The post FED Rate Cut Expectations: 96% Chance of a 25 Basis Points Cut Today appeared first on Coinpedia Fintech News

The US Federal Reserve is set to hold its final meeting for the year 2024 today. It is expected that the US Fed will make some important announcements after the meeting. There is a high chance of the announcement of a 25 basis points interest rate cut. Let’s examine the scenario.

US Fed Expected to Cut Rates Again

According to Kalshi, there is at least a 96% probability that the Federal Reserve will announce a 25 basis points rate cut today.

This year, the US Fed has already executed at least two rate cuts. Once the new rate cut is implemented, the total rate cuts of 2024 will reach as high as 100 basis points.

US Inflation Metrics Back on the Rise

Inflation pressure has risen sharply in the last couple of months. This adds complexity to the Federal Reserve’s attempt to stabilise the economy.

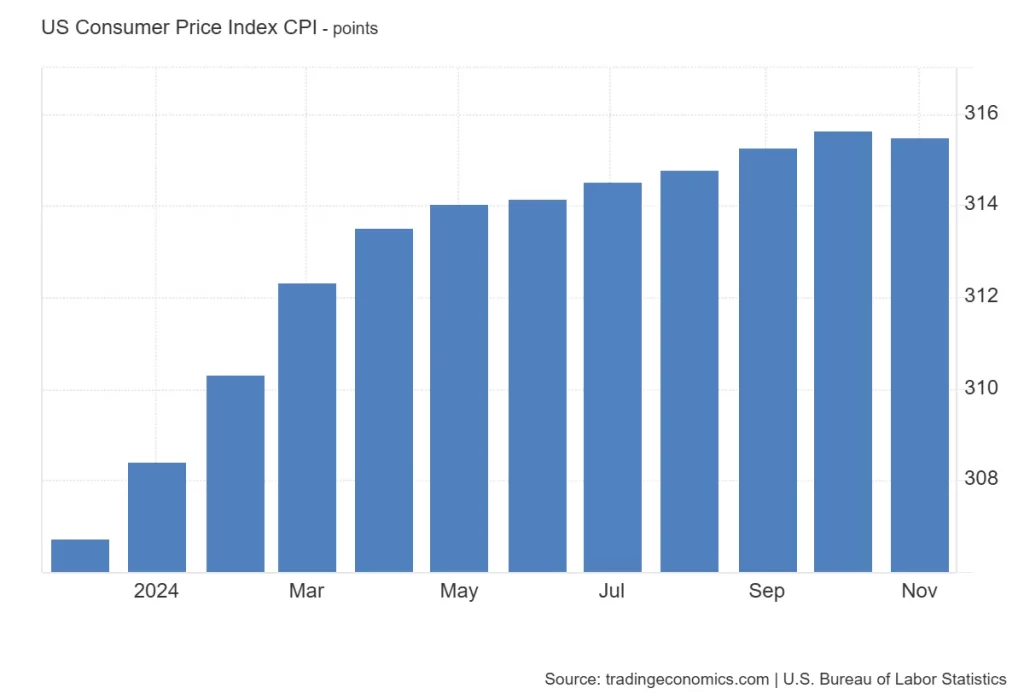

At the start of this year, the US CPI Index was as low as 308.417 Points. In April, it rose to 313.55 points. In October, it touched the yearly peak of 315.66 Points. However, in November, it slightly dropped to 315.49 Points.

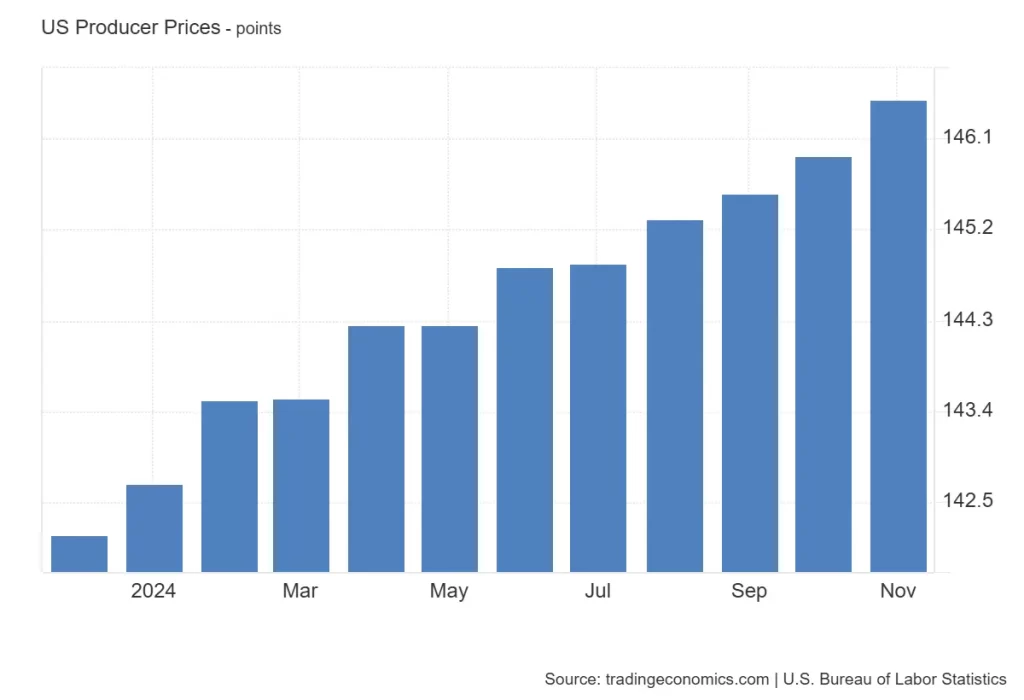

In January, 2024, the US Producer Prices index was at 142.683 Points. In June, it reached 144.834 Points. Since June, it has grown consistently. In November, it touched a yearly peak of 146.493 Points.

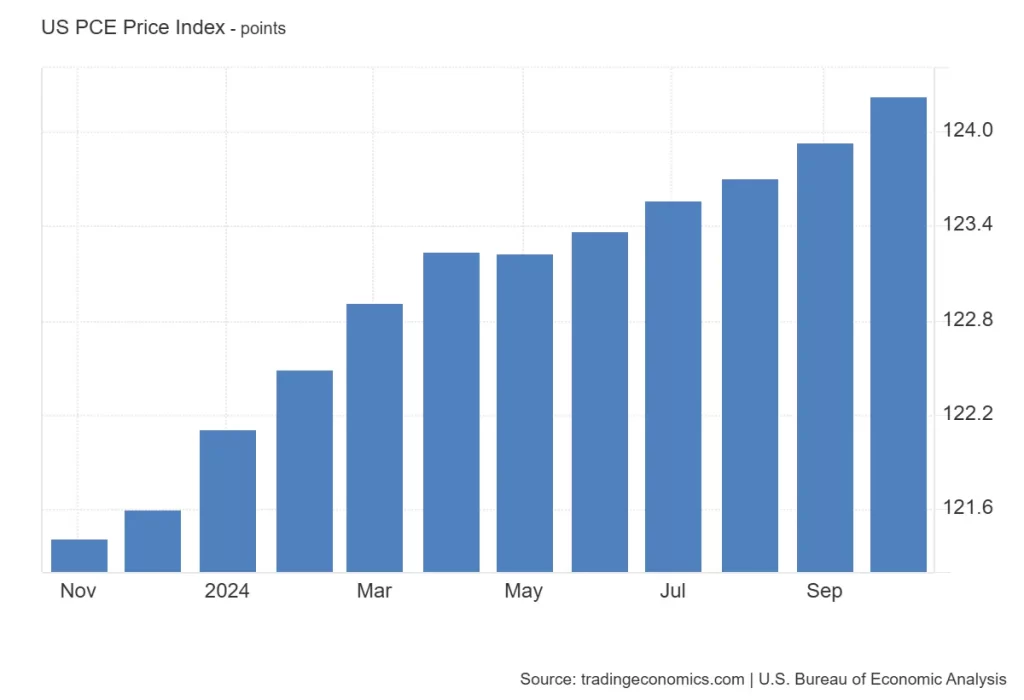

At the beginning of the year, the US Personal Consumption Expenditure Price index was around 122.115 Points. In April, it touched a peak of 123.234 Points. Since June, it has surged steadily. In September, it was at 123.931 Points. In October, it climbed to a monthly peak of 124.266 Points.

US Labour Market Challenges

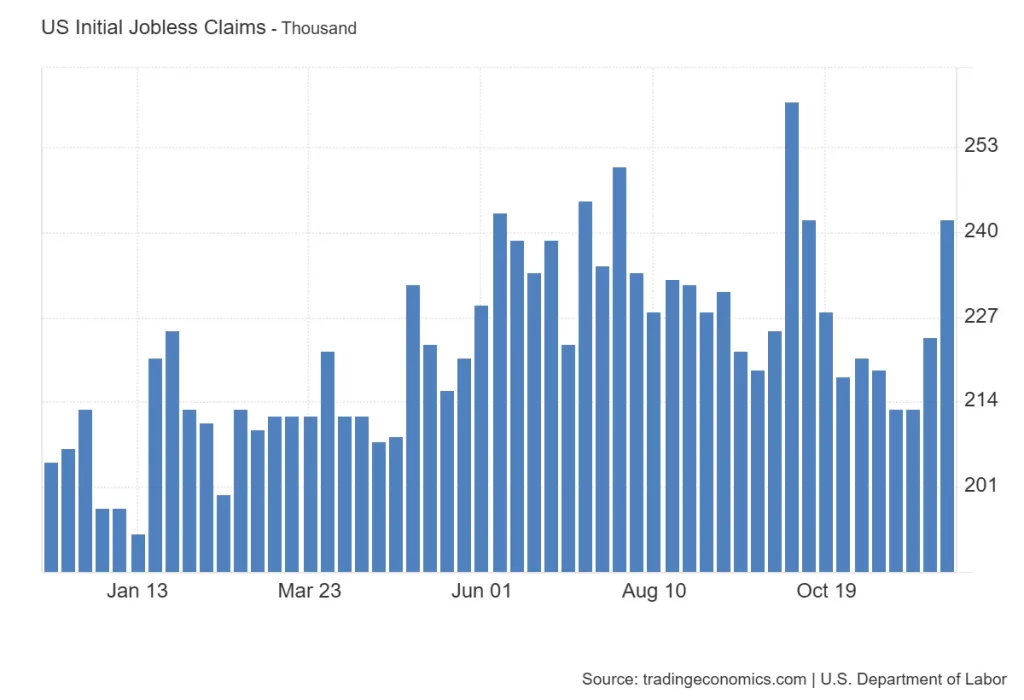

It was the deteriorating situation in the US job market that primarily prompted the policymakers to consider the rate cut option. Though initially the job market witnessed certain improvements, recently it began weakening.

The US Initial Jobless Claims index was 224K on November 30. In the first week of December, it rebounded to 242K – the level it was at least 8 weeks earlier.

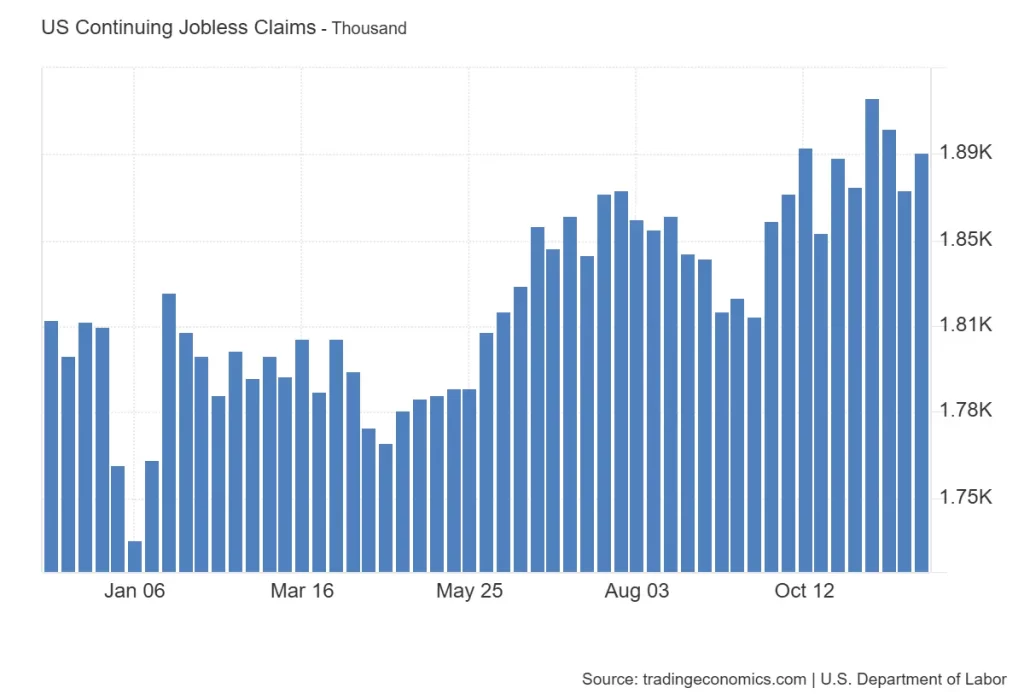

On November 23, the US Continuing Jobless Claims index was at 1.87K Thousand. On November 30, it surged to 1.89K Thousand.

What to Expect for 2025

It is important to understand the outlook of the US Federal Reserve for the year 2025. The US is going to see a new government assuming the White House in late January next year. Data indicates that the primary challenge for the upcoming government will be balancing inflation control with economic growth.