The crypto market showed signs of revival yesterday, with several assets experiencing significant price surges after weeks of subdued action. Chainlink (LINK) stood out, gaining over 15% in just 24 hours, solidifying its position as one of the stronger altcoins in the current environment. This sharp recovery highlights growing interest in LINK as market sentiment shifts.

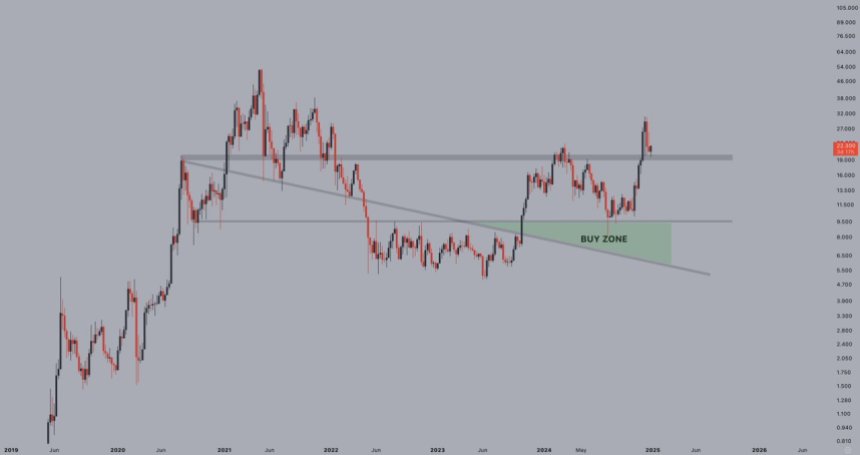

Renowned analyst Jelle shared a technical analysis on X, revealing a critical development in Chainlink’s price action. According to Jelle, LINK has successfully flipped a key resistance level into support—a bullish signal that often precedes substantial upward momentum. This structural shift could pave the way for Chainlink to target higher price levels as it prepares to test crucial supply zones.

The market’s renewed energy and Chainlink’s ability to hold key levels suggest that the coming days could be pivotal. If the bullish momentum persists, LINK could soon challenge overhead resistance, setting the stage for a larger breakout. Amid this awakening market, Chainlink’s recent surge underscores its potential as a standout performer in the altcoin space.

Chainlink Investors Waking Up

Chainlink has faced notable selling pressure since peaking at $30 on December 13, triggering a pullback that tested the resilience of its bullish structure. However, recent price action suggests a shift in momentum as bulls show signs of waking up. This could mark the beginning of a massive rally, according to analysts closely monitoring the market.

Top analyst Jelle recently shared a technical analysis on X, highlighting a crucial development in LINK’s short-term trend. According to Jelle, Chainlink appears to have flipped a key resistance level into support—a structural shift often seen as a precursor to significant upward movement. This bullish signal has reignited optimism among investors, with Jelle suggesting that LINK could target all-time highs in the near future if current momentum continues.

The key now lies in LINK’s ability to break through critical supply zones in the coming days. A successful breach of these levels could pave the way for an aggressive rally as buyers look to capitalize on renewed market strength. As the broader crypto market shows signs of recovery, Chainlink’s ability to reverse its recent downtrend positions it as a potential leader in the altcoin space.

Related Reading: Ethereum Stays Within Symmetrical Pattern – Analyst Sets ETH Target

Testing Crucial Liquidity

Chainlink (LINK) is currently trading at $22.55, reflecting a strong bounce from local demand levels. The price is now testing a critical supply zone, which could determine its next major move. Encouragingly, LINK is trading above the 4-hour 200 EMA at $22.27, a key technical indicator that often signals bullish momentum when sustained as support.

For bulls, holding this level is essential to confirm the continuation of LINK’s short-term uptrend. If LINK maintains support above the 200 EMA and builds momentum, the next significant hurdle lies at the $24 mark. Reclaiming this level in the coming days would likely trigger a massive breakout, opening the door for LINK to target higher resistance zones and potentially all-time highs.

However, failure to hold the 200 EMA as support could expose LINK to renewed selling pressure, pushing prices back toward local demand. Traders and investors are closely watching these technical levels, as the broader market recovery creates favorable conditions for altcoins to reclaim lost ground.

Featured image from Dall-E, chart from TradingView