World Liberty Financial (WLFI), the latest venture by incoming US President Donald Trump, has generated a lot of interest in the cryptocurrency space. WLFI has been working on strategic projects in the field of decentralized finance. By quickly acquiring digital assets, the project has attracted the interest of both skeptics and enthusiasts in the crypto world.

Trump, WLFI Add 722 Ether To Its Inventory

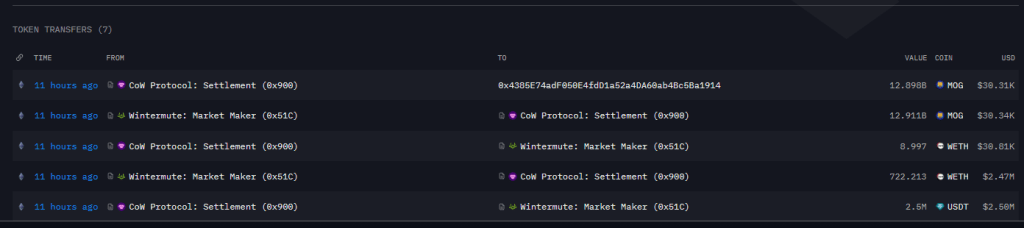

During the latest power play, WLFI took advantage of market downturn to buy 722 Ether worth approximately $2.5 million. Using this strategic acquisition, they have managed to increase the total Ethereum holdings to as high as 15,598 tokens, which can now be valued at approximately $53 million. The acquisition itself will clearly indicate WLFI’s move into becoming a major player within the DeFi landscape.

The main goal of the project is to democratize crypto loans, therefore challenging traditional financial institutions. This value proposition is fascinating. Investors who are now looking for alternatives to conventional financial systems especially in the present environment of banking uncertainty have found great resonance in this message.

According to Arkham, the Trump family crypto project, World Liberty, purchased 722.213 ETH for 2.5M USDC via Cow Protocol on December 20 at 6:54 UTC+8. The project now holds a total of 15.595K ETH, valued at approximately $53.61M. https://t.co/CklEuO9IEH

— Wu Blockchain (@WuBlockchain) December 20, 2024

Diversifying To Other Coins

WLFI has not only been focusing on buying things quickly in Ethereum. Reports say that a lot of money is being put into other well-known coins, like Aave (AAVE) and Chainlink (LINK). These acts show a well-thought-out plan to build a diverse portfolio, which fits with what Trump called a “financial revolution.”

The involvement of TRON founder Justin Sun, who has committed $30 million to the initiative as its leading investor and advisor, has been perhaps the most significant development. Sun’s involvement contributes significant cryptocurrency expertise to WLFI, while Trump’s brand recognition garners interest from both retail and institutional investors.

Questions Linger

Despite all this, criticism has also surrounded the partnership regarding fears over the likelihood of conflicts of interest and people finding ways to benefit from the venture to receive political patronage.

WLFI is now under the watchful eyes of market observers, as it keeps refining its product offerings and expanding its asset base. Those who are not comfortable with traditional banks would find some solace in their offer to challenge accepted wisdom in finance. Still under discussion, though, is how WLFI will stand out in a DeFi market that is progressively crowded.

Sun’s large financial support as well as Trump’s well-publicized leadership have definitely created tremendous momentum in the crypto market. Still, WLFI’s ultimate success will rely on its capacity to fulfill its great expectations in the face of legal challenges and unstable markets.

Featured image from Evan Vucci/AP via CNN Newsource, chart from TradingView