As of the end of Q3 2024, Tether’s USDT stablecoin has hit a new record with 330 million on-chain wallets. This shows that USDT is the market leader in stablecoins and is accompanied by an astounding rise in acceptability, particularly among small holders. Stablecoins are becoming more popular for a variety of financial transactions, including savings, remittances, and transactions, which is driving the rise.

Unprecedented USDT Growth Among Small Holders

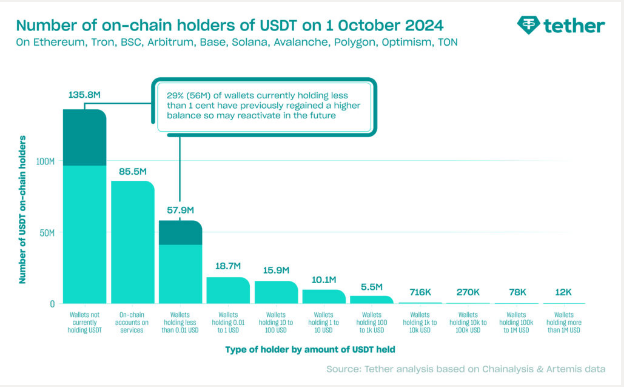

According to Tether’s latest data, the number of wallets holding USDT has increased by 71% in just one year. This rise is primarily driven by wallets with balances under $1,000, demonstrating that daily consumers prefer the stablecoin for its convenience and dependability.

In fact, around 18.7 million wallets contain less than $1 of USDT, demonstrating its utility as a financial tool for those with low resources. According to Tether’s data, approximately 30% of these smaller wallets are reactivated on a regular basis, implying that users continue to use the coin whenever funds are available.

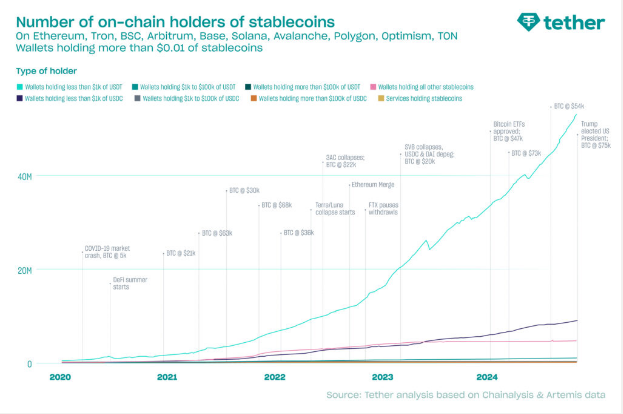

The substantial increase in wallet numbers can be linked to a variety of factors, including the aftermath of the FTX crash, which encouraged many users to self-manage their assets rather than rely on centralized systems. This move demonstrates a rising trust in USDT as a solid and secure option in the wake of market volatility.

Dominance Over Competitors

With over 109 million active on-chain wallets, USDT has surpassed Bitcoin and is closing up on Ethereum’s wallet count. Tether’s stablecoin accounts for 97.5% of the overall stablecoin supply, considerably outpacing competitors such as USDC and DAI. According to the report, USDT is stored in four times more wallets than all other stablecoins combined, cementing its status as the world’s leading stablecoin.

Emerging markets play an important role in this growth story. Almost half of the web traffic to centralized exchanges comes from these countries, where USDT is used by most consumers for money remittances and everyday transactions.

This situation illustrates how USDT narrows the gap between individuals and banks when it involves providing a trusty solution for saving funds and conducting payments without access to the banking system.

A Resource For Financial Inclusion

The emergence of USDT is more than simply statistics; it signals a larger trend toward financial inclusion. With 59% of the world’s population earning less than $10 per day, stablecoins like as USDT are becoming increasingly important for many.

Featured image from DALL-E, chart from TradingView