A recent report by crypto index fund management firm Bitwise outlines varying price projections for Solana (SOL) based on its adoption and scalability improvements. According to the report, the ‘bull case’ scenario could see SOL’s price soar to $6,636 by 2030.

What Sets Solana Apart?

Solana, currently the sixth-largest cryptocurrency by market capitalization, has experienced a volatile few years. The digital asset was heavily impacted by the FTX collapse, plummeting from its previous all-time high (ATH) of $250 in November 2021 to a low of $9 in November 2022.

However, despite the bear market triggered by the FTX debacle, SOL staged an impressive recovery, achieving a new ATH of $263 in November 2024. Bitwise’s report suggests that SOL’s growth potential remains significant in the coming years.

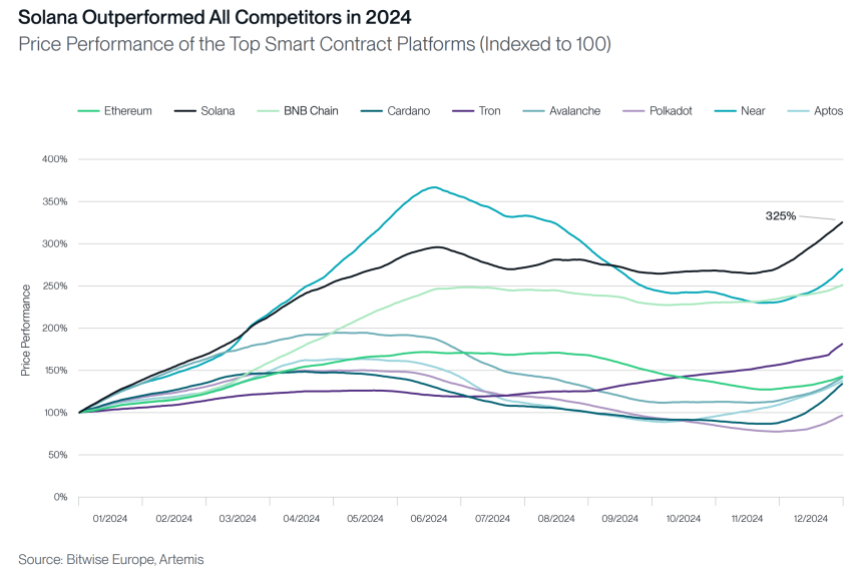

The report identifies three core pillars supporting Solana’s investment case: sustainable economics, developer attraction, and consistent execution. It highlights Solana’s remarkable outperformance compared to other major smart contract platforms in terms of price growth in 2024.

Dubbed the “iPhone moment for blockchain” by the report, Solana’s standout features include its ability to process 65,000 transactions per second (TPS) and its low transaction costs. This high throughput positions it as an ideal platform for building decentralized, high-volume, low-latency applications, such as decentralized exchanges (DEXs).

The chart below demonstrates that Solana’s TPS rivals that of Visa and far surpasses competing smart contract platforms like BNB Chain and Ethereum. Additionally, Solana experienced a parabolic increase in daily active addresses (DAA) in 2024, surpassing the combined DAA of Bitcoin (BTC) and Ethereum (ETH), indicating growing adoption.

In terms of tokenomics, the report notes that 80.7% of SOL’s total supply is currently in circulation, with the remaining 19.3% classified as non-circulating supply. While concerns about potential token inflation persist, Solana’s inflation rate decreases annually and is projected to drop to 1.85% by 2030.

The SOL Bull Case

The report applies Metcalfe’s Law to estimate Solana’s network value. For those unfamiliar, Metcalfe’s Law posits that a network’s utility increases proportionally to the square of its user base. The report states:

For the sake of simplicity, we assume the Daily Active Addresses (DAA) to be the number of users and the market capitalization to represent the utility of the network represented in monetary terms.

Accordingly, the report shares the bear case, the base case, and the bull case for Solana. The bear case for SOL foresees a cumulative annual growth rate of 35.1%, yielding a target price of $2,318 by 2030.

Similarly, the base case assumes a CAGR of 47.2%, resulting in a price of $4,025 by 2030. On the contrary, the bull case for SOL projects a price target of $6,636 by 2030, propelled by a CAGR of 59.1%.

The report adds that the aforementioned forecasts take into account the natural deceleration that occurs as networks mature and achieve significant scale. At press time, SOL trades at $214.86, up 8% in the past 24 hours.