Bitcoin experts are buzzing as President-elect Donald Trump lashed out against current Federal Reserve policy, calling interest rates “far too high” despite persistent inflationary pressures. “We are inheriting a difficult situation from the outgoing administration,” Trump said at his Mar-a-Lago club, adding that officials seem to be “trying everything they can to make it more difficult” for his incoming team.

The blunt remarks, coming fewer than two weeks before Trump’s inauguration, have stoked anticipation of a possible shift in US monetary policy—and raised speculation about a boost for Bitcoin and other risk assets in the new year.

The 2017 Trump Playbook: Dollar “Too Strong”, Bitcoin Up?

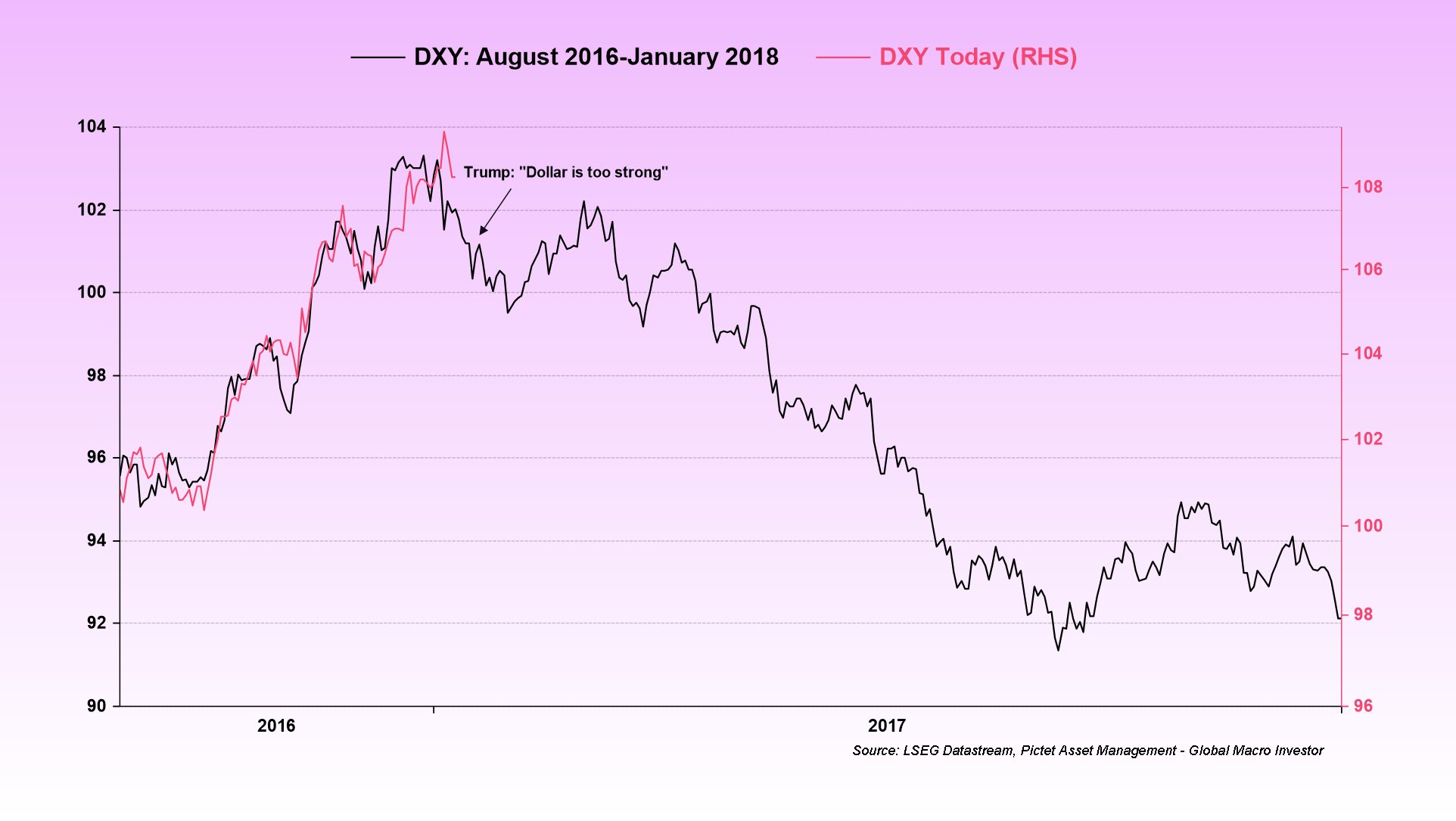

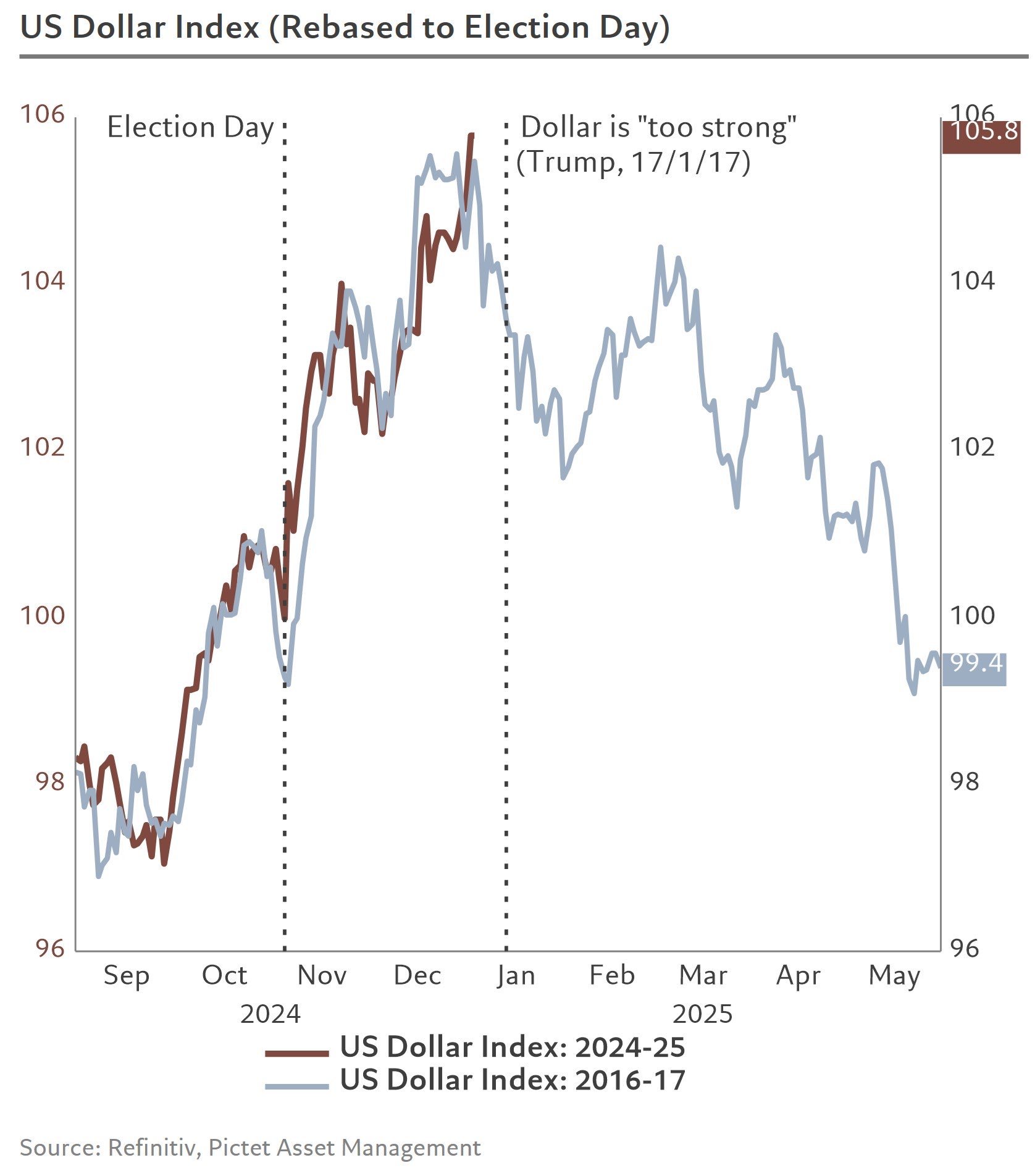

Although the economic and geopolitical landscape has changed since Trump’s first term, some market watchers see parallels to his 2017 rhetoric. Back then, he lambasted a US dollar that he deemed “too strong,” a stance that preceded a notable decline in the currency. The US Dollar Index (DXY) peaked near 104 in early January 2017 but began a downward trend that extended into early 2018, bottoming out around 98.

This sharp move in the dollar coincided with a broader risk-on environment, fueling rallies in equities as well as the Bitcoin and crypto markets. Julien Bittel, Head of Macro Research at Global Macro Investor (GMI), drew a direct comparison on X.

“The last time Trump said something was ‘too high,’ it was the dollar – back in January 2017, just days before his inauguration,” Bittel stated and recounted: “Here’s what he said: ‘Our companies can’t compete with them now because our currency is too strong. And it’s killing us.”

Notably, last year, Trump also called recent strength a “tremendous burden on US businesses.” Bittel further argued: “Trump understands the impact of a strong dollar – and the same logic applies to high interest rates. They suppress exports, hurt corporate earnings, and slow economic growth.”

Speaking on the impact on Bitcoin and the broader crypto market, Bittel concluded: “What happened next? Well, the dollar began a significant decline, setting the stage for one of the most pivotal macro moves we’ve seen in years – triggering a melt-up in risk assets. Déjà vu? I think so. Let’s see how it plays out.”

Bittel is not the only expert speculating that the DXY may already have peaked, mirroring its 2017 topping pattern. Steve Donzé, Deputy CIO for Multi Asset at Pictet Asset Management Japan, shared a widely discussed chart on X, remarking “On time. Ready for pushback,” while overlaying recent DXY movements with the currency’s trajectory in early 2017. The chart suggests a similar pattern that could foreshadow renewed dollar weakness in the coming weeks.

In a separate post, financial analyst Silver Surfer (@SilverSurfer_23) pointed to an uncanny timing overlap: “DXY topped on January 3rd, 2017—18 days before Trump’s Inauguration. DXY looks to have topped on January 2nd, 2025—19 days before Trump’s Inauguration.” He characterized the parallel as “crazy history repeating,” explaining that he sees a correlation between the path of the DXY before both inaugurations.

Such analogies are fueling speculation that a repeat dollar slump could usher in an environment favoring risk assets. Should the dollar indeed enter a new downtrend—much like in 2017–2018—Bitcoin could ride a wave of renewed liquidity and speculative appetite.

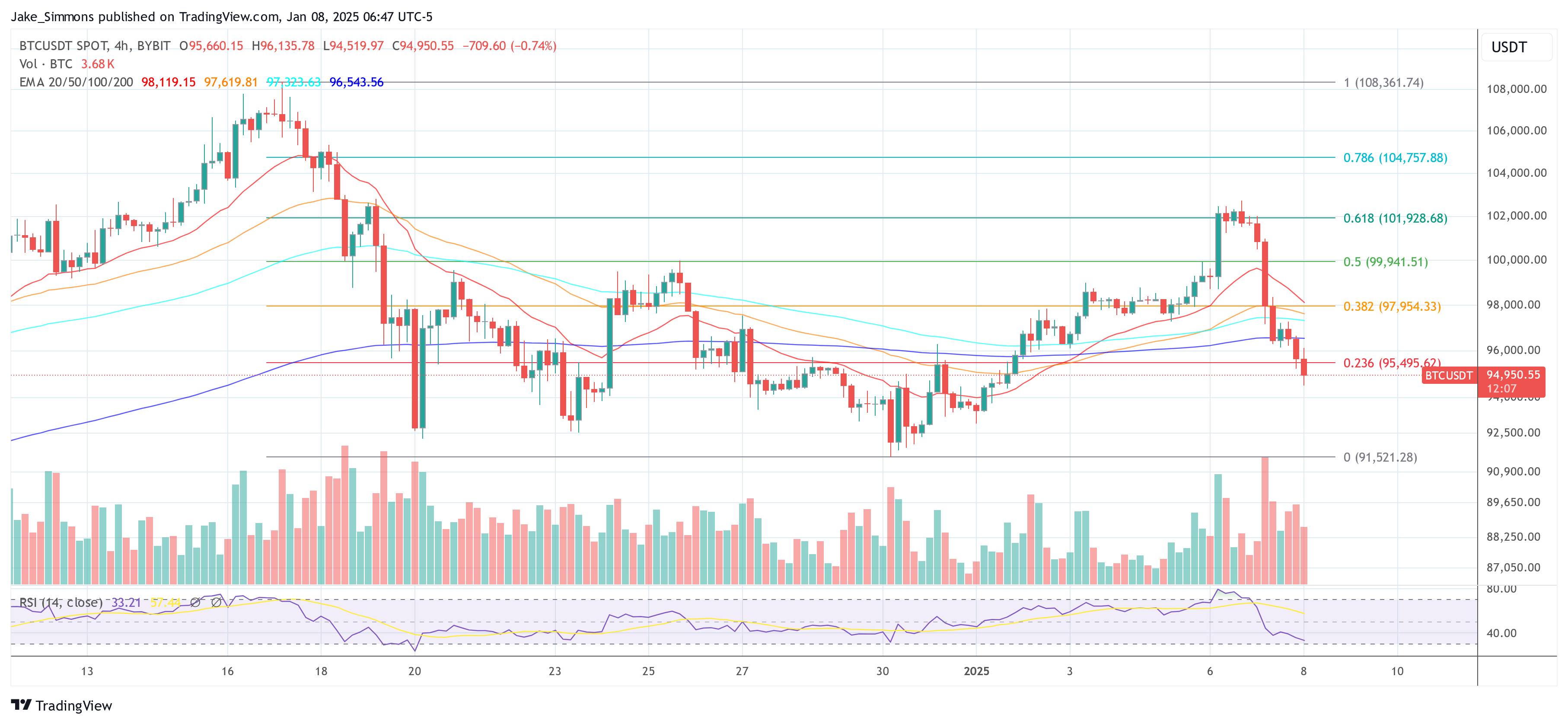

At press time, BTC traded at $94,950.