The post Ethereum (ETH) Bearish Signal, $3,500 the Next Target? appeared first on Coinpedia Fintech News

Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is showing signs of a potential price decline after recent bearish price action. In addition to the price action, whales and industry experts seem to be losing interest in the altcoin, as revealed by the on-chain analytics firms IntoTheBlock and CryptoQuant.

Will ETH Price Decline?

Recently, ETH experienced a price surge of over 15% and hit the $4,100 mark for the first time since March 2024, where it faced selling pressure and a notable price decline. Historically, ETH has reached this level five times, and each time, it has encountered a price decline and significant selling pressure.

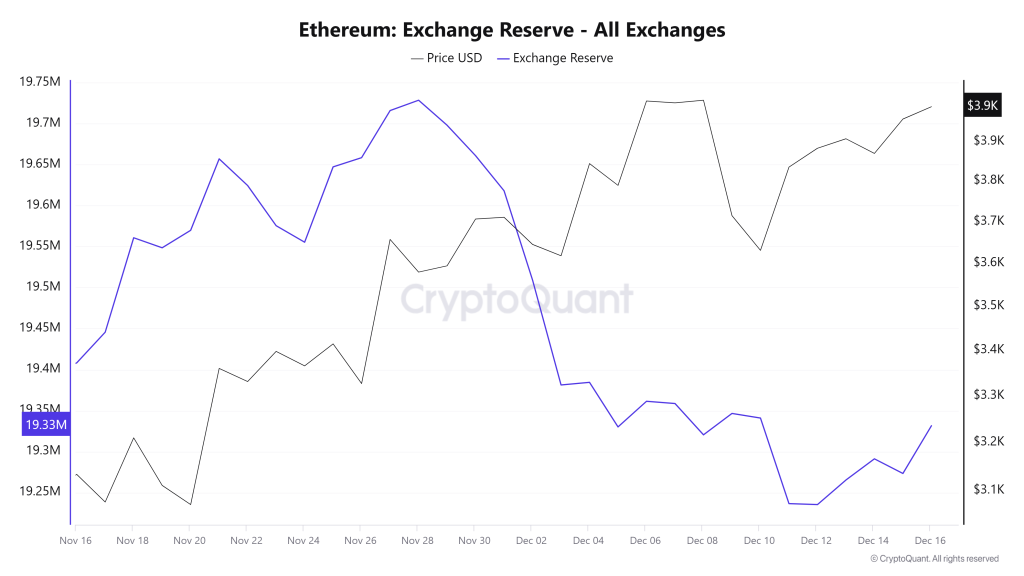

Ethereum (ETH) Rising Exchange Reserve

This time, looking at past trends whales and long-term holders appear to continue depositing their ETH to exchanges, as revealed by CryptoQuant’s ETH exchange reserve metrics.

Data shows that exchange reserves have increased by nearly 100k ETH worth $400 million which could signal increased selling pressure as the price nears a six-month high.

Rising Unstaking Activity

In addition to the rising exchange reserves, whales have begun withdrawing tokens from staking, suggesting they are gradually taking profits due to the recent price surge or indicating a loss of interest in holding ETH long-term.

This is evidenced by the recent activity of Justin Sun, the founder of Tron. On December 16, 2024, the whale transaction tracker Spotonchain shared a post on X (formerly Twitter) stating that Sun’s linked wallet address requested to withdraw 52,905 ETH, worth $209 million, from the staking protocol Lido Finance.

Ethereum (ETH) Technical Analysis and Key Levels

According to expert technical analysis, ETH appears to be forming a bearish double-top price action pattern at the strong resistance level of $4,100. In addition to the double-top pattern, ETH’s Relative Strength Index (RSI) is falling, indicating a bearish divergence, which further suggests a price decline and increased selling pressure.

Based on the recent price action, there is a strong possibility that ETH could decline by 12% to reach the $3,500 level in the future.

Current Price Decline

At press time, ETH is trading near the $3,970 level and has experienced a modest price decline of 0.80% in the past 24 hours. During the same period, its trading volume has soared by 60%, indicating heightened participation from crypto enthusiasts amid the recent price surge.