The post FCA to Strengthen Crypto Regulations in The UK appeared first on Coinpedia Fintech News

Various countries are embracing Bitcoin and crypto while some are trying to push leash on the ecosystem. The UK is one of the countries that are trying to bring strict regulations to protect the investors. The Financial Conduct Authority (FCA) has shared its latest proposals for tight regulations on crypto assets. The objective behind them is to make the market safer.

The FCA has made it clear: if you’re trading crypto, you’ll need to play by their rules. But what does that mean for the average investor—or the companies behind these digital coins? Are crypto regulations in the UK going to be tougher? Let’s find out.

What’s the FCA’s Endgame?

The FCA says it’s all about protecting people and keeping the market fair. Crypto has been making headlines for all the wrong reasons—scams, insider trading, market manipulation. You name it. So, the FCA is stepping in to sort things out.

One of the big changes? Public offers of crypto assets will only be allowed if they’re listed on regulated trading platforms. That means fewer shady coins slipping through the cracks. The idea is to ensure that anyone investing in crypto has access to safer, more legitimate options.

What Will Actually Change?

For companies offering crypto assets, the rules are about to get a lot tougher. They’ll need to provide clear, detailed information about their crypto projects. This includes risks, governance, and even environmental impacts like energy usage and emissions. The FCA also wants to see stricter checks on teams behind these projects. Think of it as a trust test—if they can’t pass, they’re out.

And it’s not just about paperwork. The FCA is cracking down on insider trading and other shady practices. Trading platforms will be expected to have systems in place to detect and report market abuse. No more turning a blind eye. Transparency is another big focus. Any documents tied to crypto offerings will need to be publicly accessible through the FCA’s National Storage Mechanism. It looks like they are adapting to the transparency feature of blockchain.

Implementing Crypto Regulations in The UK

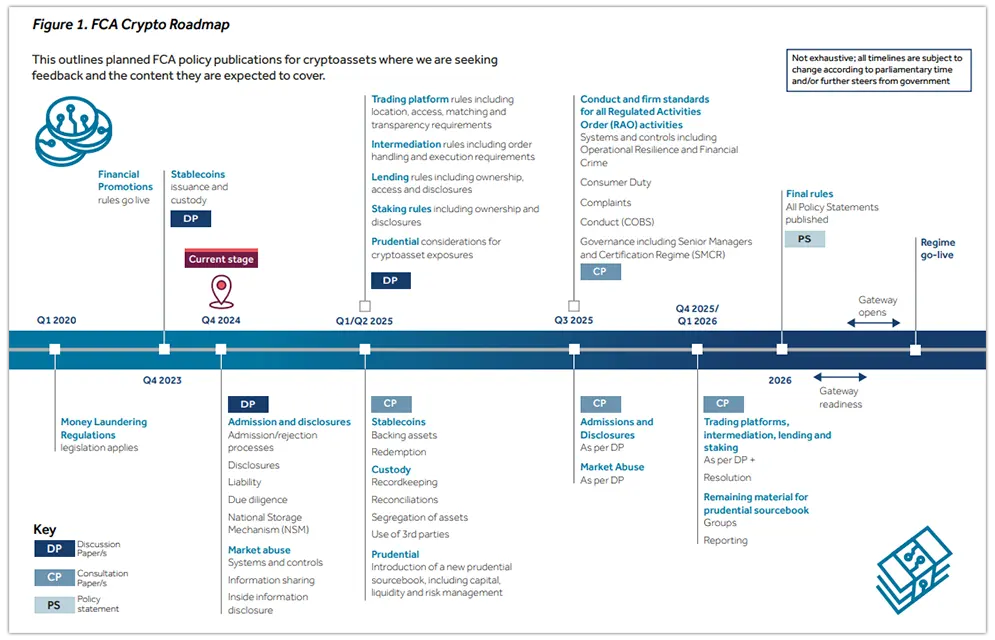

The FCA has openly invited industry experts and the public to share their feedback on the proposals by March 2025. They will fine tune the rules according to the feedback and then might roll them out by 2026.

The new crypto regulations in the UK might make the market a safer place for investors but there would be challenges involved. The cost of meeting these new standards could be steep for companies. Also, for investors, it might mean lesser options. But for FCA, its all about striking a balance between encouraging innovation and consumer protection.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.