The post Raydium’s RAY Token Skyrockets 665% in 2024, What’s Next? appeared first on Coinpedia Fintech News

If you’re into crypto, you’ve likely heard the buzz around Raydium’s RAY token. Its massive 665% rise this year has caught everyone’s attention. From dominating Solana’s decentralized exchange to smashing revenue records, Raydium has positioned itself as a key player in 2024. What brought so much fuel to the token, let’s find out.

RAY Token’s Stunning Surge

RAY has served its believers with incredible returns of 665.45% this year. With this, it became one of the top performing crypto. As Raydium is not a memecoin, this surge was not some pump and dump. It reflects the growing market confidence in the altcoin and its amazing role in the Solana ecosystem.

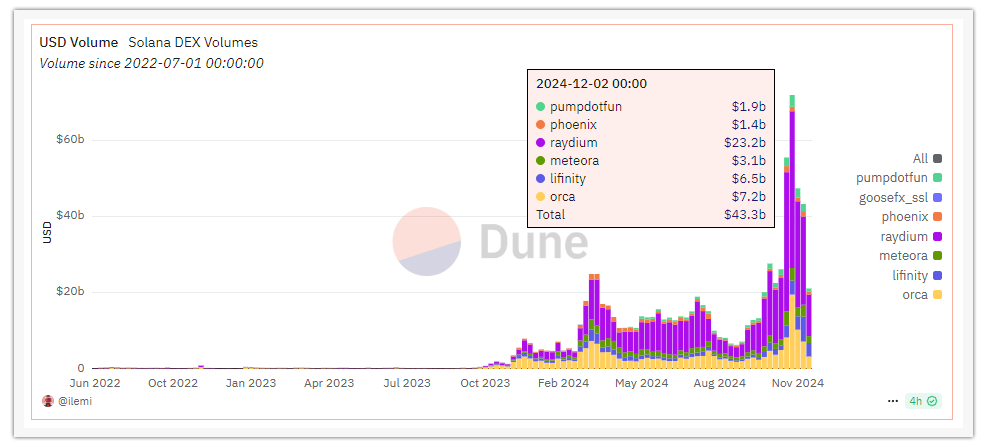

Raydium now controls almost half of all Solana DEX volumes. In a single week, from December 2 to December 9, it processed $23 billion in trades. That’s more than what all its competitors—Orca, Pumpfun, Meteora, and Lifinity—achieved combined. This boost wasn’t random. The sudden spike in meme coin trading brought massive attention and activity to the platform.

Breaking Records and Building Momentum

Raydium isn’t just leading in volume. Over the past month, it generated $226 million in fees, outpacing giants like Uniswap and even Solana itself. Only Ethereum and Tether have done better. These numbers show the platform’s profitability and its growing importance in the DeFi space.

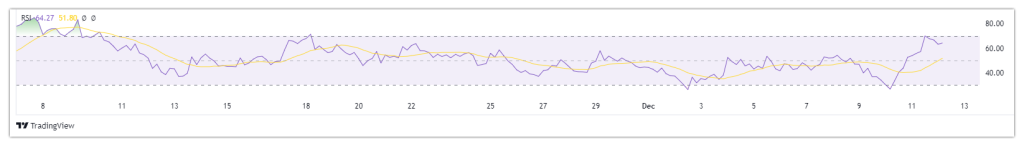

But it’s not just about revenue. RAY’s technical indicators reveal strong buying interest. The Relative Strength Index (RSI) for RAY shot up from 26 to 70 in just two days. While that level suggests a possible price correction, it also confirms the intense market momentum behind the token.

What to Expect

It looks like Raydium still got some fuel and the bullishness might not be over yet. If it could hold to its trend, RAY might hit $6.46 soon, however the resistance levels at $5.85 and $6.46 could be challenging. On the opposite side, if the momentum falls and price sinks, support levels between $5.26 and $5.19 can be very helpful.

All eyes are on RAY to see if it can climb back to its ATH of $16.93 and break it. This is a long journey without any doubt, however with growing Solana ecosystem and memecoin hype, there are still hopes for a new All Time High.

What’s next for RAY? Only time will tell, but one thing is certain—it’s a token you can’t ignore.