The post Can Bitcoin Cross $100,000? Here’s What Robert Kiyosaki Believes appeared first on Coinpedia Fintech News

Bitcoin crossing $100,000? It sounds wild, but that’s exactly what Robert Kiyosaki, author of Rich Dad Poor Dad, is saying. He believes Bitcoin’s price is about to shoot up, and once it does, it could be too expensive for the average person to get in on. But is this for real? Let’s dive into what Kiyosaki is predicting and what’s actually going on with the first crypto right now.

Kiyosaki Thinks FOMO Will Drive Bitcoin’s Surge

Kiyosaki thinks the next big wave of Bitcoin buying will come from a simple feeling: FOMO—Fear of Missing Out. He says as BTC moves closer to $100,000, more people are going to jump in before they miss their chance. But here’s the catch: once the largest crypto hits that $100K mark, it might be hard for regular investors to afford much of it. That’s because only the super-rich will be able to grab big chunks.

Kiyosaki also doesn’t trust traditional currencies like the dollar or euro. He argues that inflation is slowly killing their value. For him, BTC is the way to go—protecting your wealth in a world where cash just isn’t cutting it anymore.

Bitcoin Could Hit $100K Sooner Than We Think

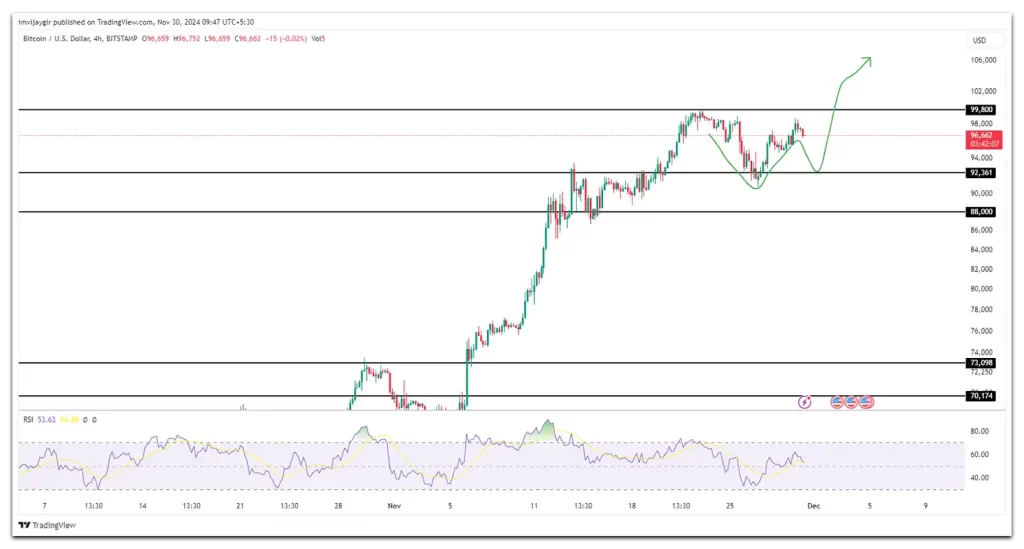

Right now, Bitcoin’s trading at about $96,662. It’s not far from that $100K mark, and some experts think it could hit it soon. The charts show a possible double bottom pattern, which could mean a price jump to $106,000 by Christmas. Trading volume is up 8.73%, so there’s definitely some action happening. It’s looking like BTC is on the move. With countries like Switzerland working towards regulating Bitcoin mining, the growth is unstoppable.

Kiyosaki is also big on Michael Saylor, the CEO of MicroStrategy, who’s been buying huge amounts of Bitcoin. Kiyosaki calls him a “genius” for making his company’s balance sheet stronger by stacking up Bitcoin.

So, What’s Next for Bitcoin?

Will Bitcoin hit $100,000? It’s hard to say for sure, but all signs point to a big jump. Kiyosaki’s prediction is more than just about the price; it’s about Bitcoin changing the way we think about money. Will it really protect wealth like he says, or will it fall short? We’ll see soon enough, but it looks like we’re in for an interesting few months.