Rumble, a Tether-backed video-sharing platform, has made its first Bitcoin acquisition two months after adopting the top crypto as a strategic reserve asset.

On Jan. 20, Rumble CEO Chris Pavlovski announced that the company had purchased Bitcoin on Friday, Jan. 17.

According to him:

“On Friday, Rumble made its first-ever purchase of Bitcoin. It won’t be the last.”

While the amount acquired remains undisclosed, Pavlovski hinted this is just the start of a larger plan to strengthen Rumble’s Bitcoin position.

The purchase aligns with Rumble’s broader crypto strategy. In November 2024, the company revealed plans to invest $20 million in Bitcoin, citing confidence in the asset’s long-term potential.

At the time, Pavlovski noted that Bitcoin adoption was still in its infancy, with momentum building due to supportive policies and growing institutional interest.

He also highlighted Bitcoin’s resilience against inflation, citing its immunity to dilution caused by excessive money printing. He called it a valuable asset for the company’s treasury.

Rumble is a video-sharing platform with 67 million active users monthly and is renowned for its relaxed content moderation approach. Last December, stablecoin issuer Tether invested over $775 million in the platform.

Broader adoption

Rumble’s Bitcoin acquisition mirrors a growing trend among top corporate firms across the public and private sectors embracing the flagship digital asset for their treasuries reserve.

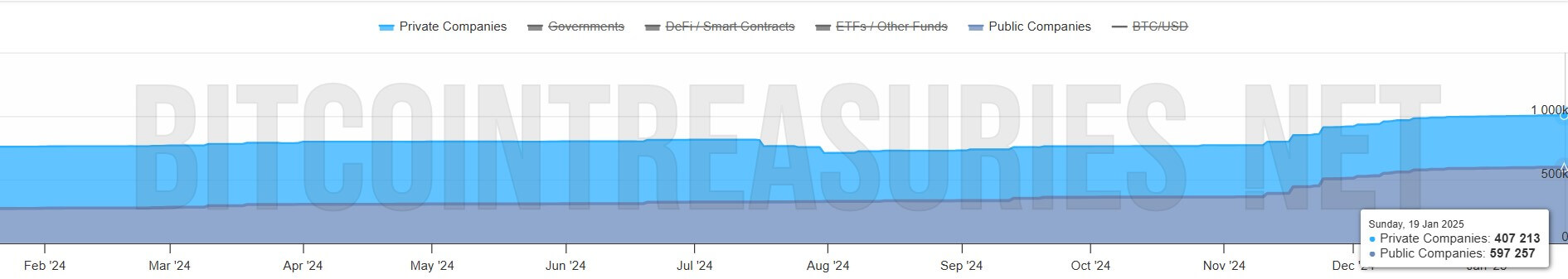

Data from Bitcoin Treasuries shows that over 70 publicly traded companies collectively hold around 600,000 BTC. MicroStrategy leads this cohort with 450,000 BTC in its coffers.

On the other hand, private firms like SpaceX, Tether, and Block.one have amassed 407,212 BTC.

Bitwise’s Chief Investment Officer Matthew Hougan believes this trend is far from a one-off. Instead, he describes it as a “megatrend” that could reshape the crypto market.

Hougan attributes part of this shift to the Financial Accounting Standards Board’s (FASB) introduction of ASU 2023-08. This new rule permits publicly traded firms to record Bitcoin holdings at market value, allowing them to reflect gains when Bitcoin’s price increases.

The post Rumble makes first Bitcoin purchase, hints at future acquisitions appeared first on CryptoSlate.