Data shows social media users have reacted to the latest dip in the prices of Bitcoin and other cryptocurrencies by calling to buy.

Bitcoin Dip Worth Buying According To Crowd On Social Media

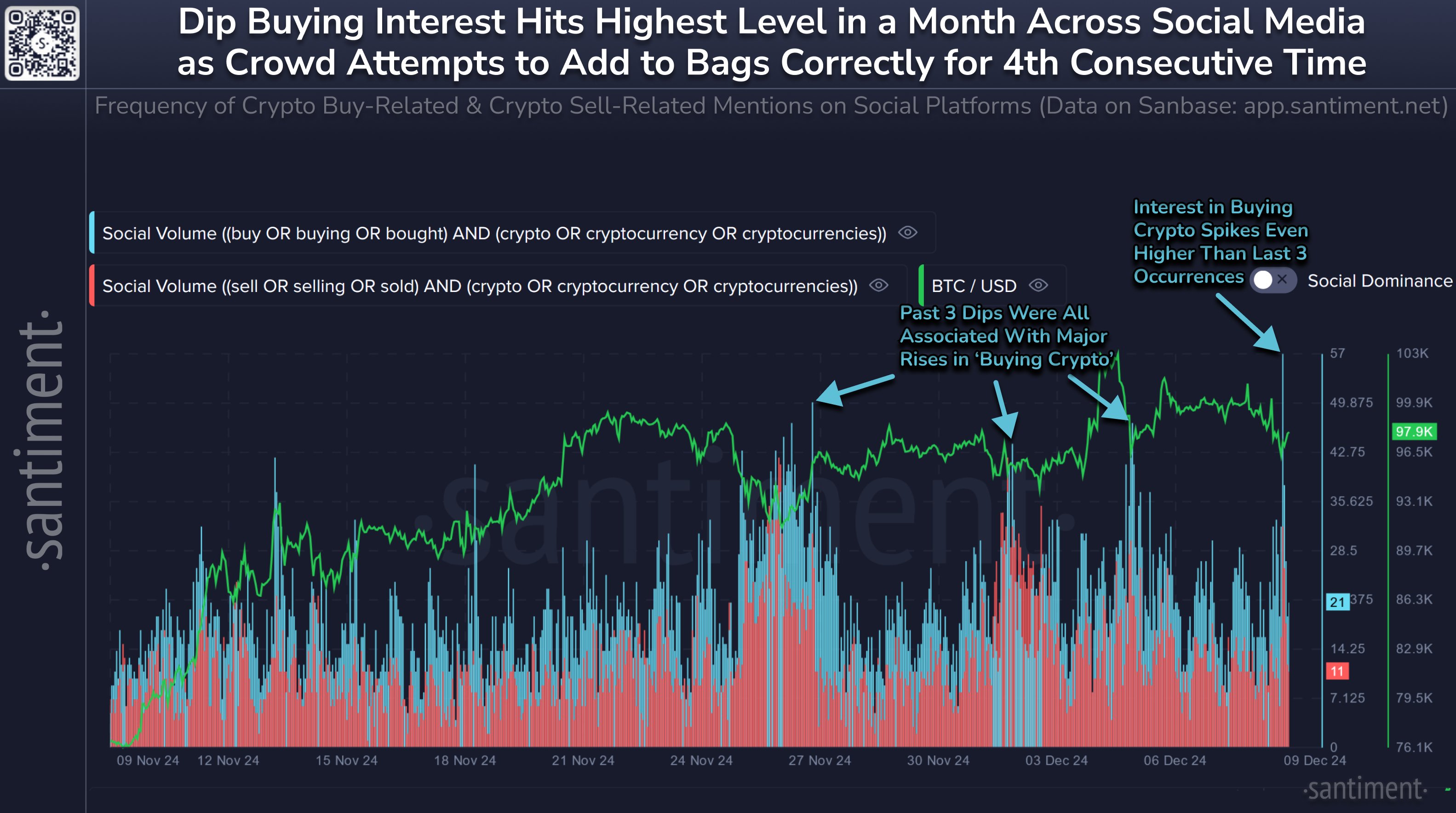

In a new post on X, the on-chain analytics firm Santiment has talked about the sentiment on the major social media platforms following the market-wide price plunge.

The indicator of relevance here is the “Social Volume,” which tells us about the total amount of discussion that a given topic or term is receiving from the social media users.

This metric measures its value in terms of the number of posts/messages/threads that contain at least one mention of the topic. The reason it doesn’t count the mentions themselves is so that a few outlier posts with a significant number of mentions don’t skew the data by themselves.

Now, in order to determine investor sentiment, Santiment has filtered the Social Volume for cryptocurrencies using terms related to ‘buying’ and ‘selling.’ Below is the chart shared by the analytics firm that shows the trend in the metric for these terms over the past month:

As displayed in the graph, the cryptocurrency Social Volume for buying-related terms has shot up following the latest dip in the prices of Bitcoin and other assets.

At the same time, topics related to selling have stayed at much lower levels, which suggests social media users are pretty convinced about the bearish action simply offering another opportunity for accumulation.

This is the fourth time in the past month that social media users have reacted to Bitcoin price drawdowns by calling to buy more. Historically, an excess of Fear Of Missing Out (FOMO) has been something that has led to tops for cryptocurrencies, but in the case of these recent spikes, the market has actually seen an uplift after them.

The trend may perhaps be down to the fact that these calls for buying only came after a price decline and not during a rally. With another spike in Social Volume appearing for buying-related terms, it’s possible that this effect seen in the last few spikes may follow this time as well.

The indicator could still be to keep an eye on in the near future, however, as further market excitement in case of a renewal of Bitcoin uptrend could trigger the bearish effect FOMO has often been associated with in the past.

BTC Price

At the time of writing, Bitcoin is trading at around $96,900, up more than 2% over the last week.