX desks, according to Head of digital Assets Research at VanEck, Matthew Sigel.

Meanwhile, stablecoins had a market capitalization of $188 billion as of Nov. 2024, with Tether (USDT) and USD Coin (USDC) accounting for the majority. Monthly stablecoin transactions averaged $425 billion in 2024, indicating growing adoption beyond digital asset trading. A survey found that 69% of respondents in emerging markets use stablecoins for currency substitution and 39% for cross-border payments.

Matthew Sigel noted that “Global Banks are on track to Report the Lowest Revenue from FX and Rates Trading Since Pre-Pandemic,” highlighting the impact of tighter margins and electronic trading advancements. In a thread, Sigel agreed with LondonCryptoClub that it’s “insane to think of any bank not building out a crypto desk,” emphasizing the need for adaptation in the banking sector.

The contrast between declining traditional FX revenues and the steady growth of stablecoins illustrates a shift in the financial landscape. As stablecoins offer faster and more accessible cross-border transactions, banks may have to integrate digital assets into their services to remain competitive.

The post TradFi foreign exchange currency trading in decline as stablecoins usage surges appeared first on CryptoSlate.