Singapore-based crypto service provider Matrixport predicts that Bitcoin may reach as high as $160,000 by 2025. In a newly released report, titled Matrix on Target (Issue #2024-112), the firm outlines a scenario in which increased institutional adoption, macroeconomic evolution, and broadening global liquidity could push the leading cryptocurrency to unprecedented levels.

Why Bitcoin Will Reach $160,000 In 2025

Matrixport’s research team notes that Bitcoin’s performance in 2024 exceeded multiple key price projections and validated their previous analytical frameworks. According to the report, this strength has been propelled by institutional investors who embraced the Bitcoin ETF market. These investors have “realized substantial gains, incentivizing further allocation as we move into 2025,” states Matrixport.

The report highlights Bitcoin’s emergence as a portfolio component, underscoring that “our analysis recommends a 1.55% allocation to achieve optimal diversification while maintaining portfolio stability.” This approach reflects Bitcoin’s gradual integration into traditional investment strategies, as well as its evolving status as a macro-relevant asset.

Looking ahead, Matrixport’s analysis emphasizes the approaching “8% adoption threshold” that could signal a turning point for Bitcoin. Drawing parallels to other technologies that experienced exponential growth once this threshold was crossed.

“Historically, technologies that cross this mark, such as smartphones and social media, experience exponential growth driven by network effects and broader accessibility. As Bitcoin gains mainstream acceptance, it is poised to transition from a niche asset to a core component of global financial markets,” the firm forecasts.

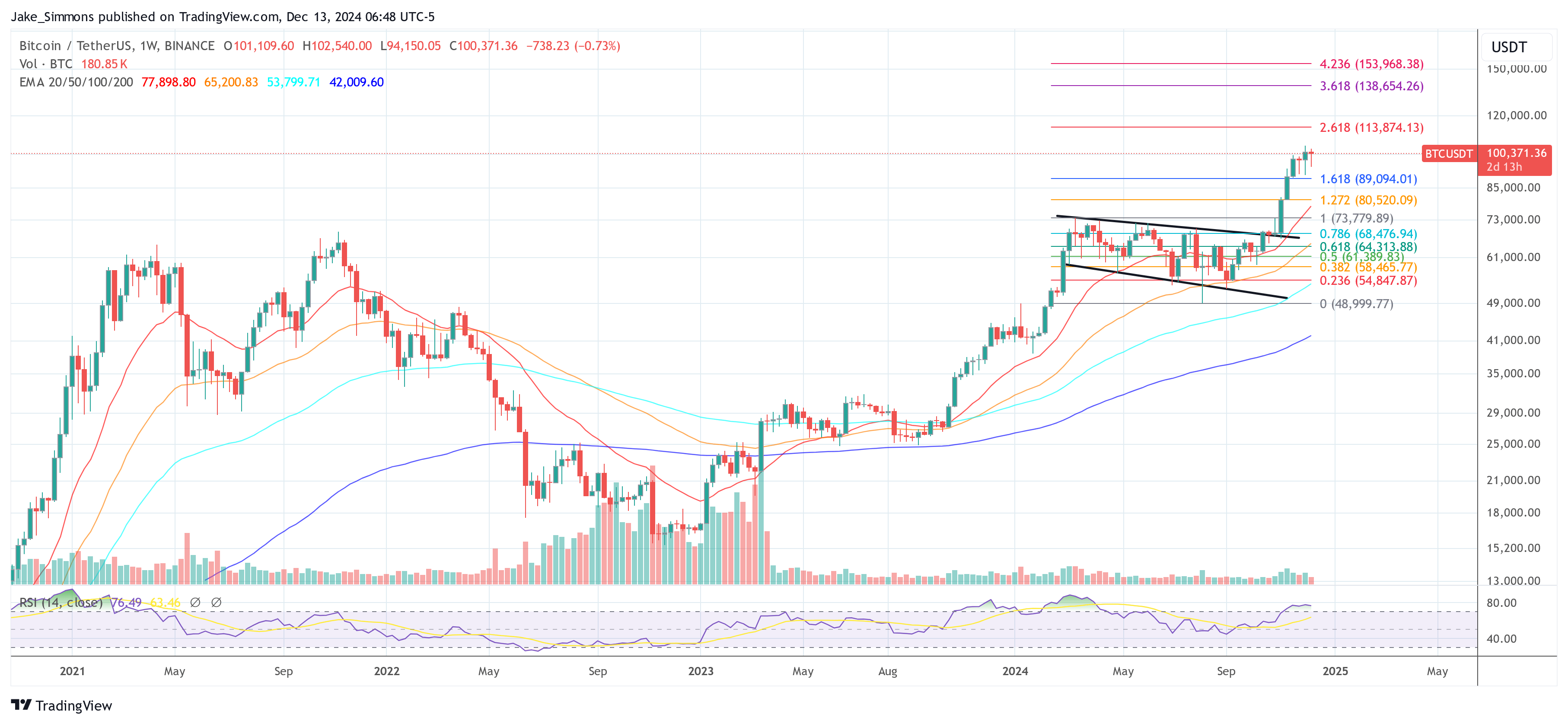

Matrixport also details a shift in market dynamics. Historically, Bitcoin’s cycles were defined by steep 80% retracements, but this pattern may be diminishing. The firm reports “a growing base of dip buyers and institutional support,” which it says reduces the probability of severe corrective phases. While temporary consolidations remain a part of market structure, Matrixport anticipates these to be “less pronounced, reflecting Bitcoin’s maturation as an asset class.”

Regarding specific price forecasts, Matrixport outlines a “+60% upside” as the market progresses into 2025, culminating in a $160,000 price target for Bitcoin. The report attributes this target to “sustained demand for Bitcoin ETFs,” supportive macroeconomic conditions, and an expansion in global liquidity.

Matrixport’s proprietary Greed & Fear Index—a barometer for market sentiment—indicates stable conditions. The report claims that “the current consolidation phase may be shorter than previous ones,” with stabilized funding rates and normalized market conditions.

In turn, the analysts see “the stage … set for renewed upward momentum.” Matrixport also calls attention to Bitcoin’s recent resilience, noting that “the swift recovery from recent overheated conditions” supports the notion that BTC price is well-positioned for another growth cycle.

The overarching view remains optimistic. Matrixport concludes that “the outlook for 2025 remains bullish,” with Bitcoin’s track record as “an inflation hedge, and its integration into institutional portfolios suggest a transformative year ahead.” The firm concludes: “As adoption accelerates and the market matures, Bitcoin is positioned to achieve new all-time highs, further solidifying its role as a cornerstone of the global financial landscape.”

At press time, BTC traded at $100,371.