Ethereum‘s price performances in the ongoing bull cycle may be lagging behind other notable crypto assets like Bitcoin, Solana, and XRP, which have formed new all-time highs. However, optimism about its price prospects still lingers as evidenced by a persistent accumulation of the digital asset

Confidence In Ethereum Growin Among Investors

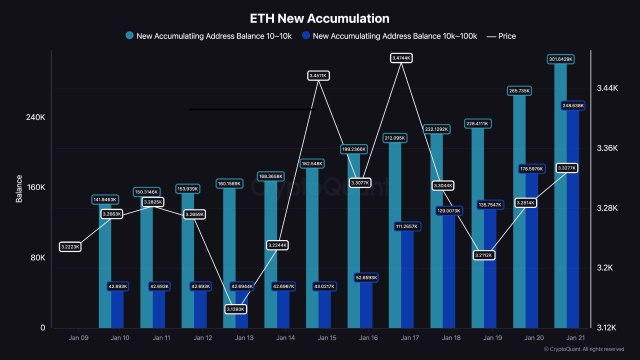

Despite Ethereum’s price struggling to initiate a major rally, an encouraging sentiment has been spotted among investors. Recently, ETH investors have ramped up accumulation at a significant rate over the last two weeks.

Kyle Doops, a technical expert and host of Crypto Banter Show shared the development after examining the key Ethereum New Accumulation metric. Data from Kyle Doops reveals a surge in wallet activity, with both small and large-scale investors increasing their ETH holdings.

The expert stated that this trend reflects unwavering confidence from investors in spite of recent market fluctuations. Furthermore, the expanding interest suggests strong faith in ETH’s potential in the long term, which is attracting many institutional and retail participants.

Ethereum’s network expansion and dominance of the Decentralized Finance (DeFi) and Non-Fungible Tokens (NFT) sectors may have played a pivotal role in the persistent accumulation. Meanwhile, if the accumulation phase extends, it could act as a precursor for the altcoin’s next major price movement.

However, waning market performance threatens its uptrend in the short term. Even in the face of market uncertainty, Kyle Doops claims that Ethereum’s future appears increasingly promising, demonstrating his optimism about the asset’s capability.

This robust investor activity is also indicated by the Ethereum Estimated Leverage Ratio metric, which has been climbing for some period. A rise in this key metric indicates heightened risk as traders take on more positions with high leverage.

The surge in high-leverage positions appears to have been climbing as ETH consolidates between the $3,200 and $3,500 price range. Given the prolonged stasis within the price range, Kyle Doops believes that a bullish breakout is likely at this point.

However, he has urged investors to be cautious as high leverage may cause liquidations and volatility as seen in the past whereby the development has led to a volatile price action for the altcoin.

A Strong Rally For ETH On The Horizon?

ETH continues to face significant resistance at the $3,500, raising uncertainty about its next price direction. However, market expert and trader Milkybull has expressed his confidence in ETH’s prospects, predicting a move to unprecedented levels.

Examining ETH’s 1-month chart, the analyst claims that the infamous rise of ETH that will push it to the $12,000 milestone is gathering steam. His bold forecast is supported by a Rising Wedge pattern, which typically oversees notable price spikes.

At the time of writing, ETH was trading at $3,381, demonstrating an almost 5% rise in the last 24 hours. Investors are betting significantly on the renewed upward momentum as trading volume has increased by more than 60% in the past day.