Bitcoin has remained range-bound between $99,000 and $102,000 since breaking above the psychological $100,000 level. While the breakout initially sparked excitement among investors, the current price action reflects market indecision, with no clear direction for the weeks ahead. Concerns about a potential correction linger as the broader market awaits stronger signals to confirm the next trend.

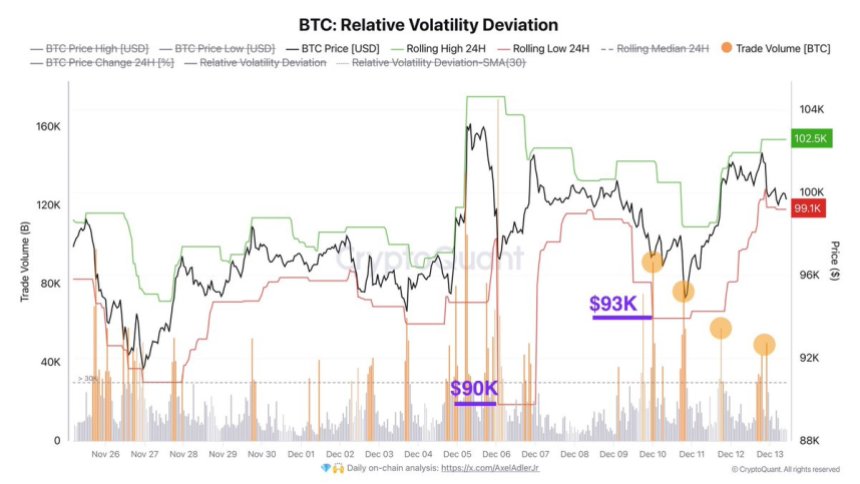

Top analyst Axel Adler recently shared insights on X, supported by data from CryptoQuant, highlighting two crucial support levels at $90,000 and $93,000. These levels represent key demand areas, underscoring that the market floor has moved higher—a positive sign of resilience even amid the uncertainty. According to Adler, these supports could act as safety nets, absorbing selling pressure if Bitcoin fails to sustain its momentum above $100,000.

Despite the hesitation, Bitcoin’s ability to hold above $100,000 for consecutive days has provided some optimism among investors. It remains uncertain whether the market will break out of its current range to continue the bull run or face a correction. For now, all eyes are on Bitcoin’s price action near these critical levels as traders look for clues that could set the tone for the remainder of the year.

Bitcoin Technical Details Explained

Bitcoin has faced choppy price action recently, leaving the market in anticipation of the next big move, whether upward or downward. Traders and investors remain cautious, closely watching key technical and macroeconomic signals. The uncertainty has kept Bitcoin trading between $99,000 and $102,000 as market participants wait for a decisive breakout.

Top analyst Axel Adler recently shared a detailed macro analysis on X, shedding light on Bitcoin’s current position. According to Adler, the market has established two crucial support levels at $90,000 and $93,000, signaling that the overall market floor has shifted higher.

These levels could act as strong safety nets if Bitcoin experiences a short-term pullback. Adler emphasized that these supports reflect growing confidence in Bitcoin’s long-term potential despite the current indecision.

One notable observation is the decline in trading volume peaks, which presents a neutral signal. This indicates that traders avoid excessive risk, preferring to wait for clearer market signals before entering significant positions. The declining volume also suggests a reduced likelihood of extreme price volatility in the immediate term.

With Bitcoin stuck in its current range, the market remains highly sensitive to external factors. Any significant news or events could quickly trigger a breakout or breakdown, setting the stage for Bitcoin’s next major move.

BTC Price Action

Bitcoin is trading at $100,100 after failing to break above its all-time high of $103,600. The current consolidation reflects market indecision while the price remains above key demand levels. Bitcoin’s resilience above $100,000 suggests bullish momentum may still be in play, as buyers look for opportunities to push the price higher.

However, the next few days will be critical. A correction could be imminent if Bitcoin fails to hold above the psychologically significant $100,000 level and struggles to find the momentum to surpass $103,600. Analysts warn that a break below $100,000 could trigger a wave of selling pressure, pushing the price toward lower support zones.

The $93,000 level is a crucial area to watch during a downturn. Losing this key support would significantly heighten bearish risks, as it represents a critical demand zone for the market. A failure at this level could result in a sharper correction, potentially challenging Bitcoin’s bullish structure.

Bitcoin’s ability to hold above $100,000 provides a cautious sense of optimism. If bulls can maintain support and fuel a breakout above the all-time high, Bitcoin could enter a new price discovery phase. However, the high stakes make every move above or below these levels pivotal for short-term direction.

Featured image from Dall-E, chart from TradingView