Amidst a momentary pause in the current crypto bull run, stablecoins have emerged as a potential factor capable of driving the market forward. Market analyst Burak Kesmeci has provided much insight on this possibility while highlighting the impressive market gains of these stable digital assets in recent times.

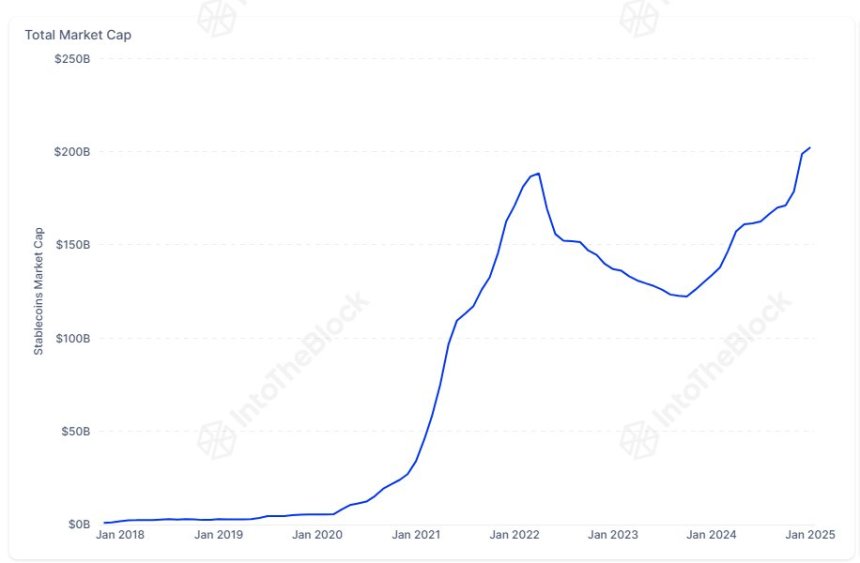

Stablecoins Surpass All-Time High Market Cap Value Of $202 Billion

In a new post on X, Kesmeci discusses the potential of stablecoins providing a much-needed boost to the crypto market amidst much uncertainty as evidenced by consistent range-bound movement by major assets.

First, the crypto analyst notes that the stablecoin market cap has recorded a 65% gain from a local bottom of $123 billion in October 2023. At press time, these assets have seen their market shares exceed their previous all-time high of $202 billion recorded in August 2022.

However, despite this gain, more data from IntoTheBlock shows that the stablecoins crypto market dominance has declined by 7.91% in comparison to Bitcoin and Ethereum, indicating investors’ preference for these riskier, volatile assets. Generally, a rise in stablecoin supply still remains a bullish sign as these assets represent an important source of liquidity for market traders.

Due to their fixed price nature, traders often move their funds to stablecoins during periods of uncertainty which can easily be deployed into other cryptocurrencies later resulting in market rallies. However, Kesmsci notes that this current stablecoin liquidity surge alone would be insufficient to re-ignite the crypto bull run.

This notion is because compared to the previous 2020-2021 bull cycle, stablecoins exchange inflows are still considerably weak, indicating investors’ hesitation to engage the crypto market. Kesmeci explains that this low investor risk appetite can be ameliorated by a fall in interest rates and an increase in quantitative easing which will allow excess capital to flow into cryptocurrencies via the stablecoins.

Stablecoin Market Overview

In other news, Kesmeci further states Tether’s USDT remains the unchallenged leader of the stablecoin market with a market of $139 billion. This report proves impressive considering the recent FUD on USDT over reports of potential delisting due to MiCA regulations in Europe.

The Circle USDC ranks second with $59 billion in market cap after an impressive 10% gain in the last month. Meanwhile, Ethana’s USDE has climbed to third place with market shares valued at $5.7 billion ahead of the premier decentralized stablecoin DAI.

According to data from CoinMarketCap, the total stablecoin market is valued at $221.86 billion following a 0.28% gain in the past day. Meanwhile, daily trading volume is down by 29.93% and valued at $129.23 billion. At the time of writing, stablecoins represent 6.13% of the total crypto market.