Spot Bitcoin exchange-traded funds (ETFs) in the United States saw significant inflows on Jan. 21— the first trading day following Donald Trump’s inauguration on Jan. 20.

Data from SoSoValue showed that the 12 spot Bitcoin ETFs recorded a collective net inflow of $802.5 million, with BlackRock’s iShares Bitcoin Trust (IBIT) leading the inflow activity with $661.9 million.

Grayscale’s Mini Bitcoin Trust followed with $136.39 million, recording its most significant daily inflow since its launch.

Smaller contributions came from ARK 21Shares’ ARKB, Fidelity’s FBTC, and Franklin Templeton’s EZBC, which recorded modest inflows of less than $10 million each.

In contrast, Bitwise’s BITB reported an outflow of $17.41 million, standing apart from the broader positive trend. Other ETFs showed no notable flow changes during the same period.

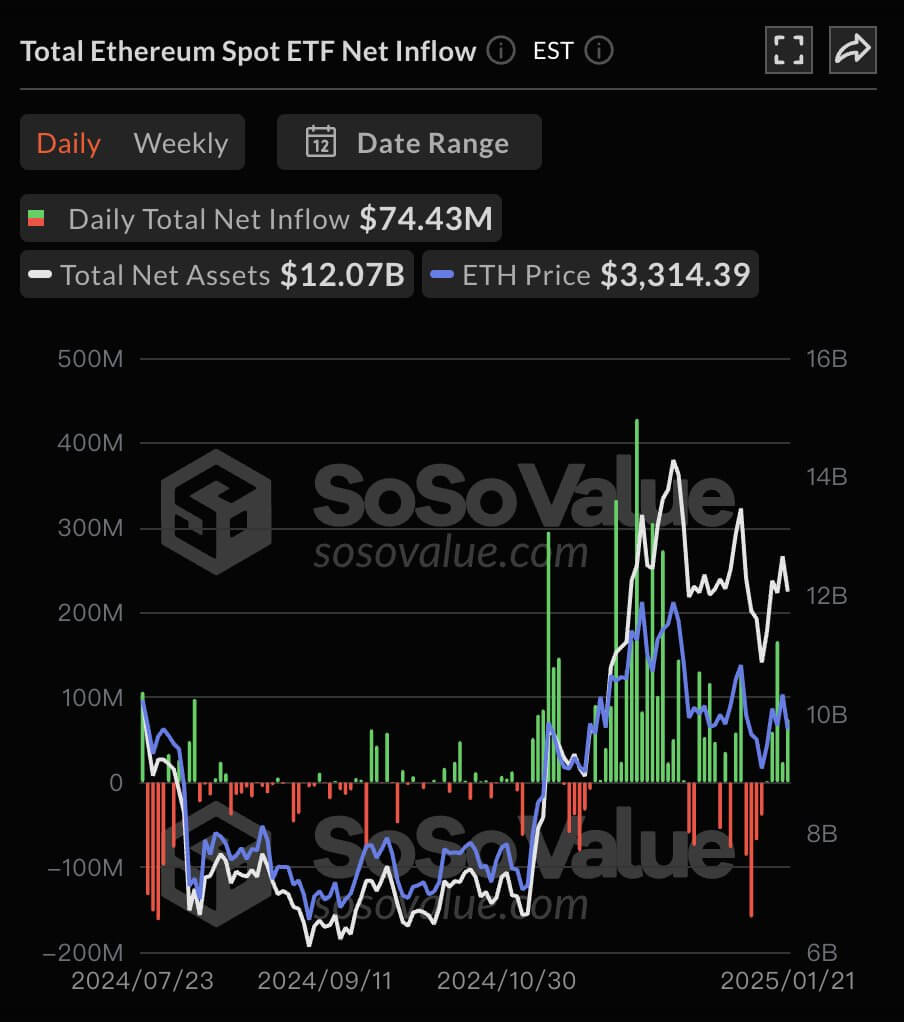

Ethereum ETFs

Ethereum-focused ETFs also experienced notable activity, with total net inflows reaching $74.4 million.

BlackRock’s ETHA led Ethereum ETF inflows, securing $56.3 million. Fidelity’s FETH and Bitwise’s ETHW followed with inflows of $3.3 million and $3.1 million, respectively.

VanEck’s ETHV added $3.6 million, while Grayscale’s Mini Ethereum Fund saw an inflow of $12.5 million.

However, Grayscale’s ETHE stood out with an outflow of $4.4 million, while other Ethereum funds remained unchanged.

The post Bitcoin ETFs see $802.5 million inflow post-Trump inauguration, led by BlackRock appeared first on CryptoSlate.