The post Fantom (FTM) Poised For 50% Rally, Here’s Why appeared first on Coinpedia Fintech News

FTM, the native token of Fantom, is poised for massive upside momentum, as it has formed a bullish price action pattern on its daily time frame. Despite experiencing a price drop of over 56% in the recent decline, it appears that this downtrend is reversing.

Fantom (FTM) Technical Analysis and Upcoming Levels

According to CoinPedia’s technical analysis, Fantom (FTM) has found crucial horizontal support at the $0.60 level. Since September 2024, the token has bounced multiple times from this level, experiencing upside momentum. However, this time, the altcoin has shown a bullish divergence on its daily chart.

Bullish divergence is a technical analysis term that occurs when an asset’s price is making lower lows while a technical indicator, such as the Relative Strength Index (RSI), is making higher lows. Traders and investors often consider bullish divergence a potential signal to buy, anticipating a price bounce or reversal.

FTM Price Prediction

Based on the recent price action, if FTM holds the crucial support at the $0.60 level, it is highly probable that it will soar by 50% to reach the $1.05 mark in the future.

Currently, FTM is trading near the $0.70 level and has shown signs of recovery, experiencing a price rally of over 9.5% in the past 24 hours. Looking at these price recoveries, participation from traders and investors is further skyrocketing. Data from CoinMarketCap reveals that FTM’s trading volume has soared by 26% during the same period.

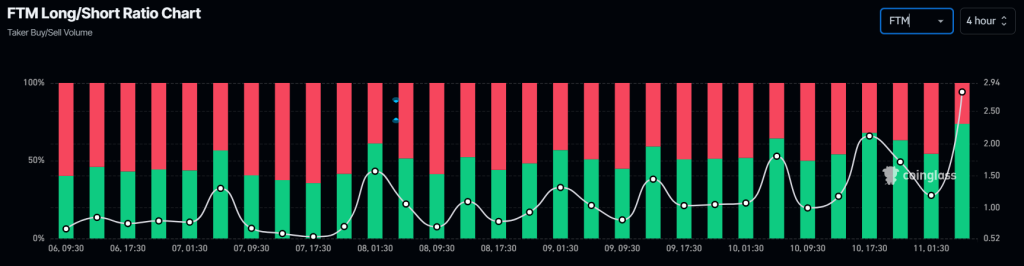

73.7% of Traders Long on FTM

Looking at this bullish outlook, traders appear to be strongly betting on the altcoin, as revealed by the on-chain analytics firm Coinglass. Currently, the FTM Long/Short ratio stands at 2.80, indicating strong bullish market sentiment among traders.

Data further reveals that 73.7% of top traders currently hold long positions, while 26.3% hold short positions.

When combining these on-chain metrics with technical analysis, it appears that the bulls are back in support of FTM and could help it achieve its predicted target.