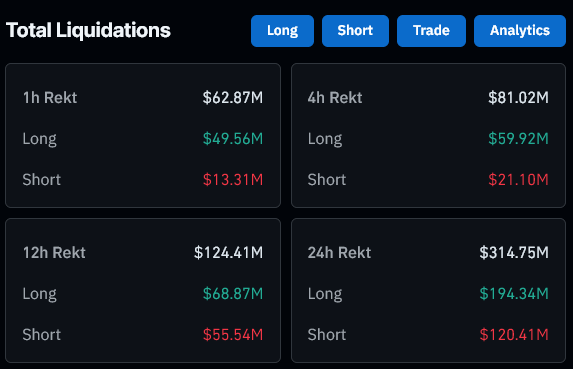

Crypto liquidations have remained elevated over the past 24 hours, reaching $314 million as Bitcoin wicked down to $92,700, according to Coinglass data.

The largest single liquidation order occurred on BitMEX, involving a $5.5 million XBTUSD position. Over 121,000 traders were liquidated during this period, underscoring heightened market volatility.

Long positions bore the brunt, accounting for $194 million, roughly 60% of total liquidations. Short positions contributed $120 million, highlighting imbalances as traders attempted to navigate Bitcoin’s fluctuating price.

Exchange-specific data shows Binance leading in liquidations, with $31.52 million cleared, of which 81.04% were long positions. OKX followed with $15.75 million, maintaining a similar long-dominant liquidation ratio of 79.75%. Bybit recorded $13.64 million in liquidations, with 78.5% attributed to long positions.

Bitcoin’s price movements have remained volatile in early January, recovering to $102,000 on Jan. 6 before retracing on Jan. 7. Today, Jan. 10, Bitcoin opened positively, gaining 4% to hit $95,000 before flash crashing to $92,7000 and subsequently recovering quickly to $94,400 as of press time.

These liquidations reflect traders’ positioning for further directional moves as Bitcoin trades within a tight range following its recent all-time highs in December.

Amid $83.51 million liquidated in BTC positions, Coinglass data also highlights notable activity in altcoin markets, with $54.93 million in ETH positions. This concentration of liquidations suggests market participants remain highly leveraged, potentially setting the stage for continued volatility in the near term.

The post Crypto liquidations reach $313 million as Bitcoin flash crashes to $92.7k appeared first on CryptoSlate.