The post Breakout Alert! Dogwifhat (WIF) Poised For 35% Rally appeared first on Coinpedia Fintech News

price decline it has experienced over the last few weeks. As of today, December 28, 2024, WIF has begun experiencing upward momentum, with the price surge standing out notably compared to other assets.

The significant price surge in WIF can be explained by the recent breakout of the descending price action pattern, interest from long-term holders, and the shift in market sentiment across the cryptocurrency landscape.

Dogwifhat (WIF) Technical Analysis and Upcoming Level

According to expert technical analysis, WIF has not only broken out of a descending price action pattern but has also successfully retested its crucial support level of $1.80. This recent support for WIF is the third occurrence since November 2024.

WIF Price Prediction

Based on historical price momentum, whenever the meme coin reaches this level, it experiences buying pressure and notable upside momentum.

This time, experts and analysts anticipate a similar kind of upside momentum in the future. Based on the recent price action, if WIF successfully breaches the descending triangle price action pattern and closes a four-hour candle above the $1.945 mark, there is a strong possibility it could soar by 35% to reach the $2.65 mark in the future.

WIF’s bullish thesis will only hold if it successfully breaches and closes a candle above the inclined trendline, otherwise, it may fail.

$16 Million Worth of WIF Outflow

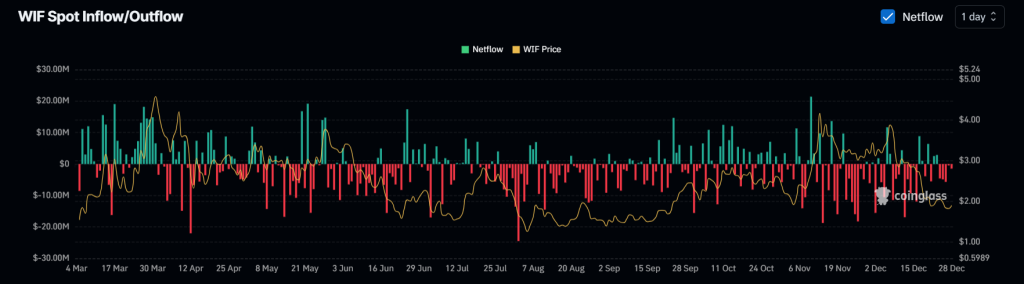

Besides this bullish price action, investors and long-term holders have continuously been accumulating the tokens despite the price struggling to gain momentum, as reported by the on-chain analytics firm Coinglass.

Data from WIF spot inflow/outflow reveals that exchanges across the cryptocurrency landscape have witnessed an outflow of a significant $16 million in WIF meme coins. The term “outflow” refers to the movement of assets from exchanges to wallet addresses, which potentially indicates upside momentum and an ideal buying opportunity.

Current Price Momentum

At press time, WIF is trading near $1.92 and has experienced upward momentum of over 4% in the past 24 hours. During the same period, its trading volume surged by 15%, indicating heightened participation from traders and investors amid the recent breakout.