Bitcoin (BTC) remains the center of investors’ attention and concern especially following the latest nonfarm payrolls data from the US Bureau Of Labor Statistics (BLS). While the general market sentiment remains bullish, recent developments in the US economy indicate that macroeconomic factors may be against the premier cryptocurrency in 2025.

Currently, Bitcoin trades above $94,000 following another turbulent price performance which produced a loss of 3.45% in the past seven days.

Fed’s Pivot To Rate Cuts Is Dead – Analysts

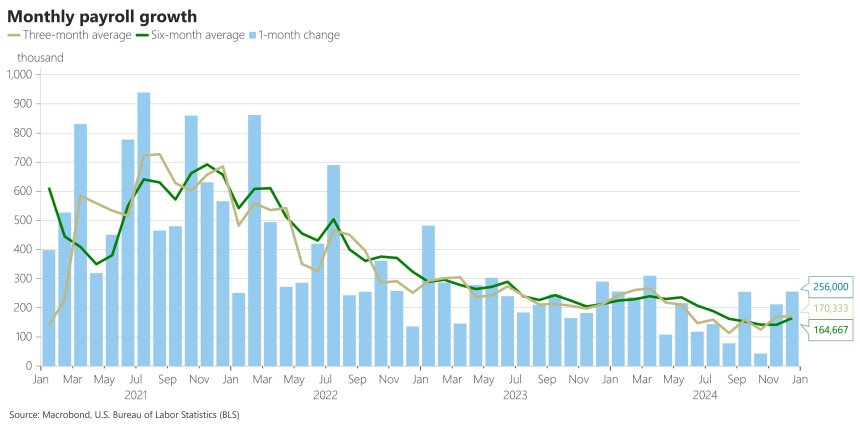

In an X post on December 10, market experts at global capital market analysis firm The Kobeissi Letter dissected the employment situation summary for December 2024. According to the BLS, nonfarm payrolls employment rose by 256,000 jobs in this month, indicating an additional 100,000 jobs to the widely predicted figures.

Following this report, The Kobeissi Letter analysts highlight that the US economy has gained an average of 165,000 jobs since July representing the highest 6-month average since July 2024.

Considering the US Federal Reserve began implementing interest rate cuts from September 2024 citing then a reduction in jobs growth and inflation, the analysts at The Kobeissi Letter stated the Apex Bank’s approach may have been misguided in light of the recent developments.

Therefore, the Fed is expected to halt interest rate cuts to battle an expected heightened inflation due to a strong jobs data, with the potential of even adopting rate hikes.

Generally, an absence of rate cuts or introduction of rate hikes is negative for Bitcoin as lower Interest rates afford investors the capacity to deal In risky assets such as cryptocurrencies. Following the Fed’s previous announcement of potential reduced rate cuts in 2025, Bitcoin experienced a flash crash of over 9% mid-December as investors moved to close their volatile positions in all financial markets.

Currently, The Kobeissi Letter forecasts that the Fed’s pivot to rate cuts is likely over, with a 44% probability that there will be no rate cuts through June 2025.

Bitcoin Price Overview

At the time of writing, Bitcoin trades at $94,028 reflecting a 0.22% gain in the past 24 hours. Meanwhile, the premier cryptocurrency is down by 3.72% and 6.35% in the past seven and thirty days respectively.

Despite the potential of reduced rate cuts in 2025, Bitcoin investors are likely to retain bullish sentiments due to other factors including historical price performance in a bull cycle, an expected pro-crypto US government and continuous institutional investments via the spot ETFs.

With a market cap of $1.84 trillion, Bitcoin continues to rank as the largest cryptocurrency and world’s eight largest asset.

Featured image from Investopedia, chart from Tradingview